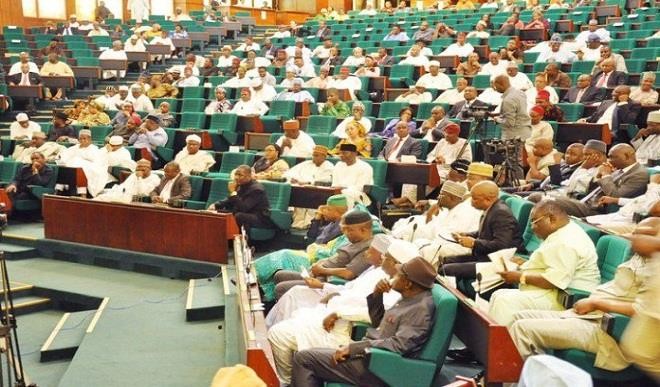

The House of Representatives has called on the Central Bank of Nigeria (CBN) to suspend its plans to charge Nigerians on deposits and withdrawals in banks operating in the country.

The House at its plenary on Thursday lamented that the planned policy has resulted in decreased deposit mobilization and credit extension by Nigerian banks.

It expressed concern that the implementation of the policy also has negative impacts on micro, mini, small, and medium enterprises which the House said were the main drivers for economic growth and employment generation.

It noted that the policy will ultimately throw owners of such businesses, many of them, out of business and send more Nigerians into poverty while forcing traders and micro investors to carry cash which may have attendant security challenges.

“While the impact of the cashless policy on Withdrawals is still starring us all in our faces as well as other numerous burdensome charges by Nigerian Money Deposit Banks heavily impacting on businesses, the Central Bank of Nigeria deemed it necessary to impose the implementation of cashless policy on deposits without due consultations with all shades of stakeholders who will be impacted by the policy,”

The House noted that, it is a matter of concern and a burden which will close down majority of micro, mini, small and medium businesses in Nigeria while enriching Nigerian Money Deposit Banks owned by a privileged few, without financial contribution to the consolidated revenue fund of the federation.

It added that the CBN did not consider the people as prime, important and indeed the centre piece of policy-making, even as Section 14(2)(b) of the Constitution of the Federal Republic of Nigeria, 1999 (As Altered) provides for the security and welfare of the people as the primary purpose of government.

The House therefore urged the CBN to suspend the implementation of the cashless policy on deposits which has taken effect from Wednesday, 18th September, 2019 until appropriate and extensive consultative process is concluded.

It also mandated the Committee on Banking and Currency to interface with the CBN to ascertain the propriety, relevance and the actual need for the implementation of that aspect of the cashless policy at this time considering the prevailing economic situation of the country and to report back to the House within four weeks.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.