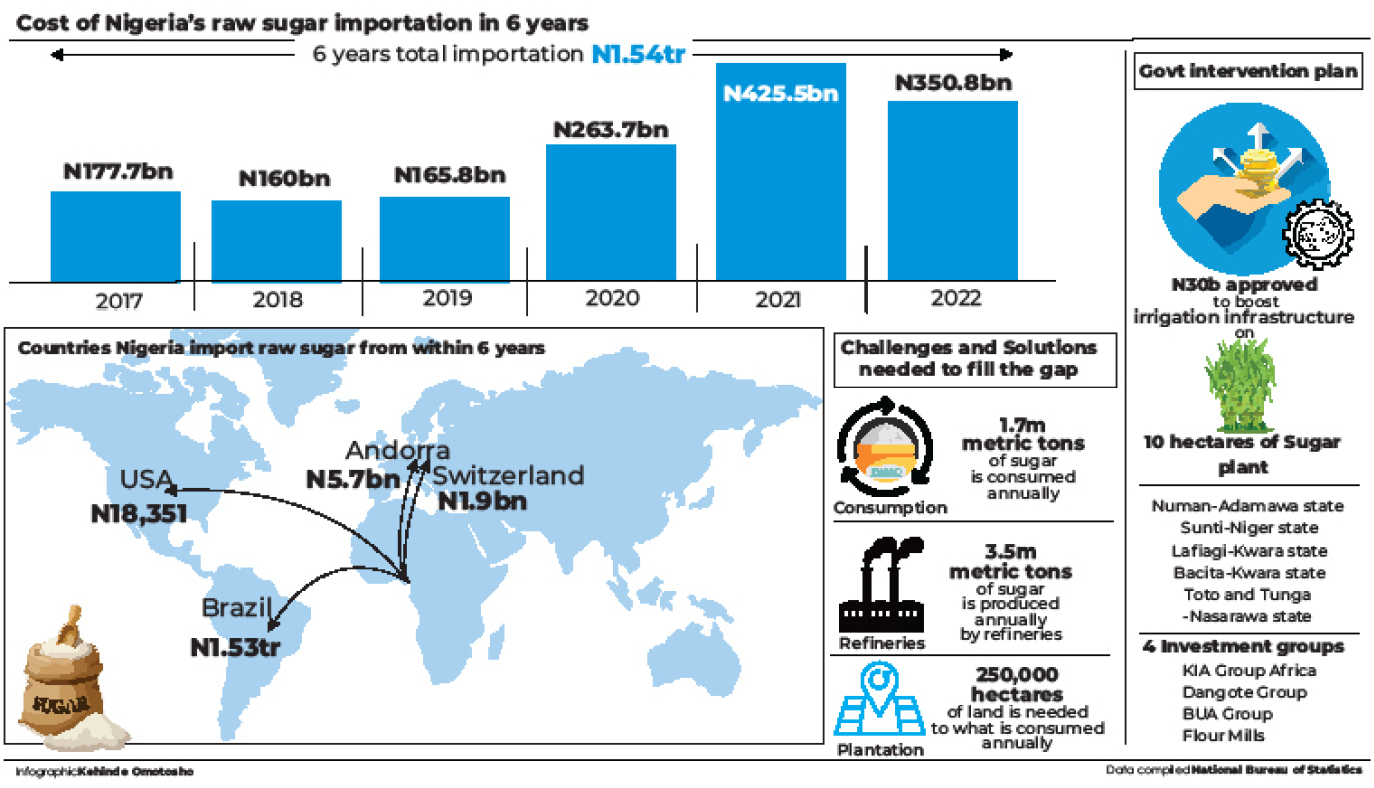

Nigeria’s importation of raw sugar rose to N1.54tr between 2017 and 2022, an analysis of quarterly reports of the country’s foreign trade reports released by the National Bureau of Statistics (NBS) has shown.

The reports indicated that the country imported the commodity mostly from Brazil which accounted for 99.3 per cent of the product which is to the tune of by N1.53tr.

