The 36 states of the federation and the Federal Capital Territory (FCT) are bracing for harder times given the recent hint by the Nigerian National Petroleum Corporation (NNPC) that its revenue projection remittance to the Federation Accounts Allocation Committee FAAC for May would be zero, Daily Trust on Sunday reports.

In late April, the NNPC had disclosed that its projected monthly remittance to the FAAC for May would be zero. This implies more financial quagmire for federal and state governments.

- Fact-check: Has debt relief been granted to African countries except Nigeria?

- Bandits kill Emir of Birnin Gwari’s driver, burn vehicle

In a letter addressed to the Accountant-General of the Federation, the NNPC said N111.96 billion would be deducted from oil and gas proceeds for April to ensure a continuous supply of petroleum products to the country in order to guarantee energy security.

With such deduction, the NNPC declared that it would not be able to make any remittances to the FAAC for May.

It is against this backdrop that the NNPC is saying there will be no remittance for the FAAC in May, especially due to subsidy payment.

If indeed this happens, it would have a ripple effect on the revenue accruing to the federal and state governments, not just in May, but in the coming months. This means that states will be unable to meet some of their statutory obligations, such as payment of salaries and other emoluments to workers.

Checks by our correspondents show that a number of states are already jittery and are bracing up for the ominous financial climate looming on the horizon.

Kaduna sacks workers, boosts revenue drive

Perhaps the Kaduna State Government had anticipated the difficult financial times, which led to its decision to right-size its civil service in a controversial policy that has received condemnation from the Nigeria Labour of Congress (NLC).

By such action, the state government will, to some extent, reduce the burden on itself. Between January and March, Daily Trust on Sunday gathered that the government had received a cumulative amount of N15 billion from the FAAC, most of which the government said had gone into the payment of salaries and personnel costs.

Kaduna’s new tax law continues to pay off, with an impressive annual rise since 2016. The state had moved from N29.45bn in 2018 to N44.96bn in 2019 and N50.768bn in 2020.

The state had made almost half of its total revenue of N113bn in 2020. Though a commendable rise, the state still depends largely on the FAAC when compared to the N63b it received from the federal government in 2020.

Like many states, Kaduna is gearing to increase its revenue base so that it doesn’t have to depend on the FAAC to survive.

The executive chairman of the state’s revenue service, Dr Zaid Abubakar, pledged to grow her internally generated revenue to N100bn by 2024, and has targeted N60bn for 2021.

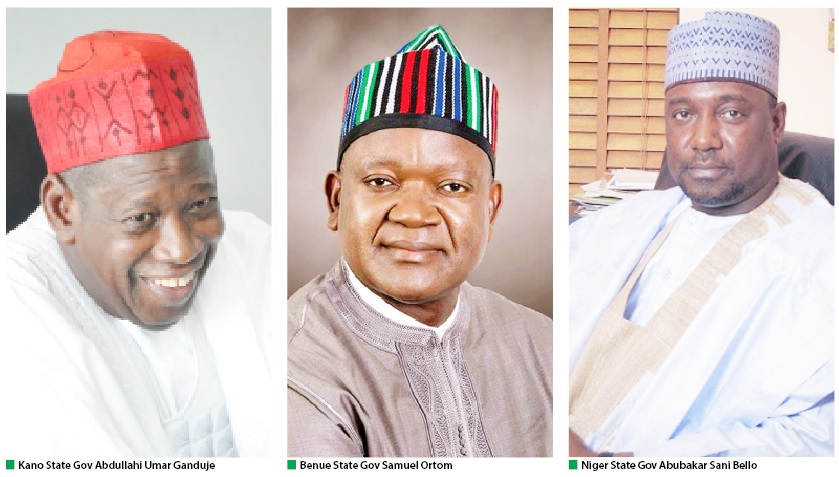

Niger blocking leakages

On its part, the Niger State Government has said it is working to revamp and revive its internally generated revenue.

Based on public records released by the National Bureau of Statistics, out of Niger’s N65bn total revenue in 2020, N54,567bn came from the FAAC account, leaving the state with a paltry N10,524bn as its annual internally generated revenue.

However, to survive, the state government says it intends to block all the loopholes in the civil service and areas where revenue is being generated, like markets and other places.

The Secretary to State Government, Alhaji Ahmed Matane, told Daily Trust on Sunday that the governor had given marching orders to the state revenue board to achieve its set target.

Matane also said the state government was trying to cut down the cost of governance, adding that activities that are not of priority would not be attended to.

“As a state, we are trying to sanitise our payroll by flushing out all ghost workers and blocking those receiving double wages and allowances to be able to attend to government expenses,’’ Matane said.

He added that the state was in a survival mode because of the security challenges facing it, as revenues are not coming from areas ravished by banditry, yet it spends on security in those areas.

Plateau cuts spending by 40%, boosts revenue drive

In January, the Plateau State Internal Revenue Service (PSIRS) announced that it was targeting a total of N21.6bn for the 2021 fiscal year.

