The price of cooking gas has failed to drop because of Nigeria’s heavy dependence on import, occasioned by the dwindling purchasing power of the naira, Daily Trust on Sunday reports.

In the last six months, Nigeria imported Liquefied Petroleum Gas (LPG) or cooking gas worth over N171 billion as consumers in the country continue to groan over rising prices.

- 120 hospitalised in Kano as expired industrial gas contaminates air

- Did Lamido, his daughter and son contest PDP primaries?

A 12kg worth of cooking gas is sold at nearly N10,000 in many parts of Nigeria, an equivalent of one third of the minimum wage being paid to civil servants in the country.

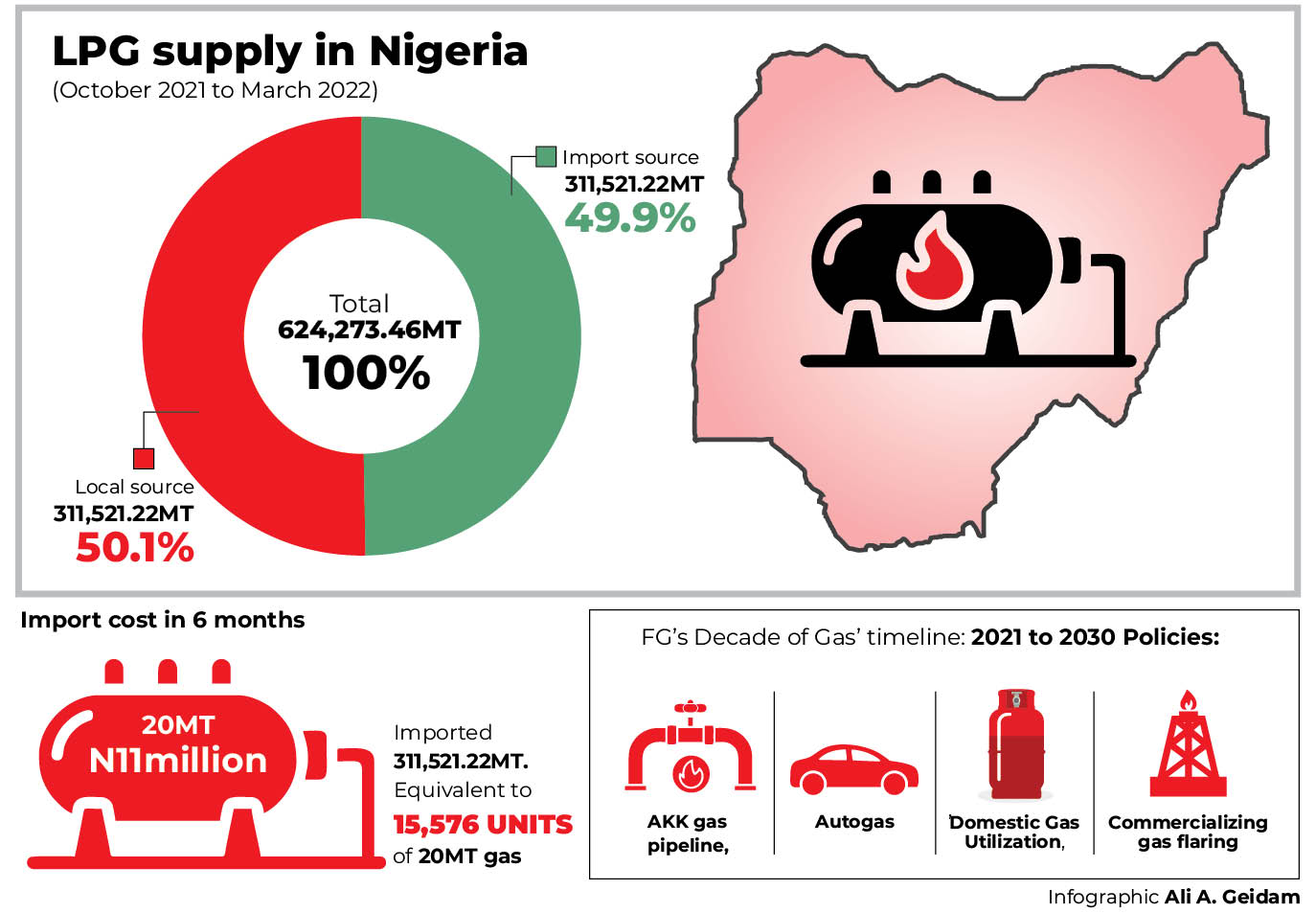

Although the federal government had come up with what it called a ‘Decade of Gas’ policy, with a view to utilising its vast resources, conserve energy and reduce heavy dependence on other countries, nearly 50 per cent of the over 624, 000 metric tones (MT) of the consumed LPG within the time under review was imported.

