The fight to attain Goal 3 of the Sustainable Development Goals – Universal Health Coverage – among third world countries remains at risk because of the scarcity of healthcare facilities with capacity to provide “…access to access to quality essential health-care services and access to safe, effective, quality and affordable essential medicines and vaccines for all.”

With governments trying to increase the percentage of budget set aside for the health care sector, private sector investors are also challenged by access to financing required to help them scale up their infrastructure and facilities to render quality care.

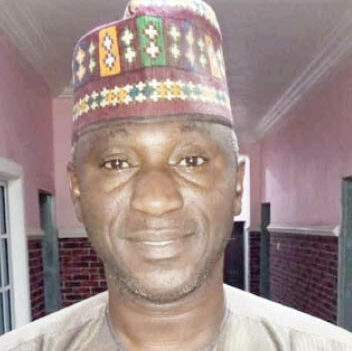

In this interview, the Chief Medical Director of First Care Multispecialty Hospital, Kaduna, Dr. Tajudeen Ajibade narrates his experience while trying to expand his diagnostic services business based in Kaduna into a full-fledged hospital to help bridge the gap in provision of much-needed health care services to residents of the state and environs.

What’s First Care, and what does it stand for?

First Care is presently a 100-bed facility in Kaduna. We started off as a diagnostics centre in 2005 and were able to transform into a full-fledged hospital in April, 2019.

We were just a diagnosis center where we run laboratory diagnosis, X-ray and ultra-sound. I always had the intention of expanding the services we render from diagnostics to a full-fledged hospital with all attendant consultation and specialist services, inviting people from the teaching hospital to partake in seeing patients. Today, we have achieved that vision.

- Why Nigeria’s maternal mortality amongst highest in the world

- COVID-19: Malami orders NDLEA to halt screening of 5,000 candidates

Within our 100-bed hospital consultants come in to see patients. Presently, we render all specialisations within health care. We have moved from seeing patients and giving results to people to take to other hospitals to us seeing patients and housing the patient within our facility. We have moved from middle partaker of healthcare to full-fledge healthcare service provider.

What financial challenges are common in diagnostics?

Most people don’t have the funds to do business, the financial challenge is to get financial institutions to give us loans. There are a lot of people who wants loans but can’t get the equity to get the loan, a lot of people don’t have collateral, a lot of people lack patience and want the money quickly even when they have not run the banking relationship with the bank for a reasonable amount of time, especially when the needs for the funds are urgent because it is also not wrong for the banks to conduct due diligence.

Even after the loans are given, a lot of economic instability is present, income and sales is as stable and lucrative as it was before, so one must be committed to have an intention of remain and this commitment is what compels one to pay back a loan, that commitment, seriousness and focus must be there and the banks need to somehow have that assurance too.

What has been your experience sourcing loans for business?

Because it’s a facility, I have always had it at the back of my mind – even from a very young age, a lot of us know that bank loans can kill and they are difficult to come out of. Being a Muslim and having read the Quran several times, knowing full well that there is an Islamic option, when you get a facility recognized by Allah, with the intention to pay, Allah will assist you, particularly when your intention is good, Islamic financing does not kill, it allows you to grow and the risk is not on the customer that collected the facility alone unless if the customer is not serious and his intentions are dubious.

After all, the facility you access is not in cash. You are not given money. The bank will pay for the goods so there is no room for diversion. Usually, where the diversion come in is when people collect such facilities and they not meeting up with the repayment plan and the income they are getting, they are now using it for other things that are completely different from the purpose of the facility.

In my case, I had the intention to pay and financial liquidity was better. Immediately I collected the loan, I was paying N2,450,000 every month. For the first 48 months I never missed a payment of that amount but moving forward, finances were not looking as great so it was time for restructure which they did but the restructure comes with a fine.

To Allah be the glory, I am happy with the fine. Everything worked well, the intention to pay was there and every revenue I generated, I put it towards meeting up with my payments so pay so Allah blessed me and I was able to come out. First you must intend to pay.

Islamic banking is good, there is blessings of Allah in it. Compared to other conventional banking where exiting a financing facility is not that easy. It is not possible to get N88 million and in five to six years you exit. I actually intend to apply for another one to enable us expand further and meet the needs of residents more.

And the facility was used in what business?

The N88 million was used to purchase property in Central Kaduna. The property is standing today and it is operational. I didn’t buy equipment because I was practising before in a rented place and I had some equipment so the main infrastructure I needed was a property in a choice location, and I am able to achieve it with by Allah’s permission with the help of Jaiz as a shareholder.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.