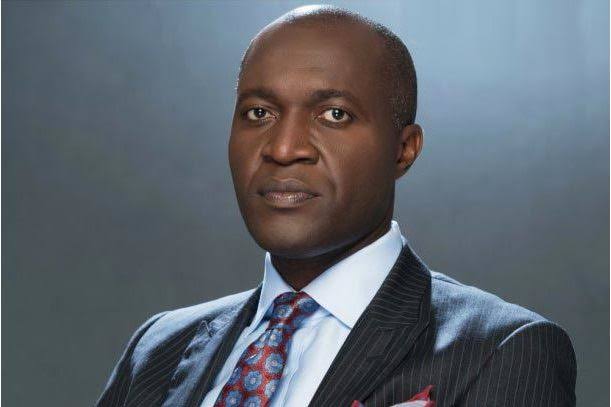

Rosevelt Ogbonna, the chief executive officer (CEO) of Access Bank, has said the Nigerian market is not as profitable as other African countries due to the naira devaluation.

According to TheCable, Ogbonna spoke during a media parley where he reiterated the Access Bank’s five-year strategy.

Speaking on the company’s investment drive, he said Nigeria ranks low in terms of strong return on equity, as more money can be made in South, East and North Africa.

The CEO said the money made in Nigeria if taken to South Africa, “will make three times the money we’re making here”.

Fuel queues will disappear when marketers start patronising us – Dangote

People’s investments depend on capital market integrity – SEC DG

He said Access Bank is expanding to other African markets where the return on equity is strong.

“Now, if you take Africa as a continent and you split it into five zones, Nigeria and West Africa is number four out of five from the retailers’ perspective.

“As a business, I’m making more money in Southern Africa, East Africa, North Africa, before Nigeria. We need markets where we have stronger returns. And even that, we have to test it, given what the evaluation has done for Central Africa”, he noted.

He said: “In today’s terms, I suspect Central Africa might have a richer banking pool than West Africa.

“So when you hear there’s a lot of noise in the public around banks making money, if we take that same capital and go to South Africa, we make three times the money we’re making here.”

He said in 2008, a South African bank was bigger and more profitable than the entire Nigerian banking industry when we were the second largest economy in the continent.

Ogbonna questioned if investors would rather invest $100 in Access Bank United Kingdom (UK) and get a 25 percent return in dollars or invest in Nigeria and get a return on equity of over 20 percent in naira and face devaluation.

“Instead, I will go to Botswana where the currency has been stable for at least 10 years to get returns in real terms, Cameroon, where the inflation rate is about 4 percent and has been for many years or Cote d’Ivoire, where because of their heads to the euro, there’s been significant stability in the market.”

Ogbonna said Access Bank is also aiming for markets where the cost of regulation is cheaper

“We’re going to markets where we know the return is strong and the cost of regulation is cheaper.

“And the structural issues around how balance sheets are managed, cash reserve ratio and AMCON charges, don’t exist in those markets,” the CEO said.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.