In recent years, social media has provided a vibrant platform for Nigerians to showcase their talents and earn big even in foreign currencies. However, unlike what obtains in other countries, content creators and influencers barely pay tax from the fortunes they make in the digital space owing to what experts identify as lapses in Nigeria’s tax laws.

The tax record of Ibrahim Ajibade, a clerk at a consulting firm in Lagos and that of an average Nigerian social media content creator, presents a stark twist of irony. Ajibade, like every civil servant in Nigeria, pays tax from his N70,530 gross earning every month.

In contrast, skit makers, YouTubers, TikTokers and influencers manage to evade tax despite earning bigger. Yet, they access – at little or no costs – infrastructural facilities such as roads and hospitals constructed with funds raised from taxes paid by poor salary earners like Ajibade and others.

As the government grapples with dwindling revenues and mounting public debts hovering above N87 trillion, these entertainers lead an income tax-free, luxury lifestyle, building mansions in choice areas and riding expensive vehicles.

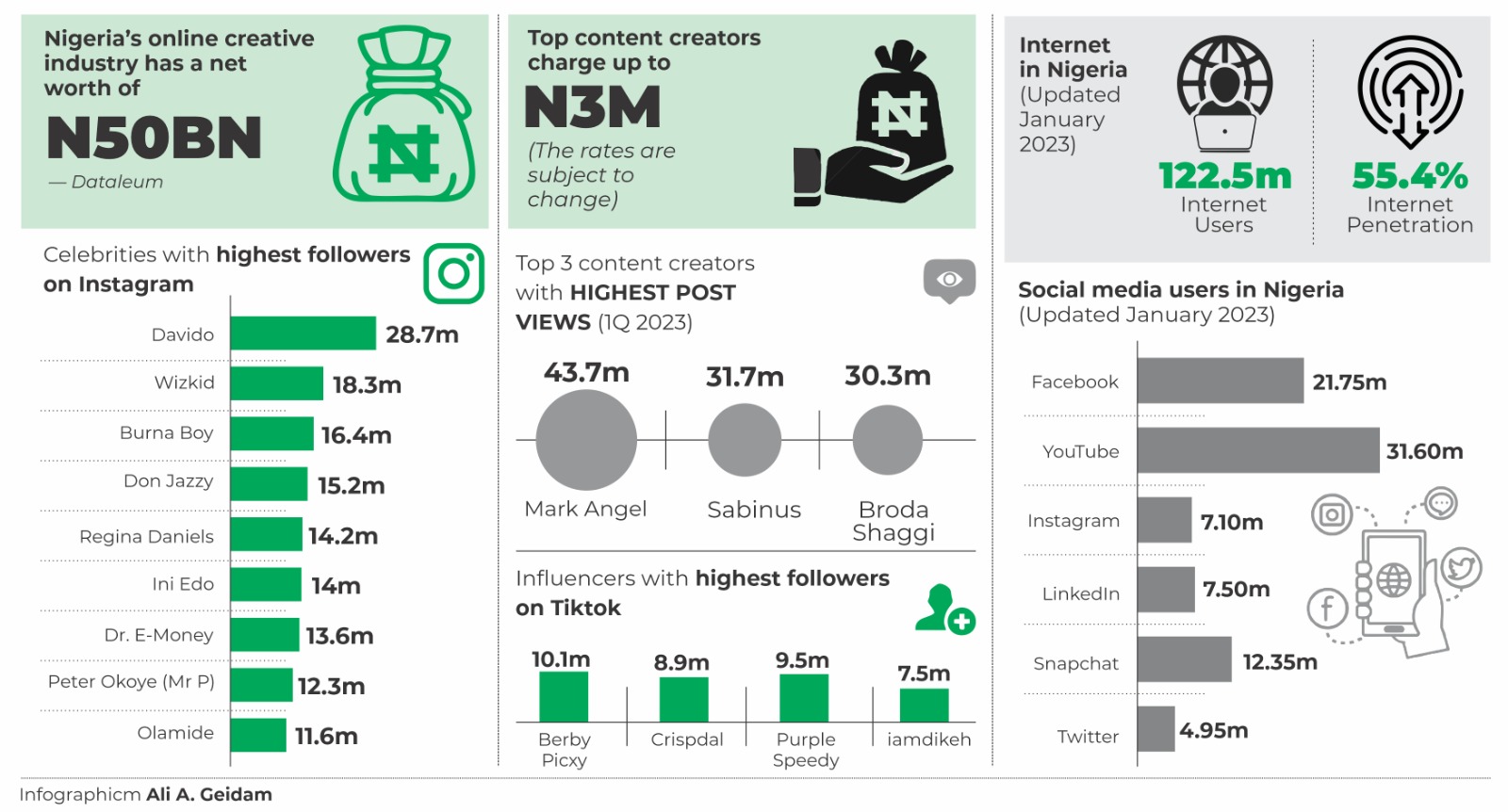

The online creative industry is a goldmine with skit making alone ranked by Dataleum “as the third largest entertainment industry in Nigeria with a net worth of over N50 billion”.