According to an analysis of data obtained from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), eight firms imported 311,521.22MT (49.9%) of cooking gas between October 2021 and March 2022 from USA, Equatorial Guinea, Belgium, Argentina, among others.

However, 312,752.24MT, representing 50.1 per cent of the domestic market supply, was obtained locally from the Nigeria Liquefied Natural Gas (NLNG) in Bonny, Rivers State and BRT LNG.

From January to August 2021, the Nigerian market recorded 740,675.72MT of gas supply, which was a rise from the 675,814.72MT recorded in the first eight months of 2020, according to a data earlier obtained from the defunct Petroleum Product Pricing Regulatory Agency (PPPRA) now, NMDPRA. From the figures, an average of 50 per cent of the gas was imported during the period.

What the ‘Decade of Gas’ means

On March 29, 2021, President Muhammadu Buhari declared the ‘Decade of Gas’ from January 1, 2021 till 2030 to demonstrate efforts of the federal government to increase the usage of gas as the energy of choice among Nigerians.

This came at a time when the world is harping on a shift to renewable energy in responses to challenges of climate change.

Buhari, on his Twitter handle, had stated that declaring the Decade of Gas followed the ‘Year of Gas’ in 2020, which was test-run.

The president had stated: “We are developing gas infrastructure (the construction of the 614km Ajaokuta-Kaduna-Kano gas pipeline is one major example), increasing domestic utilisation of LPG and CNG, commercialising gas flares, developing industrial gas markets and increasing gas-to-power.

“We have also kick-started other policies and projects like the National Gas Expansion Programme and the Autogas policy. And in the middle of a pandemic, the NLNG Ltd is going ahead with its Train 7.”

However, there are fears that with the rising cost of cooking gas, the gas utilisation of the LPG may decline, putting a clog in the achievement of the Decade of Gas objectives.

How Nigerians spent N343bn on cooking gas

As at May 2022, cooking gas was N11 million per 20MT at local depots, such as NAVGAS, NIPCO0. The 624,273.46MT of gas is equivalent to 31,214 units of 20MT bulk gas sale. This would mean that Nigeria spent over N343.4 billion on cooking gas within the six-month period. Of this amount, 15,576 units of 20MT equivalent of the cooking gas was imported, which is estimated at N171.3bn or $413. million (N414/$ CBN rate).

Nigeria had 208.62 trillion cubic feet (TCF) of gas reserve as at January 2022, according to the Commission Chief Executive (CCE) of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Gbenga Komolafe, an engineer. However, the development of gas, especially for domestic use, is still relatively low.

The NLNG had in January this year announced plans to begin to supply 100 per cent of its LPG production (propane and butane) to the Nigerian market.

This was three months after the NLNG supplied its first propane cargo into the domestic market. It was the highest supplier of LPG for the domestic market of 400,000MT last year.

Algasco leads 7 others on gas import

An analysis of the six-month domestic gas market report by Daily Trust on Sunday showed that the highest import was made in December at 79,005.26MT with the lowest import of 28,934.81MT in January. By March, the import had risen to 61,884.29MT.

The biggest importer was Algasco as it imported 88,402.99MT to its depots in Lagos from USA and Chile ahead of seven other gas importers. NIPCO, another local retail outlet was next with 74,218.22MT of gas imported to its Lagos depots from the USA and little from Argentina. Techno Oil was the third largest LPG importer with 52,948.86MT consignment from USA, Equatorial Guinea and Algeria.

Prudent Oil imported 41,559.92MT from USA and Equatorial Guinea to its Oghara depot in Delta State. Rainoil was the fifth largest importer with 28,155.72MT of gas from USA, Algeria, Argentina and Equatorial Guinea.

