There are indications and concerns that the implementation of the 2019 budget of N8.92 trillion may not be going as fast as expected due to various issues, which include poor performance of oil and non-oil revenue-generating sources.

The 2019 budget is just about four months since the implementation began. The budget was signed into law on May 27 and the implementation continues till May 2020.

The total budget estimates for 2019 was N8.92 trillion, while a projected revenue of N7trn was anticipated. The budget deficit (borrowing) was N1.92trn and debt servicing was put at N2.14trn.

With the projected revenue, non-oil revenue was projected at N3.69trn and oil revenue was equally pegged at N3.69trn.

The budget allocated capital expenditure of N2.09trn and recurrent expenditure of N4.07trn. statutory transfers were N502bn and sinking fund N110bn.

While presenting the 2020 budget to the National Assembly members last Tuesday, President Muhammadu Buhari also gave a summarised report of the 2019 budget performance.

Rating the performance slightly above average, the president said, “You will recall that the 2019 ‘Budget of Continuity’ was based on a benchmark oil price of $60 per barrel, oil production of 2.3 million barrels per day (bpd), and an exchange rate of N305 to the United States Dollar.

“Based on these parameters, we projected a deficit of N1.918 trn or 1.37 per cent of Gross Domestic Product.

“As at June 2019, Federal Government’s actual aggregate revenue (excluding government-owned enterprises) was N2.04trn. This revenue performance is only 58 per cent of the 2019 budget’s target due to the underperformance of both oil and non-oil revenue sources.

“The performance of non-oil taxes and independent revenues such as internally generated revenues were N614.57 billion and N217.84 billion, respectively.”

From the president’s presentation on capital expenditure, the 2019 budget implementation has been hindered by the combination of delay in its approval and the underperformance of revenue collections. Only recurrent expenditure items have been implemented substantially. Of the appropriated expenditure of N4.46trn budgeted, N3.39trn has been spent by June 30, 2019.

