“Do something today that your future self will thank you for.” – Sean Patrick Flanery

Today we will begin to take up a few things we can do to help us adjust wisely and normally to retirement.

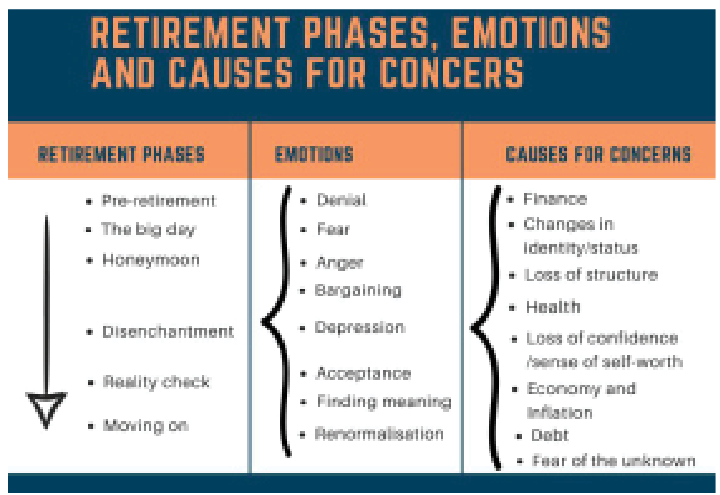

The table below summarises the transition phases to retirement, the emotions we may go through in those phases and the concerns that may trigger the emotions. It should be noted that while the phases might go in a timely sequence, the emotions and the concerns that trigger them may not necessarily follow that way. They would likely just occur at different phases, in different intensities for different people in different pre- and post-retirement circumstances.

Based on the above, we can take measures to help assuage the concerns we may have about retirement. Obviously, the first phase is the pre-retirement phase. As defined, this is the period from when we start our businesses and careers up to the day we officially retire. The pre-retirement phase lasts several years depending on when we started out. It goes without saying that this is the phase within which we should do the best we can to prepare for the retirement of our desire. Some of the actions we should take within this phase should include the following:

Start with the mind: On every matter that may confront us in life, any thoughts and plans should always be germinated wisely and deliberately from our minds. That is where we will need to understand the issue and come up with optimum responses. That is partly why we introduced the importance of having a ‘growth mindset’ in facing issues in our lives last week.

- Birnin Gwari villagers raise alarm over Ansaru militants’ presence

- Climate change: FCTA urges residents to plant more trees

People going into retirement need to be confident that they can seize opportunities ahead and face any challenges as well. Remember that we are most prepared in life at the point we are about to retire. I mean, we would have spent over two decades in schools; several weeks and months in training on the job; worked for two to four decades, learning what works in life and what doesn’t, building relationships and creating some wealth for ourselves. We just need to have the positive disposition and willingness to look for solutions to issues we may face.

Early preparations: Beyond having the right mindset, we obviously must plan, prepare, and continuously take actions. The earlier we begin our preparations and taking actions the much better we can make our retirements. I posit that “The best time to start retirement planning is the day you start your work or business. The next best day is today.” Agreed, there are realities that may militate against planning from the first day we start our work, which we discussed. However, that doesn’t remove the need to start preparations as early as we possibly can.

Basically, there are four spheres of retirement planning viz; the psychological, financial, health, and social. Everything to do with wise retirement planning, such as second careers, relationship management, legacy and estate management, etc., all fall within those spheres. Early preparations create value along each dimension in positively interacting and compounding ways. In the course of this column, we will be taking each sphere in great detail.

Carry your ‘tribe’ along: It is crucial for retiring persons to carry along their ‘tribe’ on matters of retirement. By ‘tribe’ here I don’t mean people of the same ethnic group as you but those who are within your immediate circles. They include parents, spouses, children, close friends and associates, etc. You are the best person to determine how wide the circle(s) of your tribe is/are and at which time you should begin to engage with each on your retirement.

Carrying your people early enough not only gives them sufficient notice of your disengagement from your employment/business at some point in the future, but most people are reasonably fair in scaling down their expectations on individuals who retiree, especially on matters of finances. In some cases, the reverse also holds. This typically happens when a retiree takes a ‘gratuity’ payment and some individuals in their circle expect to go on a spending spree! It is for the retiree to educate the individuals on the need for early caution on matters of finances.

Visioning: Visioning the kind of life you want to have after service is key to successful retirement. Different people have different ‘fantasies’ about the kind of retirement lives they want. Abdulrasaq, Abdulkadir and Isiaka in a paper on psychological effects of retirement identified five types of retirees as ‘Mature retirees’ (those that enjoy genuine satisfaction and personal relationships); ‘Maintainers retirees’ (those that keep the same life strategies they used before retirement); ‘Armoured retirees’ (those who remain very active after retirement); ‘Transformers retirees’ (those that take up new life roles); ‘Rocking-chair retirees’ (those that were passive but can get involved in some public works).

But visioning goes beyond deciding what type of retiree to be. It is also about deciding what lifestyle to have after retirement; what to do and what not to do; where to live; standard of living to maintain; some new hobby to pick up; travel plans; etc.

We will continue next week with more actions that we can take to help us contextualise our retirement well and address our concerns.