- Daily output down by 200,000bpd

- Oil price hits $80

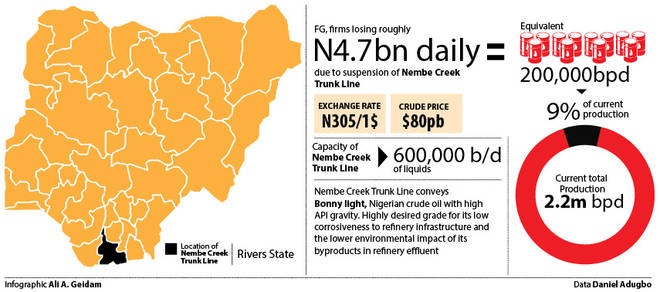

Nigeria is losing roughly N4.7 billion daily as a result of the suspension of export of Bonny Light crude, the country’s premium crude oil.

Shipments of the country’s most sought-after crude Bonny Light were suspended by Shell after an outage on the Nembe Creek Trunk Line (NCTL).

The Trunk Line is one of the two main pipelines taking Bonny Light grade to the export terminal.

This incident comes less than a week after the 400,000 barrels per day Trans-Forcados Pipeline was closed down following a leak.

The shutdown of the Forcados pipeline affected about 250,000 barrels of oil per day (b/d) production.

Shell’s Nigerian subsidiary SPDC said in a statement that the shutdown of the Nembe Creek Trunk Line by the operator, Aiteo Eastern E&P Company Ltd had prompted it to declare force majeure on Bonny crude shipments with immediate effect.

Force majeure is a standard clause in supply contracts that exempts the contracting parties from fulfilling their obligations for causes beyond their control.

The Nembe Creek trunk line is one of Nigeria’s major oil transportation arteries that evacuate crude from the Niger Delta to the Atlantic coast for export.

Before yesterday’s announcement by Shell, traders told Reuters that cargoes of oil from the Bonny Light stream, for which exports are expected to reach around 195,000 barrels per day (bpd) in June, had been delayed up to about a week.

The suspension of export of Bonny Light crude came about the time oil price hit $80 a barrel for the first time since November 2014.

International benchmark Brent crude, against which Nigeria’s crude is priced, reached an intraday high of $80.33 a barrel before receding to $80.16 on Thursday.

Despite the rally in oil price, the force majeure on Bonny Light exports could hurt Nigeria’s total daily production, causing the government to miss production and revenue targets set in the 2018 budget.

The 2018 budget, passed by the National Assembly on Wednesday, is premised on oil benchmark of $51 per barrel and production of 2.3 million barrels of oil per day.

The shut down by implications means that the federal government through the NNPC and companies that transport crude through the line cannot export around 195,000 barrels per day crude worth $15.6 million daily or N4.7bn (at N305/$1 exchange rate) assuming the price of crude remains $80 per barrel.

Expert: Outages common ahead polls

“The Bonny force majeure would have to last some weeks before export levels or treasury receipts were seriously affected,” said Aaron Sayne, a senior governance officer with the Natural Resource Governance Institute (NRGI) based in the United States.

“The negative impact on public finances could grow if these sorts of outages become more common in the run-up to the elections,” Aaron said about the effect of the suspension of export.

“As for an estimate of losses, that would depend on a range of factors (oil prices, achievable Bonny Light production during the period, volumes of crude already stored in the tanks at the terminal, length of the force majeure) that I can’t predict. So I’d rather not guess, since I wouldn’t be giving you a very reliable number.”

In recent times, supply disruptions have significantly affected the country’s oil exports as four of the nation’s five largest export streams have been suspended.

Exports particularly of Bonny Light have seen its production affected by declarations of force majeure at different points due to sabotage and militant attacks.

The last time SPDC declared force majeure on Bonny Light crude was in September 16, 2017, due to issues over a leak on the NCTL taking Bonny Light grade to the export terminal.

Before then, Shell had on August 12, 2016 declared force majeure on exports of Bonny Light crude due to shutdown of the NCTL by the pipeline operator, Aiteo, following a leak.

The declaration came just over a month after it lifted the force majeure it declared on the grade on May 10 after repairing another leak on the same pipeline.

Meanwhile, with the closure of the Trans-Forcados Pipeline about 15 oil fields producing between 220,000 and 250,000 barrels of crude oil per day was said to have been shut thereby affecting major producing companies like NNPC’s subsidiary company the NPDC.

Before the recent leak The Pipeline had suffered three sabotage incidents in 2016, beginning with the subsea bombing of the facility by the Niger Delta Avengers in February 2016, followed by a militant attack in November 2016.

Lamenting in some of its latest operations report, NNPC said that the shutdown of these facilities and the subsisting force majeure are among issues that have eclipsed its production.

The shutdown of these facilities, according to the NNPC, are the key inhibiting factors that have dragged and affected its overall performance and, by extension, revenues due to the federation.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.