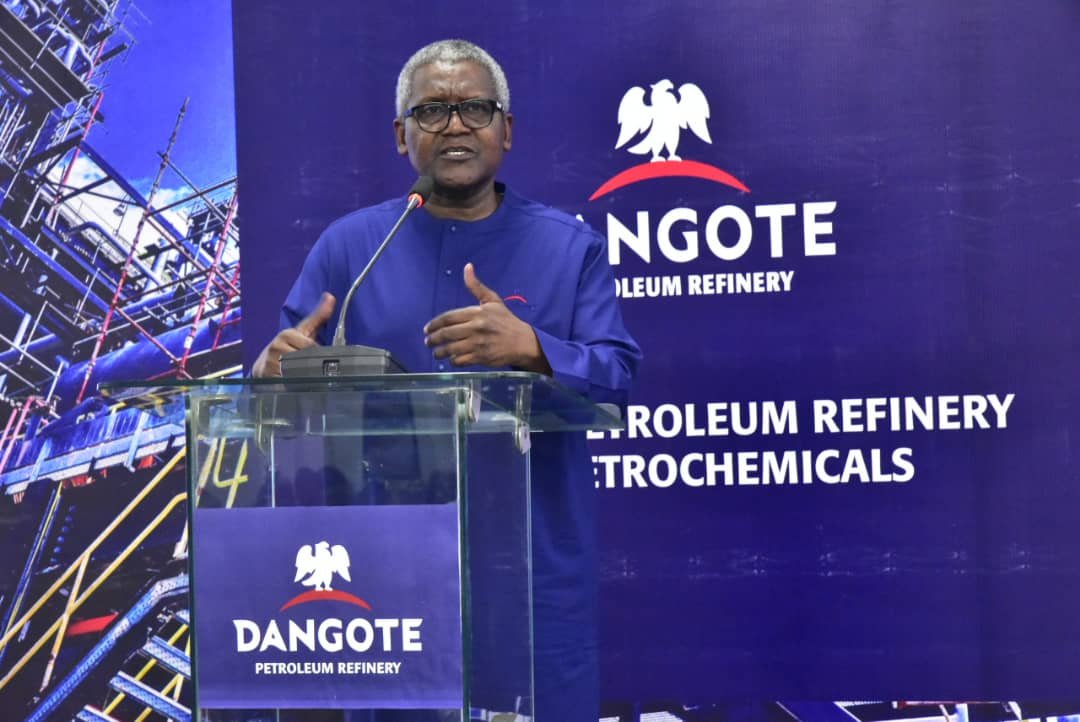

We need to save Alhaji Aliko Dangote and the Dangote Refinery. It is an urgent national assignment. It is a national assignment of urgent importance, as they say at our National Assembly because the eyes of the world are on us.

We need to save him and the huge refinery complex, which I visited in November 2021 and was awed by what I saw there. This project has gone beyond the individual; it is now a national emblem, no matter what mistakes were or have been made in the process of getting it up to this point.

The last few days have been quite traumatic for Africa’s richest man, an individual who has become the symbol of patriotism because of his choice of Nigeria as his first investment destination. His decision to invest at home first, rather than joining others to ferry their billions out of the country and enjoy them elsewhere, should be commended, and I dare say, rewarded.

The current mess enveloping the oil and gas industry is simply a measure of how chaotic our industrial policy framework has become. It explains the reason for Nigeria’s underdevelopment, because, without a defined industrial policy, there is no way we can forge ahead. From the rubble dropping from this crisis, Nigeria must rise to establish a durable industrial policy on which we can build an enduring policy framework, devoid of selfish considerations.

What is happening now with the Dangote Refinery will set Nigeria’s investment drive backwards by several years. The world is watching and will soon conclude what kind of country Nigeria is. Are we the kind of people who eat our own? If we are, then what fate awaits foreigners? Already, Dangote has told us, almost with tears in his eyes, how his friend, obviously in good conscience, advised him against investing in Nigeria.

The refinery was conceived as part of the solution to Nigeria’s perennial petrol scarcity. Are we now saying that our oil sector is jinxed; that there cannot be a solution to the long-running scarcity of the product that we produce here at home?

I wrote a piece on this page last year, with the caption: What is NNPC doing at Dangote Refinery? In it I argued that there was no justification for the former government-owned enterprise now converted to a private company, to take up a stake in the Dangote Refinery, when it had not been able to put its house in order.

NNPC has four refineries with a combined capacity to refine 445,000 barrels of crude oil per day. Yet, for a long time now, only the staff and management of that corporation know how many litres of petrol or diesel Nigerians have bought from the four plants. Instead, what we have been getting from the corporation is a rolling date of resumption of operations by the refineries. And yet, an enterprise with that kind of record was boasting of taking up a 20 per cent equity stake in another enterprise in the same industry.

But guess what, a Dangote’s spokesman who called me out, wondering what I meant or wanted to achieve by my piece. To him, I was a spoiler, who had come to imperil the project by trying to provoke their benefactor. Now, the chips are down. Just as the bubble began to bust, Alhaji Dangote told the whole world that NNPCL’s stake in the plant had come down to just 7.2 per cent from 20 per cent. Somehow, I do not know yet how that came about.

The audience wondered why. What could have happened? But the intrigues continued and even at a faster pace. Dangote, obviously exasperated by the unfolding drama surrounding his biggest investment, is calling on NNPCL to buy him out of the refinery. Whether he meant that or not, one thing is clear the man did not have this as one of his exit strategies when he was conceiving of this project, at least so soon in the life of the refinery.

The truth is that the business world is simply a small pond infested with all kinds of sharks. To an extent, each of them aims to eat as many others as possible. Those who can eat others do so and continue to get better, still looking forward to the next ones to devour. This is where regulation comes in, to ensure that the shark-eat-shark philosophy does not derail the national economy and rob consumers of their expectations.

Muds are being flung around. Allegations are flying in every direction. They raise key questions regarding the regulatory framework within which major investment and other business decisions are taken in the economy. What is the government’s stand on business or market structure, including our definition of monopoly? Who is considered a monopolist in Nigeria? When and how does an enterprise become a monopoly and when does it become necessary to begin to checkmate the tendency? The current imbroglio in the oil and gas sector has brought it to the fore and Nigerians expect the relevant authorities to wake up to their responsibility.

Coming to the quality of the refinery’s products, it would be interesting to know what the timeline of approvals of the refinery’s capacity looks like. Recalling that this refinery was commissioned by former President Muhammadu Buhari, even before he left office in May 2023, it would be a surprise to talk about the fact that its certification is not yet completed today, more than a year later. Such a complex project must have passed through various stages of approval. These would have been involved in the structural framework, and later in the refining process.

Saving Dangote and the Dangote Refinery is now like the epic film, Saving Private Ryan. It is the story of the search for and rescue of a soldier, Ryan, the only remaining of four soldiers from one family, whose three brothers had died in the war.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.