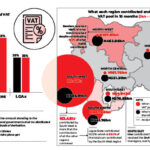

The federal government’s gross VAT collections for Q2 ‘23 increased by 10% q/q and 30% y/y to NGN781bn, according to the most recent report on value-added tax (VAT) from the NBS.

The total VAT collection in Q2 implies gross VAT collections of almost NGN1.5trn in H1 ‘23, representing an increase of 25% y/y. Returning to Q2 ‘23, domestic (non-import) VAT was the largest source of VAT revenue during the quarter, accounting for NGN512bn, or 66% of total receipts. This figure marked a significant increase of 43% y/y. Foreign (non-import) VAT and import VAT contributed to the balance of NGN143bn and NGN127bn respectively.

The manufacturing sector retained the top spot, with a total VAT contribution of NGN152bn, representing 30% of domestic VAT collection, and 19% of total VAT receipts. VAT receipts from the sector increased by 17% q/q and 28% y/y respectively.

Despite the higher VAT take, the sector posted modest GDP growth of 2.2% in Q2 ’23.

- BON kicks as Rivers shuts AIT, Raypower’s operations

- Palliatives: Kano distributes 457,000 bags of rice, maize to citizens

The sector’s GDP growth has averaged a mere 2.5% over the past eight quarters due to issues like weak consumer demand and the impact of macroeconomic headwinds, such as, the FX liquidity crunch, and high inflation on business operations.

The information and communication (ICT) sector ranked as the second-largest contributor to VAT revenue, generating more than NGN108bn. It accounted for 14% of total VAT collections.

Although ICT GDP growth slowed in Q2 ’23, it still posted a decent growth of 8.6% compared with 10.3% in Q1 ’23.

Financial and insurance services also contributed around NGN57bn to VAT revenue, representing an 11% share of domestic VAT collections, and a 7% share of gross VAT receipts.

Mining and quarrying, and public administration round up the list of the top five contributors to VAT revenue.

Both sectors contributed NGN54bn, and NGN38bn respectively, or 11% and 7% of domestic VAT revenue respectively. Their share of total VAT revenue was 7% and 5% respectively.

Despite the improved outturn for VAT, economic activity across most sectors is sub-par.

While ongoing efforts to improve collection efficiency are commendable, the government must intensify efforts to ensure that the macroeconomic environment is conducive enough for businesses to thrive.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.