Experts on Wednesday attributed the oversubscription recorded in the first dollar-denominated domestic bond to the attractive yields of the $500m bond just as they called for judicious utilisation of the proceeds in critical sectors that would reflate the economy.

Daily Trust reports that the bond recorded a subscription of $900 million, as against the initial target of $500 million, being the first tranche of the $2 billion bond registered with the Securities and Exchange Commission (SEC).

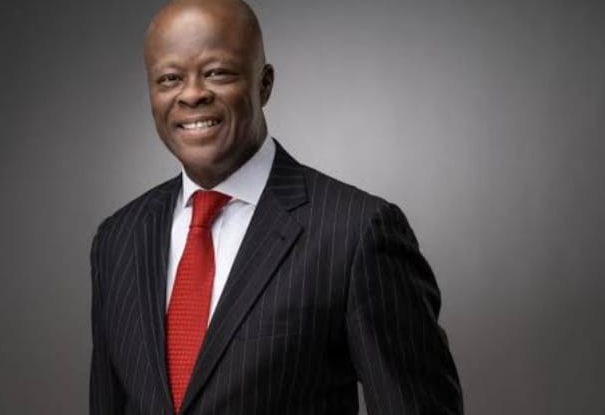

Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, had unveiled the outcome of the bond, saying the oversubscription “demonstrates that investors, as well as Nigerians, continue to have faith in the country’s economy.”

The series one $500 million Domestic FGN US Dollar Bond has a five-year tenure with a coupon of 9.75 per cent interest.

Yar’adua’s mother: Abdulsalami visits Katsina

Obasanjo, Sambo, Osinbajo, Zulum condole Yar’Adua’s family in Katsina

Speaking with our correspondent yesterday, an economist and Director, Centre for the Promotion of Private Enterprises (CPPE), Dr Muda Yusuf, and Ayokunle Olubunmi, Head of Financial Institutions Rating at Agusto & Co., said the oversubscription was as a result of the 9.7 per cent interest which they described as an attractive yield.

Yusuf said at maturity, the bond would boost foreign exchange (fx) liquidity, especially for those who would want to convert the proceeds to naira.

He said, “I think the oversubscription is as a result of two things. One, I think the rate is very attractive. Because I don’t think anybody can get that kind of rate anywhere around the world. When you talk of dollar investment, I think the rate is 9.7.

In many other parts of the world, it’s about five per cent, two per cent and three per cent. The rate is very attractive. Then it’s also a demonstration of confidence in the government that okay, this government is not likely to default when they get to maturity and all of that.

In spite of our challenges, we haven’t had any report of default in our debt service, whether domestically or externally. So, that has also enhanced the confidence of those who are investing in it.”

Yusuf also stated that the strategy of targeting the Nigerians in Diaspora also paid off as many Nigerians abroad were looking for investment opportunities.

Olubunmi on his part advised the federal government to judiciously utilise the proceeds of the bond in developing critical sectors of the economy.

He said, “This is not the first time the federal government is issuing a dollar instrument. I think what it will just do, right, is to use it judiciously because Nigerians will be tracking what they’ve actually invested, what they’ve used the funds for, rights. But I don’t think it will be a challenge for the government in terms of the commencement of the bond debenture.”

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.