Last week, we discussed two of the legs of a tripod on which a retirement financial plan should be built. We discussed ‘where we are’ and ‘what we have’. Today we will discuss the third of the legs, ‘Where do we want to get to?’

When an uncle of mine was about to retire from his public sector job, a reasonably large and successful private company discussed their desire to work with him. After retiring, he got an offer to be an ‘executive director’ with the company. Upon further enquiry and reflection, he turned down the offer on the grounds that he was not willing to start going to work at 8 am and closing at 5 pm after doing that for some thirty-five years of his life.

My uncle opted to start a small private business instead. But soon, he realised that he was needed at the business every morning and for hours on end every day. He handed over the business to his son and enrolled in a university for a postgraduate programme which he successfully completed. He is now engaged in getting more Islamic education, attending school about three hours a day for four days a week and is involved in social activities of our extended family and friends.

On the other hand, a family friend I am closely acquainted with went into agricultural value chain businesses at the end of his public service career. Today he is a successful large-scale farmer of rice and miller. His days, including weekends are, to say the least, full.

- CIBN offers N10, 000 cash incentives to patients in Kano hospital

- 2024 budget: How to address Nigeria’s economic challenges, boost IGR — Senate

The point is that there is a wide spectrum of lifestyle options we can choose to have in retirement. Some retirees want a rocking-chair-type life after retirement. Some others want to continue with active lifestyles as they had prior to their retirement. Yet, others will be somewhere in between the two ‘extremes’. None is right or wrong as long as we satisfy the conditions discussed below.

Where do we want to get to? For our purposes, I want us to look at the options of ‘where we want to get to’ in terms of how we want to live our life in retirement. This is essentially about what we will be doing, how much it will cost us financially, and the likely impact of our choice on our health. Because of the cost implications, we need to have a reasonably clear idea of what may be the requirements in time, effort, money, and any other resources that will make us achieve it both prior to and during retirement.

Regardless of what we want to do, it is important that four conditions are met viz; First, we should come up with what will work for us; Second, we should be happy about it; Third, we must be able to afford our choice; and finally, we should be alert to its health implications. A common mistake that many people make is to want to do what others are doing, particularly those close to them such as friends and former colleagues. But it doesn’t necessarily follow that we have the same interests or financial, intellectual, and social capacities as our friends and former colleagues. What, therefore, may work well for our friends and colleagues may not necessarily work for us!

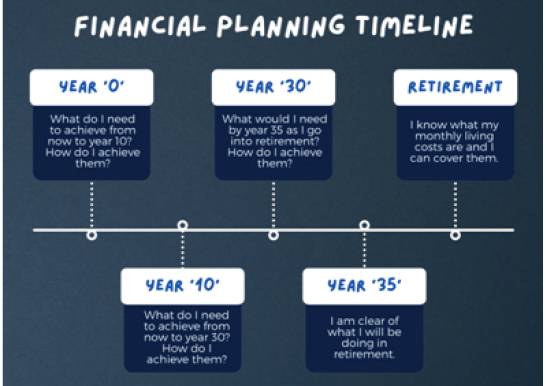

Based on where we are, what we have and what lifestyle we want to have in retirement, we will need to map out a financial plan for each phase in pre- and post-retirement. These will revolve around the following:

- What should we address in the first phase of pre-retirement, i.e., between when a person starts work and ‘year 10’? (See schematic below).

- What should we address in the second phase of pre-retirement, i.e., between years ‘10’ and ‘30’?

- What should we address in the last phase of pre-retirement, i.e., between years ‘30’ and ‘35’?

- What do we want to be doing after retirement, what will it cost us, and any health implications? Will I still be living in Abuja or will I relocate to Gombe? What will my lifestyle choice cost me per month?

Between 1, 2 and 3, we will be interested in eliminating waste, making investments for income and growth, maximising the payments we can make to our defined contribution pension scheme as long we have confidence in the system, etc. Similarly, other personal financial plans should be carried out in the various phases depending on what we have, what we earn, and what we want to make taking into consideration the risks we could take and those we should not at each stage. During retirement, we may want to earn some more income by taking up a second career in business; We may want to pick up a hobby, or go into social entrepreneurship and NGO activities; We may want to go back to school like my uncle, etc.

The sooner we can be clear about what we want, when and how much it may cost us the better we can plan for our retirement. Next week, we will take up the elements of financial planning for retirement.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.