Millions of individuals working in the public and formal private sectors of our economy rely on the Contributory Pension Scheme (‘CPS’) for, at least, some component of their financial requirements in retirement. Similarly, with the Micro Pension Scheme, we expect more participation in the CPS by operators in the informal private sector over the coming years. Consequently, it is important that plan members understand both the advantages as well as the pitfalls of the CPS for the purposes of their overall retirement financial planning.

In a paper on ‘Good Practice Principles in Modelling Defined Contribution Pension Plans’ by Dowd and Blake, the writers posited that a well-designed Defined Contribution pension plan should be a single integrated financial product that delivers to the plan member a pension that provides a high degree of retirement income security at a reasonable cost. The pension should be an adequate replacement income for the rest of the plan member’s life. In addition, it should remove the risk of the member outliving their resources.

Inherent in the structure of the CPS are some advantages such as:

Forced planning: I think the first benefit of the CPS is that it forces people to save towards their retirement. I mean, if allowed, many people will simply not plan at all. In addition, many who voluntarily plan may not succeed in doing it well. Being State-enacted and regulated, the CPS offers a window to providing some financial security in retirement.

- Transport minister talks tough on Idu train terminal management

- Police ‘arrogance’ against citizens increasing — AIG

Funding: Unlike in the Defined Benefit scheme, funding is provided before retirement. Furthermore, since funding is available in advance, investments are made out of them and positive returns and growth expected.

Tax advantages: The PRA 2014 exempts interests, profits, dividends, investments and other accruable incomes from tax. Furthermore, withdrawal of voluntary contributions is not subject to tax if withdrawn within five years. (Tax is limited to the returns on such contributions if withdrawn within the five years).

Life insurance: The PRA 2014 makes it incumbent on employers to maintain a Group Life Insurance policy in favour of its employees. The premium for the insurance is to be borne by the employer. Employees are covered for the period in which they are in the service of the employer but not after disengagement.

Reasonably assured payment of benefits: The State-regulated and private sector managed CPS delivers on benefits as they fall due reasonably assuredly.

On the other hand, there are structural and environmental disadvantages to the CPS, such as,

Limited allowable investment options: Regulators such as PenCom allow only a narrow band of investible options to PFAs. Whilst this is understandable from a risk management perspective, it restricts the opportunities for higher investment returns for the benefit of plan members.

High costs of operations: We can fairly expect PFAs and PFCs to make money for the services they provide. With the generally high costs of doing business in our country, the authorized fees and charges by PenCom have to cover those costs to justify the continued existence of the PFAs and PFCs. Inevitably, those charges will be taken out of the returns made on the investments from RSA funds thereby reducing what the plan members will eventually get.

Level of competence by PFAs: In a 2019 paper, PenCom identified, amongst others, inadequate technological capacity and skills on the part of PFAs as militating against both the growth and performance of the scheme.

Transparency in regulation: On the other hand, any lack of transparency and/or corruption in any aspect of regulation can breach trust in the scheme and consequently its performance and growth.

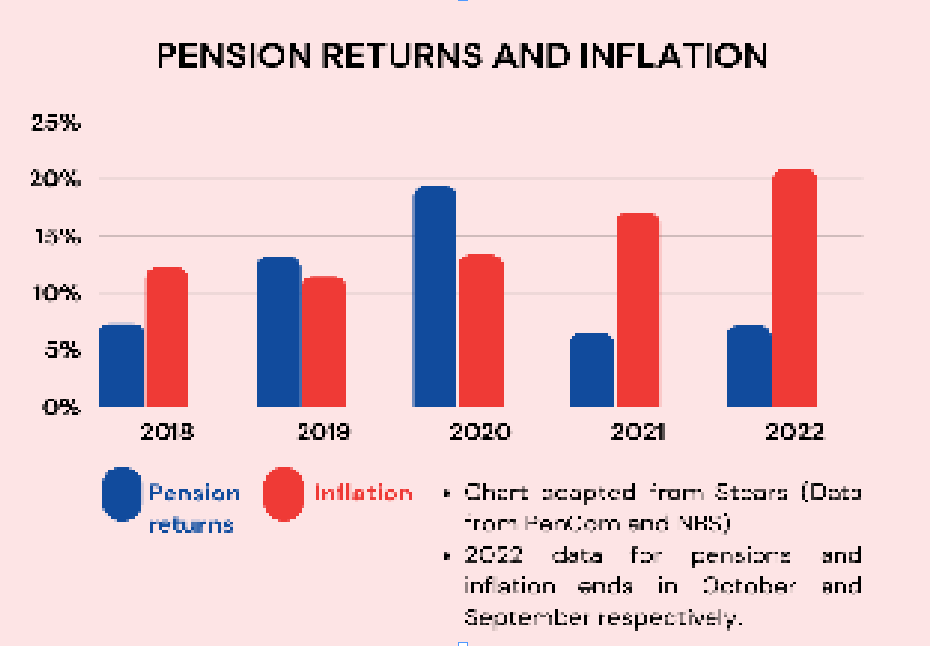

Returns on Investment vs Inflation: Because of a combination of factors, some of which have been mentioned above, returns on pension investments, leaves much to be desired. As reported by Stears, for three of five years from 2018 to 2022, returns on pension investments were less than inflation rate!

Non-remittance: Some employers deduct contributions due from the employees but do not remit to the PFC for the RSA of the employee opened with the PFA. In fact, PenCom was reported to have penalized employers to the tune of N7 billion in 2018 for non-remittance of contributions to employees’ retirement accounts.

Other limitations to the performance of the CPS are the lack of awareness of the benefits of the scheme, non-compliance by some tiers of government and private sector operators and the low coverage of the scheme, all of which limit the amount in investments that can be made; inadequacy of benefits, etc.

The implication of the paradigm position of Dowd and Blake is that a well-designed plan should be conceptualized and developed from the back to the front, meaning that desired outputs should determine required inputs. But this is not necessarily so with the CPS which is generic and does not take individual choices and realities into consideration. Hence, while the CPS is a great opportunity and window for first-level financial planning for retirement, I believe employees and entrepreneurs should have additional retirement plans as regards their finances. This is part of the wide scope of retirement planning to which this column is committed. Next week we will take up the Psychological Realities of Retirement.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.