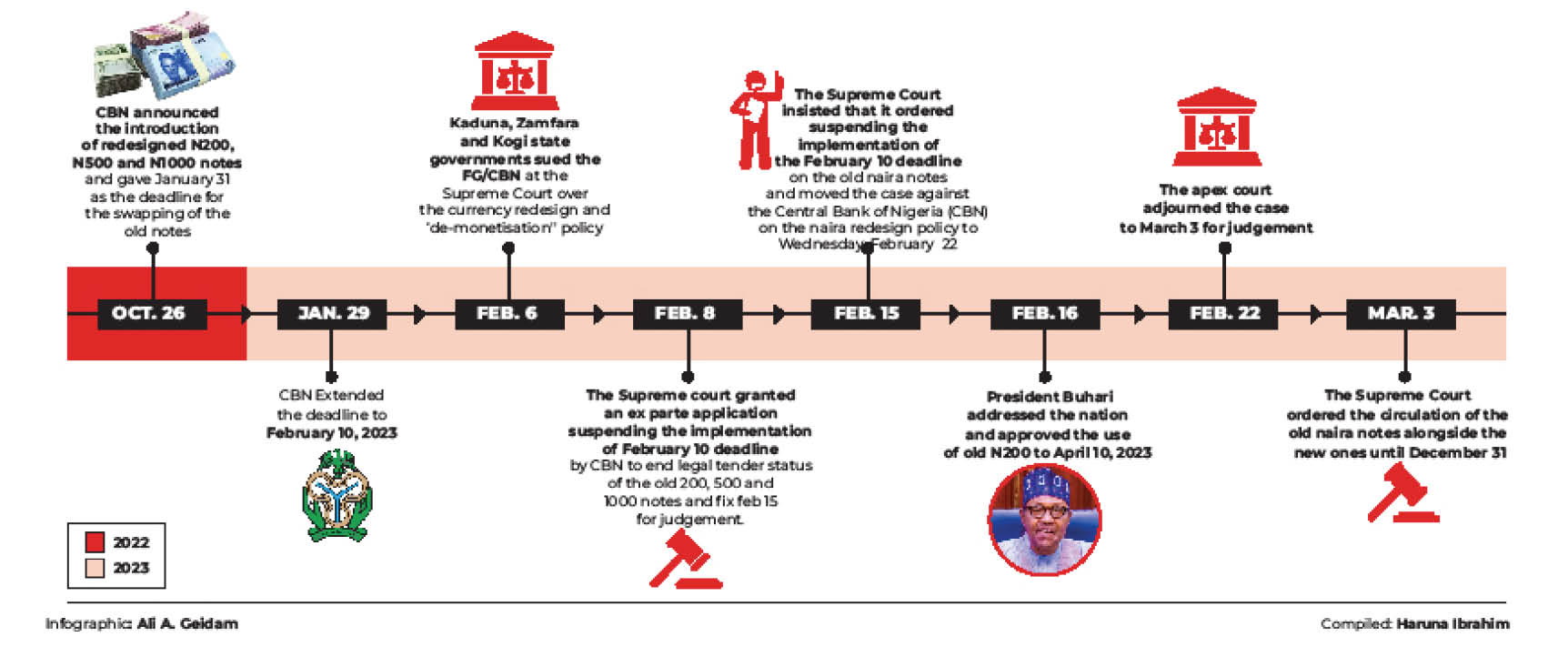

Reactions have continued to trail the judgement of the Supreme Court, which ordered the circulation of the old naira notes alongside the new ones until December 31.

In a unanimous judgement, a seven-member panel of justices presided by Justice Inyang Okoro, on Friday, held that the directive by President Muhammadu Buhari to the Central Bank of Nigeria (CBN) for the redesigning and withdrawal of old notes of N200, N500 and N1,000, without consultation with the states, the Federal Executive Council (FEC) and the National Council of State and other stakeholders, was unconstitutional.

The apex court observed that no reasonable notice was given before the implementation of the policy as provided under the CBN Act.

The lead judgement read by Justice Emmanuel Agim also dismissed the preliminary objection by the federal government challenging the jurisdiction of the apex court to hear the suits by the 16 states challenging the currency policy.