Nigeria boasts of a population estimated at over 200 million and high social media users, thereby providing a huge local market for content creators and influencers, aside from the global reach.

A report by DataReportal revealed that in January 2023, Nigeria’s internet users were 122.5 million, even though the internet penetration in the country stood at 55.4 per cent – meaning that 98.63 million people did not use the internet at the time.

Facebook had 21.75 million users, YouTube, 31.60 million; Instagram, 7.10 million; LinkedIn, 7.50 million; Snapchat, 12.35 million while Twitter had 4.95 million users.

As of 2021, a popular skit maker, Samuel Animashaun Perry, well known as BrodaShaggi, grossed up to N3 million from a sponsored post, Daily Trust on Sunday gathered.

He charged N500, 000 for a featured post (client’s picture or a video advert) on his Instagram timeline for 24 hours, N1 million for seven days and N1.5 million to leave the post permanently.

“Content creation, development, execution delivery and posting” for a client attracts N2.5 million on his Twitter handle; N2.6 million on YouTube page; N2.7 million on Facebook; N2.8 million on Instagram and N3 million on all social media platforms.

“The rates are subject to change, and once payment has been made, there would be no refund,” a document obtained by Daily Trust on Sunday stated.

Although his current charges could not be ascertained, they are expected to have been reviewed upwards given the growing acceptance of digital marketing in Nigeria.

Aside from the huge incomes they earn from brand promotion and endorsements, the contents they post on YouTube, Facebook, Instagram, TikTok, among others are monetized – in dollars – based on the number and duration of views.

The views are usually in millions, literally translating to more money for the creators. For instance, in the first quarter of 2023, Mark Angel led the pack of top 10 Instagram skit makers with his videos garnering a whopping 43.7 million views, according to Dataleum. He was followed by Emmanuel Chukwuemeka Ejekwu, aka Sabinus, with 31.7 million views and BrodaShaggi, with 30.3 million.

Like skit makers, influencers are ambassadors of top brands; they rake in millions from endorsements to promote products on social media. And Nigeria has them in numbers. The leading ones on Instagram, for instance, are ace hip hop artiste, David Adeleke, well known as Davido, with 28.7 million followers; his colleague, Ayodeji Balogun, aka Wizkid, with 18.3 million followers; Damini Ogulu, aka Burna Boy, with 16.4 million followers; Marvin record label CEO, Michael Ajereh alias Don Jazzy, with 15.2 million followers; ace Nollywood actress Ini Edo, with 14 million followers; actress and film producer, Regina Daniels, with 14.2 million followers.

Other top influencers on Instagram include Chairman, Five Star Group, Dr. E-Money, with 13.6 million followers; popular singer, Peter Okoye aka Mr P, with 12.3 million followers; Simisola Ogunleye popularly known as Simi, with 12.4 million followers and ace rapper, Olamide Adedeji, aka Olamide Badoo, with 11.6 million followers.

Among Nigeria-based top influencers on TikTok are Maduakor Chisom Faustina fondly called Berby Picxy, with 10.1 million followers; Chinese Elijah aka Crispdal, with 8.9 million followers; Peace Pever Anpee aka Purple Speedy, with 9.5 million and Chukwudike Akuwudike Damian alias iamdikeh, with 7.5 million followers.

Untapped goldmine for govt

The incomes, which content creators and influencers generate from skit video views and brand promotion, mostly escape the tax net.

The chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr Taiwo Oyedele, recently disclosed that Nigeria was losing about N20 trillion (about $26 billion) annually to tax evasion and inefficiencies in tax collection modes.

The National Bureau of Statistics (NBS) had, in August 2023, said that foreign firms, including Google, Netflix and Facebook, paid about N2 trillion in taxes into the federal government’s account in 15 months.

We’ll enforce payment- FIRS

The Federal Inland Revenue Service (FIRS) said social media content creators and influencers constituted a major block of tax evaders.

“They are not paying,” Dare Adekambi, Special Adviser on Media to the chairman of the FIRS, stated when asked if Nigerian content creators file tax returns.

“Skit makers, influencers and other content creators who are making money using digital platforms need to be paying tax. There is a law in Nigeria that requires everybody who earns income to pay tax. They earn in dollars. Tax is a civic obligation; civil servants are paying, so they also have to pay.

“The CAC’s Registrar-General and the FIRS’ chairman recently discussed how they can work together in bringing them into the tax net. The challenge is how to track them, but we are looking into it,” Adekambi said.

He said the FIRS would meet with content creators and influencers and make them see why they should voluntarily pay tax.

“But if our friendly approach is taken for granted, then we will go for enforcement,” he added.

He said the FIRS would use data and technology to scale up tax revenues.

“If Facebook, Instagram, Twitter and other social media platforms are paying taxes to the government, why would people using those platforms to create content and make money not pay? By the time a committee is a set up to look into it, a broad spectrum of activities will be covered.

