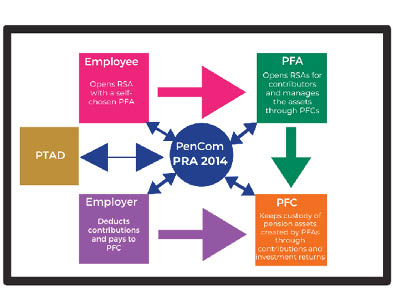

Before we take up individual plans, I think it is important at this point that we try to understand the major stakeholders of the pension industry in Nigeria and the various roles they play.

National Pension Commission, ‘PenCom’: PenCom is the Agency of the Federal Government established to regulate and supervise pension matters in our country. In the discharge of this responsibility, it licenses, regulates and oversees the activities of all pension operators for the efficient and effective administration of the pension schemes for the benefit of contributors and retirees.

The PRA 2014 (‘the Act’) is the enabling law that guides the operations of the industry. The Contributory Pension Scheme, CPS, under the Act covers all employees in the private and public sectors except Judicial officers, members of the Armed Forces, the Intelligence and Secret Services of the Federation, existing retirees prior to June 2004 and employees who had three (3) or less years to retire as at June 2004.

Pension Fund Administrators, ‘PFA’: PFAs are companies that are licensed by PenCom for the sole purpose of managing and administering pension funds contributed into Retirement Savings Accounts, RSAs. RSAs are opened by employees with a PFA of their choice. All contributions and returns on investments made are remitted to the RSA. Eventually, all retirement, including death benefits, are paid out of the RSA. Unlike a Deposit Money Bank account, however, withdrawals from RSAs are not permissible except in certain situations and must be with the prior approval of PenCom.

- Declare state of emergency on malaria, reps panel urges FG

- Isese: Kwara CP, operatives keep vigil at Yemoja River

Pension funds are kept not with PFAs but in the custody of a Pension Fund Custodian (introduced below) and are, therefore, separate from the operational funds of a PFA. Hence, in the event of the liquidation or failure of a PFA, the pension funds and assets are safe.

Pension Fund Custodians, ‘PFC’: PFCs are companies that are licensed by PenCom for the sole purpose of keeping safe custody of all pension assets in trust and on behalf of contributors. PFCs receive the contributions made by employees (from their employers) on behalf of the employees’ respective PFAs. PFCs settle investment transactions on the instructions of PFAs and effect payments of due benefits as well as carry out administrative duties as may be required.

Essentially, whilst PFAs open accounts for contributors as well as manage and invest the funds collected on behalf of the contributors, the PFCs, on the other hand, keep the pension funds and assets in safe custody whilst also carrying out the legitimate instructions of PFAs.

In the event of the liquidation or failure of a PFC, the pension funds under its custody cannot be used to settle any claims against the PFC, thereby keeping the assets protected. In addition, PenCom has both the responsibility and the powers to transfer the assets under a failing/failed PFC to another licensed PFC.

The Pension Transitional Arrangements Directorate, ‘PTAD’: The PTAD was established in accordance with the PRA 2014 for the purpose of handling pension payments of retirees of the Federal Government of Nigeria under the old Defined Benefit Scheme. For private sector employees, the terms and conditions upon which the employees retired are deemed to apply.

Employer: Employers in the public and private sectors, subject to provisions of the PRA 2014, are to make pension contributions payments directly to PFCs, which are expected to immediately notify the employees’ PFAs. The minimum rate of contributions to be made by the employer is a total of 18% of the employee’s monthly emoluments. Of the total amount, 10% is to be contributed by the employer and 8% by the employee. The employer may choose to make additional payments to employee upon retirement and/or opt to make the full contributory payment that should, however, not be less than 18% of the employee’s monthly emoluments.

Employee: The PRA applies to Nigerian citizens working in Nigeria. Nonetheless, expatriate employees in Nigeria can make voluntary contribution under the CPS. Similarly, PenCom has guidelines on Cross-Border Arrangements that aim to encourage Nigerians working outside the country to participate in the scheme on a voluntary basis like expatriates working in Nigeria. A Nigerian that worked out of the country but returns to Nigeria and secures a formal employment shall be part of the CPS.

Employees on Temporary, Contract or Tenured Appointments may opt to join the CPS by opening RSAs and making monthly pension contributions. Similarly, self-employed persons are allowed by the Act to make voluntary contributions towards their retirement under the Micro Pension Scheme mentioned last week.

Major pension stakeholders in Nigeria © Musbahu El Yakub 2023

Allowable Investment Vehicles: The success of the CPS is largely dependent on the actual contributions made, the returns on the investments therefrom and the overall efficiency of the whole process. Now this is quite a tricky and delicate responsibility. On one hand you do not want PFAs taking stupid risks in making investments but on the other hand you want them to earn returns that beat inflation and make a margin on top of that.

The balancing act requires regulation which the PRA 2014 provides. The allowable instruments are Federal Government Securities, State/Local Government Bonds, Equities, Corporate Debt Securities, Money Market Instruments, Open/Closed-end Funds, Infrastructure Bonds and Funds, Private Equity Funds, as well as other assets as may be approved by PenCom from time to time.

Generally speaking, the CPS and the PRA 2014 are quite realistic and encompasasing. No wonder a reasonable number of RSAs and pension assets have been opened and built over the last two decades. We will, however, need to continue to refine the model and the Act with time for even better results. Next week, we will take up some of the intrinsic and environmental pitfalls of the CPS that persons planning for retirement should be aware of.