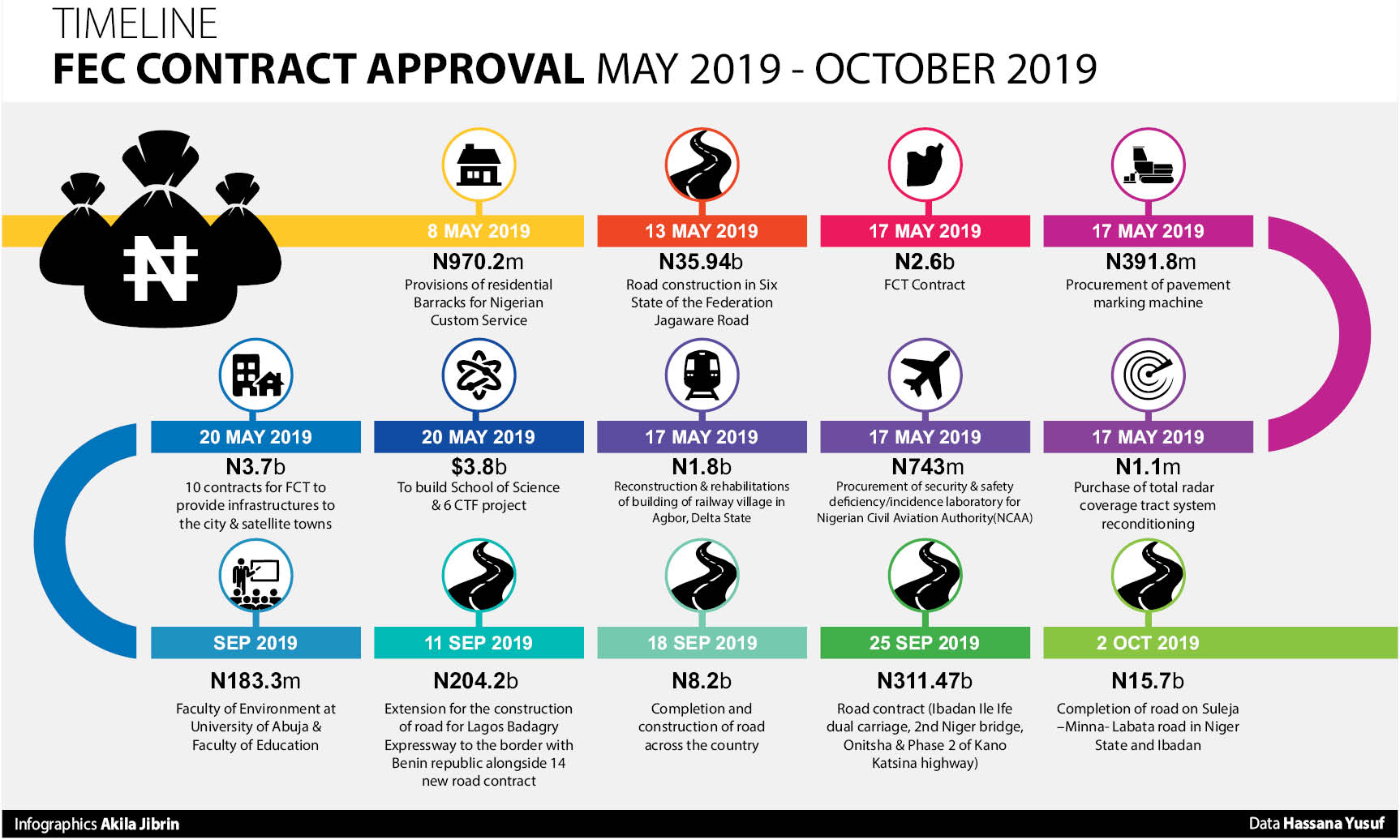

The capital releases under the 2019 budget began in the third quarter. As of September 30, 2019, N294.63bn had been released for capital projects.

“I have directed the Ministry of Finance, Budget and National Planning to release an additional N600b of the 2019 capital budget by the end of the year,’’ Buhari said. However, the monies haven’t been fully released, insider sources at the Ministry of Finance said.

The president also noted that despite the delay in capital releases, a deficit of N1.35trn was recorded at the end of June 2019, representing 70 per cent of the budgeted deficit for the full year.

FG paying salaries, servicing debts

A plus for the budget so far, as indicated by Buhari’s address, is that the Federal Government has been paying salaries, meeting overhead costs and servicing its debt obligations. The Ministry of Finance is yet to give a sectoral breakdown of the implementation of the 2019 budget.

Daily Trust on Sunday spoke to various experts and financial analysts who shared their views on the causes for the slow budgetary implementation and the panacea to accelerating it, especially with the push to deliver the capital expenditure meant for projects that would have an impact on the masses.

Embrace compliance, accountability, FG told

Dr. Bongo Adi of the Lagos Business School (LBS) said the government would need to step up its budget implementation and accountability. He said the major problem was accountability, monitoring, evaluation and reporting, which do not seem to exist.

He also queried the delay in providing significant details, including a sectoral performance of the budget.

Adi said, “Right now, what is the implementation level of the 2019 budget? We don’t even know. This is October and we don’t really know what the implementation level is. From all indications, the implementation of the capital budget has never gotten to 30 per cent. Now, we have another budget. All they need to do is show us a simple chart on their budget implementation.”

Another expert and lecturer at the Department of Business Administration, Ahmadu Bello University (ABU), Zaria, Dr. Mustapha Shittu, argued that unless a strict compliance and monitoring measure is introduced, resources would be spent and the citizens would be wondering where all the monies have gone to. For example, in the previous budgets, education was allocated reasonable amounts, but do we have better schools? Are teachers in public schools better equipped?’’ He asked.

A financial analyst and the executive chairman/chief executive officer of Xcellon Capital Advisors Ltd in Lagos, Dr. Chamberlain Peterside, also flayed the slow implementation of the 2019 budget so far.

His firm provides services in investment management, corporate capital raising and infrastructure financial advisory in growth sectors of Nigerian and the West African economy.

Dr. Peterside said, “As at September, the recurrent expenditure has been 80 per cent achieved, whereas the capital expenditure is poor. Out of over a trillion naira, it is just about N300bn that has been released.”

He said revenue generation stood at 69 per cent by September, but the budget will be implemented up to May 2020. “It is our expectation that before the full expiration of the budget, some of these numbers would have added.

“The volume of recurrent and capital expenditure would have increased and the volume of revenue generation would have also appreciated, but as it is, the implementation has not met up to expectation,” Peterside noted.

Nigeria should utilise positive IMF projection

Peterside said the 2019 budget implementation level could rise beyond the poor state it is now if government leveraged on the positive projection by the International Monetary Fund (IMF) and the World Bank for 2020.