- Presidential poll: Why LP defeated APC in Nasarawa

- Clerics from 16 LGs back Senator Bwacha’s governorship bid

The federal government had argued that the matter before the court was rooted in section 20 of the CBN Act, which made the Supreme Court lack the jurisdiction to entertain it as only the Federal High Court under Section 251(1)(a)(p)(q) & (r) of the Constitution.

But the panel held that the CBN, being an agent of the federal government, needed not be joined as a party in the matter.

“It is not in dispute that none of the commercial banks nationwide has received enough of the new notes to pay their customers,” he said while bemoaning the hardship occasioned by the policy.

Governments of Kaduna, Katsina and Kogi had in February filed an action against the federal government’s demonetisation policy while contending that the three-month notice by the federal government and the CBN under the directive of the president was not a sufficient time and, therefore, a violation of section 20(3) of the CBN Act 2007, which specifies that reasonable notice must be given before such a policy and that the limit cannot be outside that provided under section 22(1) of the CBN Act 2007.

Other states which joined the three states were Katsina, Lagos, Ondo, Ogun, Ekiti, Cross River, Sokoto, Jigawa, Rivers, Kano, Niger, Nasarawa and Abia.

The states of Bayelsa and Edo filed as co-defendants in support of the federal government’s monetary policy and objection against the jurisdiction of the apex court to hear the suits.

Relieved traders berate FG

Some residents of Maiduguri, Borno State, have berated the federal government over what they described as CBN’s deliberate and unwarranted pain on the populace as a result of the cashless policy.

A trader, Malam Bukar, expressed disappointment in what he termed “the wickedness of the Buhari-led administration to punish the masses.”

“It is unfortunate that Muhammadu Buhari, who was weeping because of what he loved for the masses now deliberately inflated the suffering of the masses who voted him into power. Many got sick and eventually died as a result of CBN’s cashless policy,” he said.

Another resident, Alhaji Rabiu Yusuf, described the cashless policy as an anti-people programme that had negative effects on both small traders and civil servants.

However, traders in Lagos expressed mixed reactions over the policy as many stressed the hardship imposed by the monetary policy.

Ikemefuna Edeabi, one of the electronic speaker vendors at Nigeria’s largest electronic market, Alaba International Market, said he was not surprised at the Supreme Court’s judgement, adding that the process was political.

He said, “We all know that the whole process was geared towards curbing vote buying in the just concluded presidential election. However, the outcome of the whole electoral process shocked most of us. So, it is just one of those political dramas we have seen in our great country, to the detriment of the poor masses anyway.”

A trader, Stanley Ndive, simply stated that the process was no longer between the CBN and the poor masses, but between the CBN and the court.

He said, “I no longer have the old notes as I deposited them long ago. I don’t have the new notes either, and this has greatly affected my business.”

Patrick Eze stated that he was more concerned about the government creating an enabling environment for businesses to thrive. He added that since the restriction on the old naira, he had made use of his bank apps for transactions as the new notes didn’t circulate adequately.

An electronics vendor, Collins Michael, expressed anger at the level of suffering most people have been subjected to before the judgement by the Supreme Court.

He said, “I am wondering why they had to put citizens of Nigeria through that kind of stress, knowing full well that it would result to this.”

A Bureau de Change operator at Allen in Ikeja, Yakubu Suleiman, faulted the CBN governor, Godwin Emefiele for implementing the policy without considering the plight of Nigerians.

While noting that the redesign of the naira was not a bad move, he questioned the mode of implementation.

‘S/Court decision good intervention’

Experts have asked the CBN to comply with the judgement as a means of restoring economic stability in the country.

Reacting to the verdict, the director of the Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, commended the ruling of the Supreme Court on the use of the old currency naira notes as legal tender.

Yusuf, who is the director of the centre, urged President Buhari, the CBN governor and the Attorney General of the Federation to comply with the court order in the interest of the rule of law, good order and public interest.

He said, “To date the CBN had mopped up about N2trillion cash from the economy, thereby paralysing the retail sector, crippling the informal economy, stifling the agricultural value chain, immobilising the transportation sector and disrupting the payment system in the economy.”

Also reacting, Dr Ayo Teriba said, “The Supreme Court has pronounced that the way they went about the policy was out of line with the CBN Act, as such, the withdrawn notes should be returned into circulation until the end of 2023.”