Matrix got 5,953.77MT from the USA during the period; 11 PLC imported 5,777.17MT cargo from Trinidad & Tobago in November while a consortium of NIPCO and 11 PLC imported 5,065.03MT from Belgium just as A.A. Rano only imported 4,362.19MT of gas from the USA in October.

7 large retail firms jostle for only 2 local producers

At least there are 10 firms contending for local gas supply mainly from just the NLNG and BRT LNG, the reports indicated. Of the 317,369.06MT total local gas supply within the period, NLNG produced 271,756MT, representing 85.6 per cent of the local stock while BRT LNG produced 45,613.06MT (14.4%).

Again, Algasco dominated the NLNG supply source, leading the entire local gas supply stock with 116,313.09MT within the six months to its depot in Lagos.

Another competitor with Algasco in the NLNG gas run is NIPCO and 11 PLC consortium, which got 80,354.29MT of cooking gas consignment. They were trailed by Stockgap, which got 75,088.62MT of gas from the NLNG to its Lagos depot.

From the BRT supply source, Matrix got 24,231.09MT, Techno Oil got 7,484.37MT, Ultimate got 7,092.45MT, while Prudent got 6,805.15MT of cooking gas for retailing.

Higher imports, higher gas prices for Nigerians

The more volume of imported LPG, the higher prices Nigerians are paying for the product. Some marketers and members of the Nigerian Association of Liquefied Petroleum Gas Marketers (NALPGAM) noted that the gas importation took into account the rising foreign exchange rate (forex), which is officially N414 to a dollar (CBN window) but is N600/$ at the black market last week.

The petroleum product prices report of March 2022 released by the National Bureau of Statistics (NBS) indicates that Nigerians paid more for cooking gas as a 5kg LPG cylinder refilled sold for N3,778.30 at the retail outlets. That was higher than the N2,057.71 Nigerians bought same in March 2021 when the forex was relatively low. Nigerians bought that gas volume at N3,708.58 in February 2022. In terms of spread, people paid more for 5kg gas refill in Ekiti at N4,200, Niger at N4,163.33 and Imo at N4,150. The price for a 12.5kg gas refill rose to N7,617.71 in March against N4,359.23 in March last year.

A survey by Daily Trust on Sunday within Abuja, Nasarawa and Niger states shows that the same volume of has is now refilled at N8,300 and N8,500.

How to boost gas utilisation – Experts

As more Nigerians are joining the clean cooking energy league, experts and gas marketers said the investment to drive local sufficiency is still low and is responsible for the about 50 per cent monthly cooking gas import bill. They, however, feared that this would continue to dissuade the adoption of cooking gas as clean energy.

John Omeiha, a gas marketer in Abuja said marketers would prefer to get supply from producers in Nigeria than placing orders abroad.

“You see, there are a lot of hurdles involved with shipping gas to Nigeria: Customs clearance, shipping firm issues, insurance and a lot of others before the cargoes get to our depots.

“We believe that the government should drive a favourable environment to increase the production of LPG in Nigeria,” he said.

Philip Aliyu, a retail depot operator in Abuja, said there was a decline in the sales since the price rose to over N600 per kilogramme.

“What we have observed is that people come to buy in smaller quantities, unlike what happened two months back. People are resorting to charcoal and firewood, but we are hopeful that with more local production, the gas price will ramp down,” he noted.

On his part, an energy expert, Hassan Abdulrahman, an engineer, lauded federal government’s decision that the NLNG, jointly owned by the Nigerian National Petroleum Company (NNPC) Limited should devote 100 per cent of its LPG production to the Nigerian market.

He, however said the NLNG should allow more retailers to access it.

“From what you explained in the report, the gas supply from the NLNG is dominated by just three firms. It makes those firms to take monopoly of the domestic LPG market. There is a need for a more level playing field for local firms, just as more production is required.

“When the market has enough local capacity, the price at the retail outlets will drop. However, if we continue on this trajectory of import-reliance, we may buy gas again at over N10,000/12.5kg with the way the naira is fast weakening against the dollar,” Abdulrahman explained.

This story was produced under Dataphyte’s 2022 Media Fellowship.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.