Last week, we introduced why we, understandably, get attached to our jobs and careers. Those reasons, and others, are part of why we go through a mix of varied emotions before retirement, during the transition and thereafter. Today, we will look at some of the specific emotions we may experience prior to and in retirement.

The pathway matters: How we retire is a major factor that may shape our understanding and emotional response to the situation. For instance, a person could be compulsorily retired for many contractual reasons such as age, poor performance, economic recessions, re-organisations, fraud, etc. For the compulsorily retired, the individual affected does not, often, get room for further and gradual preparation as in other retirement pathways. This can make things a little more difficult.

At the other end of the spectrum, some individuals may retire early and voluntarily for many possible reasons such as frustrations with the job, desire to pursue other interests, pressure from family, friends/community, financial inducements by employers for early retirements, etc. As long as the alternative to the existing career is more appealing and likely more rewarding, certain individuals will leave early and voluntarily. In such situations, the psychological issues faced are different from those faced by the compulsorily retired.

In between the two extremes, there are those who retire mandatorily in compliance with some existing policy or regulation. Typical of this is the retirement after service of thirty-five years or at attaining the age of sixty, whichever comes first, in our civil service. (Other regulations apply differently to some other institutions and professions). The retiree in this case has ample notice of exactly when they will retire. Sufficient notice, unfortunately, does not completely take away all the psychological challenges.

- FCT primary school teachers begin strike over unpaid arrears

- Doctor arrested over woman’s missing kidney in Jos runs ‘mad’ in cell

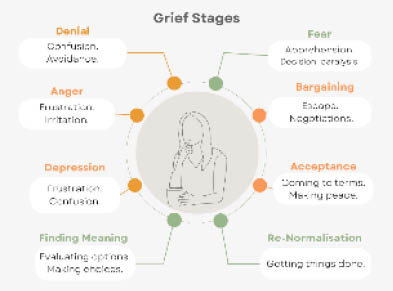

‘DABDA’ model: In 1969, Psychologist Elisabeth Kübler-Ross working with terminally ill patients developed the ‘DABDA’ grief model that sought to explain the stages of grief. Because retiring individuals go through a feeling of grief for various reasons such as loss of identity, opportunities, and the uncertainties they may face, I think the ‘DABDA’ model can be adapted to explain some of the emotions that run through those who may retire or have retired. ‘DABDA’ refers to ‘Denial’, ‘Anger’, ‘Bargaining’, ‘Depression’ and ‘Acceptance’. This was later expanded by David Kessler to include ‘Finding meaning’. On my part, I specifically add a ‘Fear’ stage before ‘Anger’ and a last one that I call ‘Re-normalisation’. Key points about the model are that not all persons go through all the stages the same way and that the stages are not necessarily linear.

Denial – Denial is a usual first reaction to an overwhelming, undesired situation. On a positive note, denial helps protect us by creating a time lag over which the situation is gradually understood, ‘accepted’ and treated. I would think, though, that denial will apply more to those who are compulsorily retired with little or no notice. For those who retire early/voluntarily or in line with a clear and pre-known policy, this may not be the situation. Instead, the denial may be in the processing of handling the fallouts of retirement such as loss of privileges. No matter, different people have different capacities of understanding situations, processing and adjusting to them.

Fear – We all desire some level of physical and mental safety. Fear is what we experience when we perceive a threat to our safety. It is an emotional response that seeks to push us away from what we are currently experiencing or anticipate experiencing irrespective of whether it is real or imaginary. Some may perceive retirement as a threat to the safety they are currently enjoying or may enjoy later. They may experience fears about finances and the risks of outliving them, economic situations that may alter their current living standards for the worse, health and its possible decline, idleness, loss of title, status and influence, ageing, death, etc. Except for those in excellent health, good financial state and with a clear retirement purpose, most retirees, regardless of their retirement pathways will entertain some fears. I find this to be a significant and common state for our about-to-retire and many already retired.

Anger – Anger is closely related to fear. It can positively protect us by energizing us to ‘fight’ against an undesired and/or create a structure to a situation that gives us a sense of control. Our anger at retirement might be triggered by different causes and for different purposes. Those compulsorily retired may be angry at the system and/or individuals that they feel probably had a hand in their disengagement. Those who voluntarily retire may do so because they want to seize some opportunity or because they are angry at something or someone at their places of work. Those who retire on a mandatory basis may only be angry at the system, which they may feel should otherwise give them more years of service, or at their bosses who refuse to extend their service on contract where possible. In all situations, the anger can be transferred to innocent friends, family members and community.

We will continue with both DABDA and non-DABDA factors next week.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.