The Speaker of the House of Representatives, Femi Gbajabiamila, on Friday hailed the decision of the Supreme Court, which invalidated the deadline for the currency policy introduced by the Central Bank of Nigeria (CBN) and extended it to December 31, 2023.

Gbajabiamila, in a statement noted that by the decision, the apex court had once again proved that it is the highest court of justice in the land.

He said the House had faulted the implementation of the policy as it went contrary to the law establishing the CBN, adding that the Supreme Court’s decision has validated the position of the House of Representatives.

He said the implementation of the policy was “remarkably haphazard’ “and “fell way short of international standards.”

Gbajabiamila commended the governors of Kaduna, Kogi and Zamfara, as well as their other colleagues, for approaching the apex court to decide on the matter, describing their action as ‘the right thing to do.’

Similarly, a finance expert and president, the Association of Capital Markets Academics of Nigeria (ACMAN), Prof Uche Uwaleke, advised the CBN to comply with the judgement of the Supreme Court, which states that the old N1000 and N500 would remain legal tender until December 31.

Speaking with Daily Trust Saturday, he said, “The CBN should comply with the ruling since it has come from the final court in the land as doing so will help revive economic activities and reduce the current difficulties being experienced by Nigerians on account of the policy.”

Emefiele, AGF should resign – APC chieftain

The North West zone of the All Progressives Congress (APC) has asked the CBN governor, Emefiele and the Attorney General of the Federation (AGF), Abubakar Malami to resign for “misleading” President Muhammadu Buhari on the naira redesign and swap policy.

Salihu Mohammed Lukman, who is the party’s national vice chairman in the zone, while reacting to the Supreme Court judgement, accused Emefiele of misleading President Buhari into approving the cashless policy.

“Given the injurious nature of the consequences of the cashless policy of the federal government as was implemented thus far, and the damage of the Supreme Court ruling to the profile of President Buhari, the governor of the CBN, Mr Godwin Emefiele and AGF Abubakar Malami must take personal responsibility for this act of illegality by the federal government,” he said.

“In advanced democracies, public offices who commit such acts of illegality voluntarily resign from their appointments.

“Therefore, if indeed the cashless policy of the federal government was supposedly designed to conform with extant legal provisions of the Nigerian federation now that it turned out in the direct opposite, both the CBN governor, Mr Emefiele and AGF Malami should accept the limitations of both their knowledge of the law and commitment to democracy by resigning from their respective offices forthwith.

“The rule of law is fundamental to democracy and individuals who flagrantly violate the laws or promote acts that breach the constitution of the Federal Republic of Nigeria must not be tolerated.

“It is gratifying that Nigerians resisted the antics of subversive politicians who wanted to use such crude methods, including inflicting untold hardship and pains on Nigerians to provoke citizens into voting against the APC during the February 25 presidential and National Assembly elections.”

However, a professor of Economics, Ndubuisi Nwokoma called for caution over the judgement as the law permits the CBN to conduct the country’s monetary policy.

He said, “I think the CBN should be allowed to conduct monetary policy. It should be allowed because the apex bank does not need Supreme Court’s approval for every monetary policy decision it takes, but this one has been mingled with politics.

“There are three variables involved – politics, economics and law. It is not just only economics. I think it is still an unfolding event but we need to demarcate the power of the CBN without interference from other arms of government.

“We wait and see because like a lawyer even said, the Supreme Court judgement is declaratory and not executory.”

Another economist, Austin Nweze, in his view said the judgement might not change anything because even the old notes are not within the reach of the masses.

He said the CBN should focus on bringing out new notes, and further advised that the withdrawal limit should be removed immediately.

“How many people still have old notes hanging there? Seventy and 80 per cent of Nigerians have traded the money. What the CBN should do is to release the new notes so that businesses can grow, and they should remove the withdrawal limit.”

Contributions by John C. Azu, Itodo Daniel Sule, Sunday Michael Ogwu, Philip Shimnom Clement, Saawua Terzungwe (Abuja), Vincent Nwanma, Abdullateef Aliyu, Yvonne Ugwuezuoha (Lagos) & Olatunji Omirin (Maiduguri)

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.