Last week, we discussed the importance of cutting out financial wastes, getting value for all spendings and the need to begin making investments in the first phase of working and business careers, having defined ‘investments’ in a sweeping manner to include both buying into ‘passive’ assets such as shares and businesses in which the investor may play active, part-time or inactive roles. Today, we will take up a few more investment options.

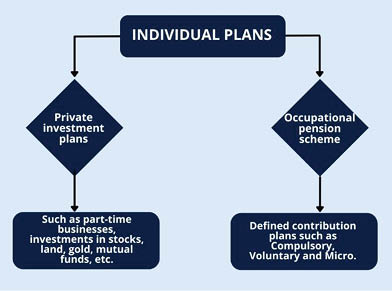

Basically, investment options fall within two broad groups viz: contributions to pension schemes regulated by the government and the private investments that individuals could make on their own.

Defined contributions pension plan: The minimum that individuals in this phase should begin to ‘invest’ in is through the defined contribution plans regulated by the National Pension Commission through the PRA 2014 that has been discussed earlier in this column. Regardless of the structural, environmental and operational constraints, the scheme is a significant improvement over the previous defined benefit plans that ended up providing little or no benefit to many should-have-been beneficiaries. Persons in this phase can open RSAs and contribute (read: invest) through any of the options offered by the Act depending on employment and business status and individual objectives.

Invest in assets: It is important to invest in assets that can provide income and/or capital growth depending on our requirements, interests and resources. At the beginning, it may be wise to begin to invest with either discretionary incomes or borrowed funds that we can always pay back if the assets do not do well. Investible assets can be categorised into ‘physical’ and ‘financial’. Physical assets may be land, gold, etc. Financial assets may be stocks, bonds, mutual funds, annuities, etc. Each of these types of assets appeal to different people at different times. Similarly, the assets respond both similarly and differently to different situations in the economy.

- 35 die in Anambra auto crashes in 11 months

- ECOWAS reopens talks with Niger junta, demands short transition roadmap

Investing in these assets will require three things. First, take your time to study the asset very well as regards what it is, how it responds to different situations and how you can invest in and divest from it. Invest in only what you understand! Secondly, engage a competent, experienced and trusted professional in the field. However, regardless of what the professional may recommend, any buy, hold or sell decision is yours and should never be abdicated. Thirdly, go into these investments gradually, in measured and deliberate steps until you build understanding and competence. In essence, do only what you are comfortable doing.

Moonlighting: Many people do have interest to go into business when they retire. And they come knowledgeable, experienced, with extensive network of relationships and some reasonable assets. But a few things hinder many of them. First, they find business being ‘too risky’ in ways they do not understand. Second, they may have been managers and executives in government and even the private sector. However, as long as they didn’t manage resources directly and significantly owned, partially or wholly, by themselves, and the results of the business do not, at least in the short run, affect their salaries, benefits and some other aspirations, they really never get the visceral feeling or emotional understanding of what business is!

The way to help address this is for people who are allowed by their terms of employment to begin to go into businesses they can handle without affecting their work. They could also go into partnerships with others. Thankfully, getting competent and experienced persons to go into business with is reasonably easy. What is challenging, sadly, is getting those who will value, honour and protect the trust bestowed in them.

The ’10,000-hour rule’ promoted by Malcom Gladwell reporting Anders Ericsson’s research on the practice required to master many skills has been contested because of oversimplifications. But consensus remains that deliberate, and quality practice definitely help push us towards achieving our goals. Moonlighting will help you to gradually learn business in skin-deep ways and how people may think and behave in various situations. You will learn not just how to make money but also how to handle losses, which you can be sure you will suffer, hopefully only sparingly.

As a former employee in the private sector, I started various businesses reasonably early. In addition to investing in stocks, I had, at different times, a travel agency, a computer parts business, gypsum mining and supply, poultry farm, sell of rams, etc. To date, a good friend mocks me that that I have been in ‘one hundred businesses’. The amusing thing is that he has been in more businesses than me. I have offered that we should sit and list out what each of us has done to ascertain who has been in more businesses than the other. He has refused. Some of my moonlighting businesses have worked very well and made good money for me. Some failed woefully and left me in debts to settle. Both have made me wiser. I also have two friends who are partners in their profession and business. If there is anything called ‘perfect partnership’, my two friends are in one.

The points here are that one, we need to build direct business experience in our youth if we are to enhance our chances of going into business, succeeding and enjoying it later in life. And two, there are windows of opportunities, even if narrow, for viable partnerships in our environment in spite of some sad realities.

Next week, we will take up investment planning options for persons in phase II.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.