Brazil is followed by Andorra with N5.7bn, France with N4.8bn, Switzerland N1.9bn and the United States of America N18,351 of the product.

The analysis by yearly importation showed that the product was imported more in 2021 gobbling N425.5bn. This is followed by importation in 2022 amounting to N350.8 and in 2020.

This is followed by N177.7bn of the product imported in 2017, N165.8bn in 2019 and N160.1bn in 2018.

250,000 hectares plantation elusive to fill gap

The Nigerian Sugar Master Plan (NSMP) was launched in 2013 as a harbinger to ensure sustainability of production in the country.

With the country overly dependent on imported refined sugar, the masterplan, termed Backward Integration Policy (BIP), engendered development of the sector with the establishment of Dangote Sugar Refinery, BUA Sugar Refinery and Golden Sugar Refinery.

These refineries have ensured that the country made headway in its drive for self-sufficiency.

However, the lack of adequate sugar plantations for raw sugar to meet the demand of the refineries has led to over-dependence on its importation.

According to the Executive Secretary/Chief Executive, National Sugar Development Council (NSDC), Mr. Zacch Adedeji, Nigeria consumes 1.7 million metric tons of sugar annually with the majority used by manufacturers.

With the refineries producing 3.5 million metric tons of refined sugar annually, Nigeria has the edge to export to other African countries when the African Continental Free Trade Agreement (AfCFTA) is fully in place in the continent.

But another integral component of the PIB is the creation of plantations, for which Adedeji stated the country would require 250,000 hectares of land to produce raw sugar that would stem the importation of the product.

Even though there are four major investors in the sector, KIA Group, Africa Dangote Group, BUA Group and Flour Mills, with sugar plantations in the country, subscribing to the BIP was not adhered to judiciously.

Thus, Adedeji last year announced to the sugar companies that allocation of raw sugar would no longer depend on the size of refining capacity but on the extent to which operators have complied with the BIP policy.

He stated that the new system was to reward efforts put in complying with the BIP, and urged the companies to reinvest profits into the country by establishing sugar estates.

This, he said, would enable the country to be self-sufficient in the production of sugar through the 250,000 hectares needed to produce the 1.7 metric tons consumed annually.

With the realization that closing the gap in achieving production is still a long year ahead, President Muhammadu Buhari, also approved a N30bn infrastructure intervention to drive development in the sector.

The intervention was for infrastructure development to accelerate sugar backward integration programme projects for irrigation infrastructure on 10,000 hectares of sugar plantations located at six BIP sites namely; Numan-Adamawa state; Sunti-Niger State; Lafiagi-Kwara State; Bacita-Kwara State; Toto and Tunga-Nasarawa State.”

Similarly, the failure to achieve optimal investment led to the approval of the federal government to extend the BIP for another 10 years.

The Minister of Industry, Trade and Investment, Otunba Niyi Adebayo, had said the extension was to allow self-sufficiency in the commodity.

He added that four investors have jointly created 15,000 jobs, and acquired about 200,000 hectares of land to grow sugarcane and produce sugar locally.

High import shows lack of infrastructure to harness potential – Expert

Speaking on the importation, Prof. Jonathan Aremu, a consultant, Common Investment Market, ECOWAS, stated that the importation level showed the failure or lack of provision for basic infrastructures needed to harness Nigeria’s potential in the sector.

Aremu said with the product essential to the manufacturing sector, importation would be the available option to meet demands.

While noting that this is straining the strength of the naira in the global market, he called for innovative ways to make the Nigerian sugar attractive to investors.

“Except we want the manufacturers to close down, I don’t think there are other options when the infrastructure to develop the raw materials is not available. If the masterplan does not solve the issue of attracting investors, what is its essence?

“Review of the plan should have been made before its expiration date to look at ways to tweak it if it is observed that its objective will not be achieved at the end of the day.

“What will happen if the extension fails to materialize in the local production of raw materials, will it be extended again? What the government needs to do is to evaluate the success of the particular policy midway to check the gains made and potential to achieve the set objectives.”

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.