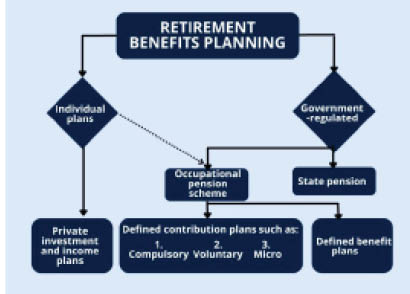

Last week, we tried to bring out some of the issues that governments and regulators confront in the quest for developing retirement benefit models that meet the objectives of retirees and other stakeholders. Today, we will introduce the broad types and models of pension schemes in operation and how they fit into what will be the framework of our overall retirement financial planning.

Retirement benefits are essential ‘only’ a financial component of retirement planning. And generally speaking, each individual, irrespective of employment status, trade, or profession, is at liberty to develop a retirement financial plan that meets their choices and any peculiar circumstances. I am consistent in always making it abundantly clear that even though broad financial retirement principles and objectives might be common for all, each of us should develop and execute a plan that meets their realities and requirements. But given the dangers of not economically securing old age for people, most governments worldwide are still involved in many ways in ensuring that different categories of people, such as retired workers, disabled, aged, etc. are provided with some economic cover. Many countries have varied and wide dragnet of schemes for different people in particular situations. Our challenge is to build our Individual Plans that seize legitimate opportunities and possibilities.

Government-regulated schemes can be grouped into two; State Pensions and Occupational Pension Schemes. In countries where they apply, State Pensions are paid to certain individuals by the State when they reach a State pension age. On the other hand, Occupational Pension Schemes come in two broad groups, viz, Defined Benefit and Defined Contribution.

Retirement benefits planning options © Musbahu El Yakub 2023

Defined Benefit: In a defined benefit scheme, the employer guarantees that the employee will be entitled to receive a specific periodic payment after retiring. The pension payments to the retiree are made in an amount predetermined by a formula based on variables such as years of service and terminal earnings. In planning for the payments, the employer may or may not take any contributions from the employee. In fact, the employer may not even make any investments but, instead, make due pension payments on a ‘pay-as-you-go’ basis.

Evidently, there are many drawbacks to this scheme. Prior to our independence in 1960 and for about two decades thereafter, pension payments to retired workers were reasonably full, timely and assured. But from the 1980s onward, we began to have failures in making full and regular payments. By around 2003, we were in a pension deficit of over N2 trillion! ‘Interestingly’, we were not alone in the world in that challenge. The same failures had triggered pension system reforms in Chile between 1980 and 1981 that led to the development of a fully funded system based on individual accounts that were managed by private companies. Our PRA 2004 and PRA 2014 were conceptualized and enacted along the lines of the Chilean model.

Defined Contribution: In the defined contribution plan, governments set a minimum level of contribution that must be made into the scheme. The contribution in Nigeria is currently 18% of the employee emoluments, out of which 10% and 8% are to be made by the employer and employee respectively. Unlike in the defined benefit, what the retiree here receives will depend on the amount contributed by the employer and employee to the pension pot, the duration of the investment made and how the investment performed over the period.

In our country, the scheme is available to employees in the private and public sectors. The employees open a Retirement Savings Account (RSA) with a Pension Fund Administrator (PFA) to which the contributions are made. These contributions are invested in assets that are approved by the National Pension Commission. We would expect the investments to be reasonably safe, yield positive returns that outpace inflation, and are liquid.

Some other pension schemes to address different situations include:

The voluntary pension scheme: As the name suggests, this is an additional but optional plan. It is a more flexible scheme in terms of the quantum and frequency of contributions to your RSA. Even though there are policy guidelines on this scheme, we will discuss it under the individual plans depicted above when we take up retirement financial planning in greater detail.

The Micro Pension Scheme: The PRA 2014 allows for a scheme for self-employed persons. It permits the kind of flexibility in making contributions that should suit various classes of entrepreneurs who do not qualify for the regular contributions mentioned above. Like the voluntary pension option above, we will take this up in detail under retirement financial planning.

The Cross-Border Pension Scheme: This scheme is for persons that live and are employed outside the country. It allows such Nigerians to make contributions to the pension fund through their RSA which is denominated in Naira.

As we have seen at the debut of this column, retirement planning goes beyond pensions. However, it is crucial that in making financial plans, both private options and those introduced and regulated by the government are taken into consideration. Next week, we will introduce the individual plan as the superstructure around which your retirement finances should revolve.