This will move the state a little above the N19.122bn it raised in 2020. Out of the state’s N54,766bn total revenue for 2020, records from the NBS show that N35,644bn was from the FAAC while the remaining N19.122bn was internally generated.

Though Plateau’s internally generated revenue has shown a gradual climb, it is not enough to sustain it without the FAAC.

With the recent announcement by the NNPC that it may contribute zero allocation to the FAAC, a state like Plateau may find it difficult to survive.

The Commissioner for Information and Communication in the state, Mr Dan Manjag, however, said the government had been doing everything possible to tackle the impending revenue challenge.

Manjang said the target for the state was to hit a N3bn monthly internally generated revenue, adding that measures had been put in place to achieve that, including the employment of the services of consultants.

“Government has cut off expenditure to 40 per cent. We have put so many mechanisms to ensure that we tackle the challenge.

“For example, we came up with an efficiency unit, which scrutinises memos that are viable, after which they would be taken to the governor to advise on the figure to be approved,” he said.

He said though the poor remittance was going to be temporary, the state would rely on the capital market for salaries and emoluments.

“Already, there are banks we work with. During COVID-19, our allocation from the federation account went down to as low as N120 million, but we were able to tackle the challenges before the revenue improved. So, at that point we had to think outside the box,’’ he added.

Like Plateau, Benue is one of the states that cannot meet its expenditure obligations without reliance on the federal government; hence it may find itself in a quagmire with the current situation of dwindling FAAC.

But despite this, the state government said it would not downsize its workforce as a measure against the imminent shortfall of the monthly FAAC to its purse.

The special adviser to the governor on labour matters, Chief Ode Enyi, said the state government was thinking of new employments if not for paucity of funds.

Enyi expressed optimism that the state government had better plans to tackle shortfalls accruing from the country’s account to the state as he stressed that such ideas were within the purview of the state’s commissioner of finance.

Kano worried over cut in allocation

Like other states, Kano has been battling with the impact of the coronavirus pandemic on its revenue. For instance, in November and December 2020, the state reneged on its promise of N30,600 minimum wage to its civil servants by deducting from their wages, which led to an outcry from the organised labour.

With the decision of the NNPC to withhold its contribution to the FAAC in May, civil servants and pensioners, as well as contractors in the state, fear that the worst may be looming.

But the state government said it remained committed to its promise never to owe civil servants their monthly salaries no matter the situation, and that it would always be open to all the stakeholders on what is accrued to the state and share based on priorities.

The Commissioner for Information, Malam Mohammed Garba, said the state was worried that the NNPC made that pronouncement, but added that “Kano is one of the few states committed to paying salaries.”

He admitted that the revenue of the state was not as healthy as it should be, noting, “We have this culture of not paying taxes in Kano because of the orientation of the Peoples Redemption Party (PRP)/Northern Elements Progressive Union (NEPU).

“So people find it very difficult to pay taxes, and the governor has been saying it is only those who have the capacity that should pay.

“He said the tax should not be collected from the less privileged, but even the privileged people in the society are not paying as expected.”

He said the state was working on a lot of sensitisation (with media, traditional and religious leaders) and making a checklist of businesses on the ground, as well as looking at how other states are generating revenues, with the aim of learning from them. He cited Kaduna and Lagos states as examples.

He, however, noted that in Kano, “whatever the government tries to do is politicised, including revenue generation. You will hear people saying the governor is putting a lot of pressure on them to generate revenue. And these are things that have to be done for us to survive.”

Way forward

An Abuja-based economics expert, Samson Simon Galadima, told our reporter that states could be self-sufficient by boosting economic activities within their territories.

“They can directly be involved in production and distribution of goods and services; that is, pursuing state capitalism. Or they can improve on their ease of doing business; hence, getting investors. They can also cut down on unnecessary expenditure, consequently freeing up resources for much-needed infrastructure,’’ he said.

Also speaking on the issue, a petrol industry analyst, Suraj Oyewole, said though NNPC’s non-remittance of N112bn would be a major blow to government revenues, “the little joy about it is that the corporation is not the only source of remittances to the FAAC. The Nigeria Customs Service, Department of Petrol Resources (DPR) and others also remit.

However, the NNPC clarified that the revenue projection contained in the letter to the Accountant-General of the Federation being cited in the media pertained only to the federation revenue stream being managed by the corporation and not a reflection of its overall financial performance.

A press release by the corporation’s spokesman, Dr Kennie Obateru, stated that the clarification became necessary in the light of media reports insinuating that the corporation was in financial challenges.

Itodo Daniel Sule, Zakariyya Adaramola (Abuja), Lami Sadiq (Kaduna), Clement A. Oloyede (Kano), Romoke W. Ahmad (Minna), Ado Abubakar Musa (Jos) and Hope Abah Emmanuel (Makurdi)

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.