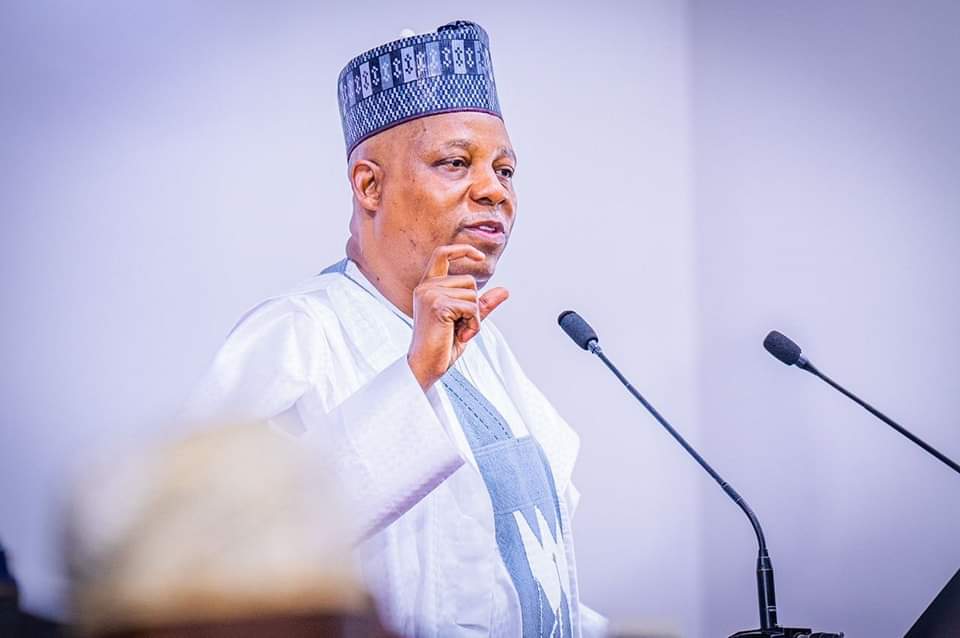

Vice President Senator Kashim Shettima on Wednesday, said that the capital markets in West Africa can help bridge the infrastructural gap in the sub-region.

Senator Shettima stated this at the opening ceremony of the 3rd West Africa Capital Market Conference (WACMaC) with the theme: “Infrastructural Deficit and Sustainable Financing in an Integrated West African Capital Market” held in Lagos.

Shettima who was represented by Mr. Tope Fasua, Special Adviser to the President on Economic Affairs in the Office of the Vice President, said the centrality of capital markets to Nigeria’s development trajectory, especially to the evolution of our corporate sector, our industries and perhaps most importantly, our infrastructural development cannot be overemphasized.

“Just two days ago, on Monday, 23rd of October, 2023 at the opening of the 29th Annual Conference of the Nigerian Economic Summit, His Excellency President Bola Ahmed Tinubu sought the cooperation and intervention of Nigeria’s private sector – and specifically the capital market – toward the funding of Nigeria’s $3 trillion infrastructure gap, which he said should not require 300 years to cover – as propounded in some texts – but 10 years. If this is so for Nigeria, it presupposes that the entire region has similar – or perhaps larger – infrastructural deficits waiting to be filled. They are better filled from inside, not through foreign borrowing alone,” he said.

Judgement day for Tinubu, Atiku, Obi as S/Court rules today

Tinubu okays N18bn assurance policy for fallen heroes’ families

The VP therefore urged regulators and operators to be deliberate on how to meet the challenges the capital market presently faces by meeting young West Africans online, creating apps that they can relate with, using block chains where necessary to show transparency and to give them control that they seek.

He implored West Africa Regulators and Operators to think hard to find liquidity, growth and sustainability in their markets, urging them to draw lessons from what has kept stock exchanges in developed countries thriving and attracting African listings.

Governor of Lagos State, Mr. Babajide Sanwo-Olu, who said governments are actively aware of the imperatives of addressing infrastructure deficit and sustainable financing in the region, stressed that the theme of the conference is especially apt for the moment as across the sub region, modern infrastructure such as roads, rails, ports, fibre optics connectivity power among others are largely inadequate.

He added that only innovative and creative financing, especially the products coming out of the capital market, can ease this gap.

In his opening remarks, Director General of the Securities and Exchange Commission and Chairman of West Africa Securities Regulators Association, WASRA, Mr. Lamido Yuguda stated that the Conference (WACMaC) was conceived as a platform to address crucial issues related to the orderly growth and development of regional and continental capital markets and jointly hosted by WASRA, the Economic Community of West African States (ECOWAS), the West Africa Capital Market Integration Council (WACMIC), and the West African Monetary Institute (WAMI).

The DG disclosed that the integration project in the region is divided into three phases.

He said Phase I facilitated trading between the stock exchanges in the sub-region, through the Sponsored Access model, while Phase II which is currently underway, is set to harmonize and validate regulations for the trading and settlement of securities in West African capital markets through the Qualified West Africa Broker (QWAB) model.

This phase with a target completion date of June 2024, he said, is made possible through funding from the African Development Bank (AfDB) and is implemented by the West African Monetary Institute (WAMI).

He said Phase III holds the promise of delivering a fully integrated market and the establishment of the West Africa Securities Market, which will reflect securities listed on all member exchanges. This phase is expected to deepen West African capital markets, attract institutional and retail investors across member countries, and broaden the range of capital market instruments and issuances for funding private and public enterprises and infrastructure in the region.