“Luck is what happens when preparation meets opportunity.” – Seneca,

As a young graduate decades ago, I wanted to work only in a particular industry. I got transport money from my family and took a taxi from Kano to Lagos where I stayed with some family friends. Every morning, I would visit one more of the companies on my list to see how I could gain employment. During a visit to one of the companies one early afternoon, I took the queue at the reception to see anyone to whom I could commence the process of getting employed. The officer at the reception would ask visitors who the visitors wanted to see; make an intercom call and then either usher in the visitor or pass any message from the company staff to the visitor.

The immediate challenge I had was that I didn’t know any officer I could see. However, as my turn was approaching at the receptionist’s desk, a visitor ahead of me was asked which company official they wanted to see and the visitor mentioned a name to my hearing. When it was my turn and I was asked which official I was there to see, confidently, I mentioned the name that I overheard from the earlier visitor attended to, but whom I really didn’t know and didn’t have any appointment with. When my name was mentioned to the official on the intercom by the receptionist, the official graciously agreed to see me and I was allowed access. On getting to the office I realised that the official was an Executive Director of the company’s ‘corporate services’ (which typically includes HR)! He was impressed with my only two-page curriculum vitae that showed good academic results for a twenty-five-year-old but no work experience. I was invited for aptitude tests which I passed and then an interview at which I also did well. I got the job.

Many things made the success above possible. First, I had spent most of those twenty-five years going to school to acquire a first degree and two postgraduate degrees; I had left Kano to go to Lagos where I wanted the job; I was going out everyday to visit my captive companies; I thought creatively on how to gain access to any official in the company; I applied myself at the aptitude test that lasted from around 10am to 5pm on a Saturday, and later at the interview, etc. The point is that success in any act, dimension or field of endeavour does not come by accident. What may seem like an ‘accidental occurrence’ is likely due to several things done previously, presently, and correctly but which we may not realise are interconnected.

Our country has some of the greatest economic opportunities in the world. Thankfully, we see people in all walks of life doing very well legitimately. From individual entrepreneurs at Kantin Kwari market in Kano to the market women in Balogun market, Lagos to executives in the oil companies in Port Harcourt and the government officials in Abuja. Sadly, we also see people who are opposites despite the opportunities they may have or have had. And indeed, as we shall see, success in managing our personal finances is not something we can accidentally attain. We need to do many things right, well, consistently, and persistently.

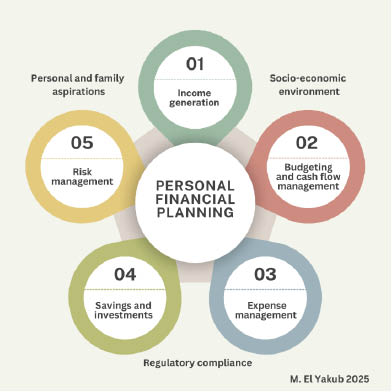

Personal financial planning and management refers to all the aspects of planning and managing individual and household financial issues such as savings, investments, expense management, etc. The retirement planning which we covered over the last several weeks is but just one aspect of personal financial planning and management. Other aspects include budgeting, tax management, risk management, etc. In another breadth, we can also look at personal financial planning and management as a systematic process of crafting a finance strategy tailored to meet the goals of the individual and/or their household, taking into consideration their aspirations, resources, risk tolerance, economic and market opportunities, etc.

Broadly speaking, personal financial planning aims to ensure financial security and stability, optimization of asset accumulation, and effective management of economic, business and financial risks through making informed decisions to meet short-term and long-term financial objectives. Specifically, the objectives of personal financial planning and management are threefold; The First is to ensure that sufficient income is earned and resources are created that will help meet current and future needs. The second is to ensure that expenses are deliberate, understood and controlled for the greatest value. The third is to ensure that savings and investments are made and protected for the greatest financial and non-financial benefits of the individual and the household.

We need to understand that most of the things we are doing in life are about getting a good life for ourselves and our loved ones and being of value to others. For most people and households, regular income may come from sources such as professions, salary, business and/or investments. Regular activities and routine expenses of the individual and the household are normally woven around the regular income and the time when it is received. However, some irregular activities and expenses may also have to be met out of the available income and other resources. Being able to foresee, plan for and take care of all the financing needs of the individual and the household successfully is within the ambit of financial planning.

Next week, we will take up the benefits and broad process of personal financial planning and management.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.