He said, “I don’t see the budget performance rising; I rather see it remaining the same. But given that economic growth figure, according to the IMF, will be slightly better next year, that is a plus and we should check the box.

“We also hope that we do not see any shock in the global energy market, like prices, production and crude oil export. We have had peace and tranquillity in the oil-producing region and the volume of production has remained steady.”

He, however, feared that the pegging of production level at a proposed 2.1m bpd, as opposed to 2.3m bpd this year, may not translate into an improved budget next year.

He also explained that the foreign reserve at the Central Bank of Nigeria (CBN) cannot be used to finance the budget. “The reserve is a buffer to shield the country from global shocks, and it helps one on current stability. It does not meet anything for financing annual budget because you can’t draw from it to pay debts or for any recurrent,” he added.

But the Excess Crude Account (ECA) is best for short term financing. However, he said: “I don’t know how much that is now, but that is what we need for those short term needs like security or emergency, power project, etc. But that buffer has gone very low and that is quite a bit of a challenge there.”

2020 budget presentation good for January-December cycle

Dr Peterside, who also commented on the 2020 budget presentation, said it was a good thing that it came early, adding that it could help government return to the January to December implementation cycle.

He, however, added, “There are areas of concern. There is the deficit, and then the increases. The budget increased from N8.2trn to N10trn. Despite that increase, we have not seen the achievement in the revenue generation for the current year.

“How do you expect that one can achieve a higher budget number if that budget number has not been achieved in the previous year at a lower level.”

A professor of Economics at the University of Abuja, David Okoroafor, also agreed with this position. He, however, called for a political will to push for the implementation of budgets, noting that if the Federal Government jettisons the 2019 budget, it may not have any impact on returning the budget to January-December cycle, especially if the political will is not there.

He said that before now, Nigeria’s budget had been from January to December, but it slacked because of issues that bother on delay in the passage and lack of political will on the part of the government, as well as “too many unnecessary protocols.’’

To properly jettison the 2019 budget based on its performance, Okoroafor said the money that could not be spent would be rolled over into the new budget, adding, “Even the recurrent part of the budget will still be paid.’’

He also said all the projects that should be done should be reflected in the new budget and implemented.

Okoroafor added: “The aim is not just to return to the January to December budget cycle, but to ensure that the plan is focused.”

New 7.5% VAT may hit consumers

The proposed 7.5 per cent increase in the Value Added Tax (VAT) for the 2020 budget was also another point for the experts, besides the implementation level of the 2019 budget.

Professor Binta Yahaya of the Department of Economics, Yobe State University, said the 2020 budget was realistic. She also noted that the proposed increase of VAT from five per cent to 7.5 per cent may help improve the tax base to strengthen the country’s fiscal position and enhance the revenue generation of the country.

She said there were concerns that the proposed hike in VAT is making government optimistic in its revenue target, which is fair. However, Prof. Yahaya said it should not be at the expense of the masses.

On his part, Dr. Peterside said it was not a good thing for the consumer because the government could stifle consumption and business activities with higher tax. “I will say the VAT will actually go to paying a higher minimum wage, and so, it is hard to convince me that a higher tax will mean a high capital expenditure.

“The budget service also envisages some borrowing, and we know that the debt service has been growing. So a higher VAT or tax will go towards meeting our recurrent obligation and debt obligation so that we don’t default. So, a higher VAT may not necessarily translate to capital expenditure,” he explained.

The director-general of the Budget Office, Ben Akabueze, however, clarified last week that the proposed tax rate would only apply to businesses with a turnover of N25m and above. He said it had minimum engagement with the poor.

Implementing the 2020 budget is another concern by the experts who spoke with our correspondents. An Abuja based expert, Mudashir Mustapha, expressed reservations about the implementation.

On the implications of the increased borrowing and debt servicing, Prof. Mohammed Yelwa of the University of Abuja said the economy was already operating in a deficit.

While he noted that it was good to borrow when it is aimed at growing the economy to close the gap on a deficit, Dr Yelwa said the country was notorious for borrowing to build bridges and roads.

“The productive capacity of our economy is not working, and oil and agriculture are not contributing largely to the economy; and as such, poverty and inequality keep rising,” he said.