“There is a way the government monitors everything in other climes. One of the cardinal goals of the current FIRS chairman is to leverage technology and data. When you have these, revenue will be predictable and it will be easy for the government to plan,” he said.

What obtains in other climes?

Unlike in Nigeria, social media content creators and influencers pay taxes in developed countries. In the United States and Australia, for instance, they are required to file their tax returns at a specified period.

As a general rule of thumb, any income above $600 in a financial year generated through Instagram, Twitch, TikTok, Patreon or any other digital platform is taxable in Australia. And those who see their socials as just fun are not exempt from tax by the Australian Tax Office (ATO) so long they post or stream contents with the intention of making money.

“The amount of taxes you’ll pay depends on a number of factors such as your income bracket, any other investments or financial obligations you may have, and the amount of business-related deductions you have claimed for the year.

“Typically, you can claim any item that you have purchased specifically for developing your Instagram or TikTok platforms. However, this doesn’t mean that you can live a lavish lifestyle to promote your channel and just claim your living expenses back on tax. You can only claim back the business-related portion of your expenses,” a report on ATO revealed.

What is more? Expensive gifts are considered as part of influencers’ incomes and they are expected to pay taxes on them.

“We’ve all seen pictures of Instagram influencers surrounded by expensive handbags, clothes, and other goods that brands have sent them to promote. ‘They’re so lucky,’ we think, ‘they get thousands of dollars worth of stuff for free!’ Maybe not; because according to the ATO, physical goods received in exchange for other goods or services are considered a bartering exchange. Just like cash transactions, bartering exchanges are accessible and deductible for income tax purposes. Bartering exchanges can also include intangibles such as free accommodation or event entry, use of a car, or free travel.

“That doesn’t necessarily mean you’re required to declare every small freebie you may receive from fans or commercial partners. But if you receive goods of substantial value, the ATO considers that part of your business income, and will expect their share of its value at tax time,” the report further stated.

How to get social media content creators to pay tax–Experts

The Chief Executive Officer, Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, noted that digital platforms created a big economy, especially for the young people.

Yusuf, a former Director-General of the Lagos Chamber of Commerce and Industry, said the sector offered huge potential for youths to fend off unemployment and a viable avenue for the government to shore up its dwindling revenues.

“I know the government has taken some steps to ensure that activities taking place on the digital platforms are also captured in the list of revenues. Some steps are being taken on e-commerce, for instance, on how tax can be paid on transactions that take place there.

“The same thing can apply to content creators on the digital platforms. However, a threshold should be defined so that tax authorities won’t frustrate them. The government can define a threshold (of income), after which they can start to impose tax on them,” Yusuf said.

The Managing Partner, Primo Tax, Olufunsho Ola-Ojo, said the government could generate sizeable revenue from the digital creative sector, but expressed worry that Nigeria’s current tax law is not sophisticated enough.

“The way they earn their income, you can’t even tax it because it is mostly inflows coming from Facebook, Instagram and others and the payments are made offshore. Even if the government meets with Facebook and co, it will be difficult to know what those people earn because some of them are not even paid directly. They are paid through their managers,” he said.

Ola-Ojo advised tax authorities to collaborate with tax practitioners and design a framework to draw content creators and influencers into the tax net.

Ola-Ojo further encouraged the government to leverage the Bank Verification Number (BVN) to gain insight into the influencers’ incomes via their bank accounts. This way, he said the government could ask them to show evidence of tax payment on their incomes.

“If well harnessed, the government can generate significant revenue running into billions from this sector. I know that Lagos State Government tries to enforce tax payment by asking for tax clearance from people before they can benefit from certain government services. But that is not adequate. If peradventure, they do not need those government services, then they won’t pay,” he said.

Aside from BVN, National Identity Number (NIN) can assist in enforcing tax payment, a senior official of BAO Tax Consultants & Accounting Firm, Tunde Onanuga, disclosed. He said with NIN, the government can access the bank accounts of individuals trying to evade tax or underpay.

“Let everybody have NIN and (the government will) secure the database. By the time we tap the button, all what you are earning will show up,” he added.

Onanuga expressed hope that the ongoing tax reforms led by Oyedele would address tax evasion in various sectors, including the creative industry, if the recommendations by the committee were implemented.

Oyedele addressed some of the issues raised by Ola-Ojo and Onanuga while speaking to journalists shortly after the inauguration of the tax reform committee by President Bola Ahmed Tinubu in August 2023.

He said many of our existing laws were outdated and required comprehensive updates, adding that “without introducing any new taxes, if you get everyone that needs to pay their taxes to pay, we will not be where we are.”

In an earlier interview, Oyedele said if a working system was in place, the intelligence would capture any money spent by individuals.

“If we look at your tax record and we cannot reconcile it, it becomes a target for investigation because you need to explain the source of that money. That is why countries like the United Kingdom have Unexplained Wealth Order, which Nigeria should have introduced, because it was a treaty signed in Ethiopia and Nigeria was a party to it, but we never introduced it. If we introduce it and tie it to taxes, we can solve not only the revenue and deficit problems, but also check criminal activities,” he said.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.