Banking has always been a way for people to save money or move from place to place without the risk of carrying large sum of cash.

Gone are the days when people kept money hidden under their beds or in piggybanks. The banking system that started with the goldsmith has evolved. Now “Mobile app”, “internet banking”, “electronic banking”, “POS”, “ATM”, “Cashless”, “Token” are the buzz words.

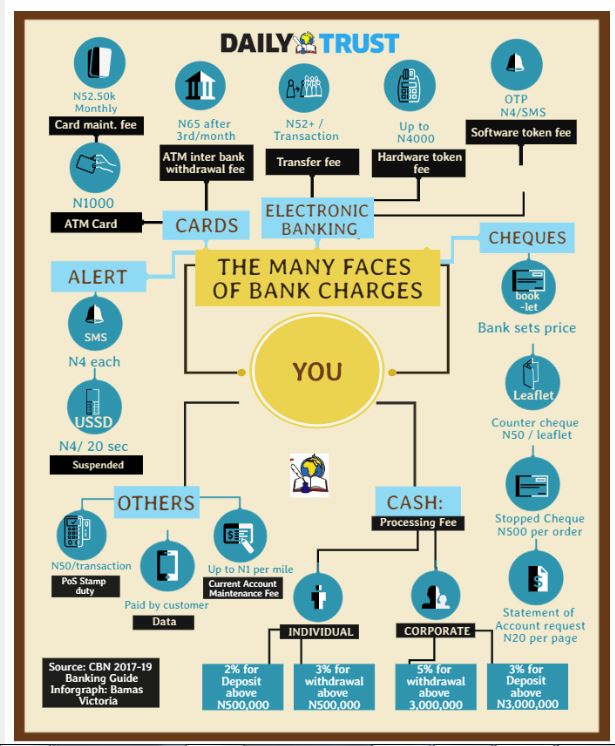

You can recover 100% of the money you put away under your bed or in a piggybank. That is not the case with modern banking as nothing comes for free. There are charges upon charges associated with different services rendered.

A running joke is that if you left N2,000 in a savings account for five years, at the end of five years, you would be in debt: bank charges would have exhausted everything.

On Sunday the 20 October 2019, users of MTN mobile network received a message notifying them of a new charge related to banking transaction. The message reads “Yello, as requested by your bank, from Oct 21, we will start charging you directly for USSD access to banking services. Please contact your bank for more info.”

The above message was followed by another: “Yello, Please note that from Oct 21, we will charge N4 per 20 seconds for USSD access to banking services. Thank you.”

Even though MTN subscribers recently got the message, many opined that it’s not a new development as other mobile service providers had been making such deductions.

The myth of self service

Self-service is an idea pushed for ease of transaction for the customer. A customer is made to perform some transaction by themselves. Despite doing this yourself you are still made to pay certain charges. And sometimes when you go to the bank to do some transactions the tellers will refer you to use USSD or App or the ATM not minding the fact that you still pay for this. And if you ask why, they say it is meant to decongest the banking halls, but at whose expense?

The Plethora of charges – The different faces of charges

Here are some of the charges and fees banking customers pay

ATM Card Fee: Some banks might or might not request for minimum account balance but one thing you are subtly forced to get is an Automated Teller Machine (ATM) Card. This is because unless a customer is making transactions above N100,000, a number of bank tellers will not attend to you but ask you to use the ATM. These cards are not given free: you will be charged between N1,000 to N1,500. This fee is applicable both for renewal and replacement.

Card maintenance fee: Should you opt for a card, you will be charged between N52.50 or more monthly. As at October 2018, the charge was N50. And sometime between then and June 2019, it was reviewed upwards with an additional N2.50 kobo.

Current account maintenance fee (CAMF): According to a CBN circular dated April 21 2017 with ref No FPR/DIR/GEN/CIR/06/017 and titled “Guide to charges by banks and other financial institutions in Nigeria”, banks can charge up to N1 per mile on an account, “Negotiable, subject to a maximum of N1 per mille (1/N1,000)”.

This, it says, is “applicable to current accounts ONLY in respect of customer-induced debit transactions to third parties and debit transfers/lodgments to the customer’s account in another bank.

SMS alert fee: According to the CBN, SMS alert is mandatory. However, where a customer opts not to receive SMS alerts, the customer should issue an indemnity (for losses that may arise as a result) to the bank. A customer is charged N4 for every customer-initiated transaction.

PoS transaction charges / Stamp duty: The Federal Government recently mandated the CBN to strictly implement merchant service charge, which would impose more charges on all point of sale (PoS) transactions. To this end, the CBN issued a circular to banks and other stakeholders titled, “Review of Process for Merchants Collections on Electronic Transactions.

The new policy covers every transaction that occurs on PoS platform, unlike previously when charges are tallied on aggregate transactions. Thus, for every PoS transaction of N1000 or more, a stamp duty of N50 will be charged.

Cheque book: Customers operating a current account are issued a cheque book. This cheque book cost is set by a bank according to its production cost referred to as “cost recovery” by the CBN. Also, a counter cheque costs a minimum of N50 per leaflet while for Stopped Cheques, a customer is charged N500 per order

ATM withdrawal fee: ‘On-us’ (withdrawal from issuing bank’s ATM) are not charged whereas, ‘Not on-us’ (withdrawal from other bank’s ATM) is charged N65 for each transaction after the third withdrawal within the same month.

Transfer fee: A customer either via USSD, internet banking, or mobile app who initiates a transfer from a bank to a different bank is charge at least N50 for each transaction.

Hardware token fee: To carry out some transactions, especially on the internet banking platform, requires a password which is usually generated by a hardware. This hardware according to CBN can cost up to N4,000.

Software token: Some transactions do not require a hardware token generator. However, where the (one-time pin) OTP is sent to the customer via SMS, a charge of not more than N4/SMS shall apply, says CBN.

Statement of account request: If you request for a statement of account (request in a manner other than agreed on mandatory issuance) you are charged maximum of N20 per page

Deposit fee and withdrawal fee: CBN in an effort to promote cashless policy in a circular to all deposit money bank (DMBs), announced the start of charges on deposits in addition to already existing charges on withdrawals.

According to the circular, “the charges, which take effect from Wednesday, September 18, 2019, will attract 3 percent processing fees for withdrawals and 2 percent processing fees for lodgments of amounts above N500,000 for individual accounts.”

Similarly, “corporate accounts will attract 5 percent processing fees for withdrawals and 3 percent processing fee for lodgments of amounts above N3,000,000.”

The statement, however, disclosed that the charge on deposits shall apply in Lagos, Ogun, Kano, Abia, Anambra, and Rivers States as well as the Federal Capital Territory.

USSD Fee: Unstructured Supplementary Service Data (USSD) is when you use designated short codes to carry out banking transactions. According to MTN you will be charged N4 for every 20 seconds. This the government and regulatory body have asked to be kept on hold.

Precedence…

To the relief of customers, Nigeria Communications Commission and CBN have asked that the USSD transaction fee be halted. But will this relief be permanent? A Look at precedence will say otherwise.

For instance, the federal government had earlier introduced the stamp duty and halted it in 2017. However in 2019 it has been reintroduced it again.

In 2017 the CBN suspended cash handling fee. That is, charges on withdrawals and deposits but in 2019 it has re-introduced it again

Also FG at a point suspended the ATM withdrawal fee, but it was later re-introduced albeit for a reduced cost of N65 from the initial N100.

The bank charges discussed here are not exhaustive. Let us know what you think in the comment section.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.