This week we will discuss the principles of financial planning for retirement.

Definition and Scope: To avoid any technical mix-ups, let us first understand the differences and relationship between ‘finance’ and ‘investment’ in concept and practice from personal and corporate perspectives as well as their respective scopes.

‘Corporate finance’ deals with how businesses address funding issues such as capital structuring, investment decisions, dividend policy, etc. Corporate finance activities are essentially aimed at maximising the value of a business and returns to shareholders through the implementation of strategies backed by short- and long-term financial plans that balance the divergent pulls of risks, profitability, growth, and cash flow.

‘Personal finance’, on the other hand, is about realising our individual and family financial goals. It is the conscious management of our incomes, living expenses, savings, investments, etc., aimed at achieving our short- and long-term wealth and legacy goals. Like corporate finance, personal finance is fundamentally about wealth creation through income, cash flow, debt, tax management, etc. Retirement planning is a key component of personal financial planning.

Investment refers to the act of acquiring an asset with the objective(s) of generating income and/or capital gains. Investments come with risks associated with the business, economy, etc. Some investments might be made for short-term whilst others may be for long-term depending on several consideration factors. On the other hand, Finance refers to the process of raising funds for the purpose(s) of meeting financial needs such as the desire to make an investment. As with investment, there are risks that come with different finance options in different situations. Similarly, there are short-term and long-term finance options or mix thereof.

- CJN Ariwoola inaugurates 58 new SANs, new legal year Nov 27

- Student remanded over attempted rape of 3-year-old girl in Kwara

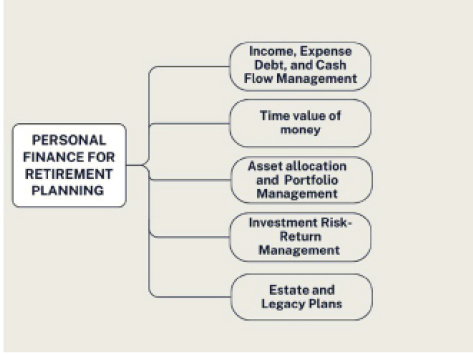

‘Financial Planning’ in this column shall be a broad cover for both personal finance and investment issues, the scope of which is as shown below.

The principles that will guide retirement financial planning are as follows:

Time value of money: It is important to start financial planning for retirement ‘early’. How ‘early’ will depend on our individual realities but definitely the ‘earlier the better’. Not only do we begin to learn early when we start early, but we have ‘all the time’ to recover when mistakes are, often inevitably, made. Equally importantly, starting early makes it possible to maximise returns that are possible through compounding. Compounding happens not only with interest income but also in most businesses and investments where the incomes we make become available resources for making more money in the same or other businesses and investments.

Prioritisation and deferred gratification: One of the key indicators of long-term success in life is the ability to prioritise and delay gratifications. Regardless of where we may be, we will need to make certain sacrifices now so that we can earn some greater benefits in the future. But it is not just about making any sacrifices anyhow. Rather, it is about making wise trade-offs through prioritisation.

Risk-Return management: Some fundamental essences of all finance and investment activities are to earn income, gain asset growth, and have the cash or near cash assets that may be required from time to time for various reasons. These require that finance and investment decisions will be about ‘balancing’ risks and returns depending on our appetites, desires, and capacities. For each business and investment opportunity that we may have, we will need to understand not only what the returns may be but also what risks may be inherent.

Liquidity and cash flow: While for both personal and corporate purposes, keeping cash might seem like failing to seize opportunities for earning some additional income and gaining asset growth, the truth is that cash is required for several important reasons. What is key is that we should know how to balance the need for cash for those purposes and the desire to earn income and asset growth.

Income, profitability, and asset growth: For the various phases in pre- and post-retirement, we may need to have more, equal, or less focus on of being profitable and making income on one hand and gaining asset growth on the other. As mentioned previously, it is partly about seizing the opportunities at each stage while managing the risks therein.

Plan for a long life! In most parts of the world, people are living longer, partly due to advances in medical services. We will likely live even longer if we can take better care of what we eat and our lifestyles. And since we never know when we will finally depart this world, we need to plan our retirement as if we will for certainty live long. This ‘conservative’ approach is what we will adopt on several issues that we will discuss later. Planning our retirement on the assumption that we will live long ensures that we will have the private resources that we need as we age. Being alert to this is particularly important in Africa where the younger generation is beginning to take less care of their elderly contrary to our historical ways.

In all that we do in life, having the right principles and policies is fundamental to what we do and our successes. Next week, we will take up financial planning practices in the first pre-retirement phase of our working and business careers.