On his part, the director-general, Nigeria Employers’ Consultative Association (NCEA), Mr. Timothy Olawale, lauded the early budget presentation. He, however, said, “Although this is an improvement over previous years, the budget should have been presented earlier to enable the National Assembly to perform their duties thoroughly. The 9th National Assembly is, therefore, expected to expedite action in order to return the budgetary process to a January-December fiscal year as enshrined in the constitution.”

Mr. Olawale emphasized that although the overall policy thrust of the 2020 budget is to ensure economic growth and job creation, the document wasn’t clear on the inclusion of the consequential adjustment of the national minimum wage.

Consequently, there could be the possibility of government at all levels embarking on massive retrenchment of workers and the further threat of strikes by Labour unions.

Olawale is also concerned about the N10.33trn budget with a projected Federal Government revenue of N8.15trn, saying it reflects a deficit of N2.18trn.

He noted that with the exemption of some food items, the increase in VAT rate should not have a significant impact on food.

To efficiently manage the current budget and others, he advocated a reduction in the cost of governance at all levels, promotion of efficiency and accountability, as well as transparency of the process.

The country director of the ActionAid Nigeria (AAN), Ene Obi, also expressed worry over the slow implementation of the 2019 budget, owing to the low level of revenue generation, aggregating N2.04trn as at June and amounting to only 58 per cent. According to her, it is more worrisome that N3.39trn has been spent out of the N4.46trn budgeted for recurrent expenditure as of June 30, while only N294.63bn was released for capital expenditure as at September 30.

“This has a major implication to the infrastructural development of the country, meaning that we continue to consume far more than we invest. Furthermore, the set parameters for the 2020 proposal remain unrealistic, given the volatility in the global oil market and the increasing insecurity across the country. Oil benchmark at $57 and the crude oil production of 2.18bpd are unrealistic.

“The estimated revenue of N8.155trn for 2020 is highly welcome if this would be vigorously pursued. The AAN hopes that with the new finance bill to be submitted by the president, the review of the domestic tax policy would lead to improved revenue over the period,” Obi said.

She expressed concern that the 2020 budget proposal would deepen the huge gap between capital and recurrent expenditures.

She said the capital expenditure proposal for 2020, which is N2.46trn, about 24 per cent of aggregate projected expenditure is not good enough for a country with a high need for infrastructural development.

“The AAN decries the abysmal allocations to agriculture, education and the social investment programme. It portrays the continued downward trends in these key sectors. It is pertinent to make provisions for adequate funding of agriculture, health and education sectors, given their strategic importance. Agriculture employs up to 80 per cent of the population, especially in the informal sector, where the majority of the small-scale food producers are female farmers,’’ he said.

Obi, therefore, urged lawmakers in the National Assembly to take a bold step to correct the inherent inequality in the pattern of allocation in the 2020 budget proposal.

On his part, Eze Onyekpere, the lead director of the Centre for Social Justice (CSJ), said the early presentation of the 2020 budget had positive notes. He said the National Assembly should endeavour to approve the budget before the middle of December 2019 to ensure the restoration of the fiscal year from January to December as enshrined in the Financial Year Act.

He also listed areas to be adjusted as revenue framework, especially on deficit and borrowing; oil assets ownership restructuring; oil revenue framework; general revenue projections; under-recovery; outdated fuel subsidy; revenue from minerals and mining; and monetary policy, among others.

He, therefore, called for deliberate steps by the president and members of the National Assembly on upward review in accruals to the Federation Account from production sharing contracts under the Deep Offshore and Inland Basins Production Sharing Contract Act, which can be done before the end of the first quarter of 2020.

“The president and NASS must show sufficient political will to expeditiously reform the oil and gas sector through the Petroleum Industry Bills. This can be done before the end of the first quarter of 2020.

“Transparent rules encompassing best practices should be deployed for the oil assets ownership restructuring. This should also be done expeditiously. Revenue projections should be based on empirical evidence. Trends from recent years, innovations from revenue collection agencies, as well as a change in social, environmental and economic circumstances, should be taken into consideration.

“Fuel subsidy is outdated and has no place in modern economic processes. It is a subsidy on consumption supporting industries abroad. Any meaningful subsidy should target production by our local industries. Fuel subsidy, under any guise, encourages fraud, criminality and mismanagement of public resources. The claim that Nigeria consumes 55-65million litres of petrol a day is false and cannot be supported by empirical evidence. The Central Bank of Nigeria (CBN) should seriously consider abolishing the dual exchange rate for a unified rate applicable across the board for all transactions,” Onyekpere said.