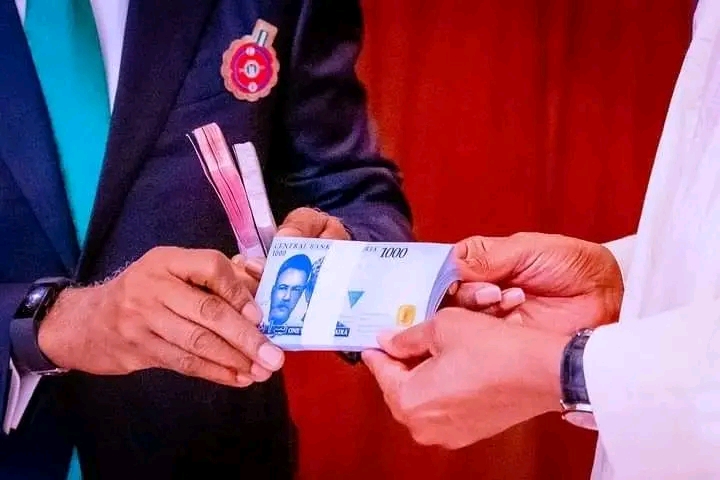

The naira redesign has proceeded normally and the new designs have been unveiled. The volatility in the naira has been fairly well-managed but the critical moved to begin to banish street trading of foreign exchange has yet to be taken. This is the thing that feeds our corruption. Since President Buhari is not ready to deal with this matter, the next leader must, for all of our sakes. If we can achieve this, black market dollar patrons and sellers will go underground and whatever their rates are will not be daily reported. Nigeria will thus focus on the naira and the possibilities for our local economy.

- The CBN should also try to meet other form A (Invisible Trade) transactions and reduce the frustration around import transactions presently experienced by businesses. However, technology should be deployed to curb the many incidences of attempted round tripping by Nigerians who raise fake import forms.

- CBN could also use this opportunity to power the e-Naira and its proposed domestic card. The e-Naira could enable Nigeria’s currency to attain a level of compatibility which has been elusive for some time. This will be based on guarantees to the international community by the CBN. The Nigerian card could also serve this purpose just as the Indian Rupay card, and China’s Unionpay is doing. Every country is now taking charge of their own destinies.

- Using tariff barriers against the 43 ‘unsupported’ items to reduce the excuses around those who say the CBN is encouraging them to approach unofficial sources. Tariffs non-foreign toothpicks, Indian incense and candles, water, vegetables, eggs, fish, and other items which we are producing locally could be as high as 200% and this could also enable some income redistribution.

- If it becomes very difficult to change dollars on the streets and CBN can get the BDCs on side (I don’t see why not), the CBN may incentivize holders of dollar cash to deposit at the banks and/or change at a premium to I&E (official) window rates. This way, the CBN may be able to get more dollars to fulfill its burgeoning obligations

- In the alternative, the CBN may consider in addition to outlawing black market dollar trading, the removal of personal Domiciliary account privilege for Nigerians for now. When people ‘save’ in dollars and people change their salaries into dollars, they are taking a position against the Naira and a self-fulfilling prophecy situation occurs – the naira will keep falling.

- CBN must be able to cause revaluations of the naira in the official markets to indicate market direction and move against speculators and currency attackers if 15 above can be achieved. We have to be able to show that the naira is not going to hell.

- CBN must ensure a focus on the naira and a gradual but certain shift of mindshare of our people from the dollar, such that with the Naira we are able to reboot our economy by increasing the velocity of the money supply and for payment of fully local services – like labour.

- People have speculated that the CBN will not print all the N3.2 trillion it is taking out of circulation and that makes sense. Scarcity of Naira at some point may lead to people changing their dollars back into naira cash just to live their normal lives, thus strengthening the naira. Scarce naira cash, coupled with the new innovations that the CBN is bringing up (such as the Naira domestic card) will also lead to better adoption of e-banking. In the UK for years now, a third party cannot pay cash into any account. In most countries they have since gone contactless.

- The CBN must assure the markets that it is impossible for people to walk to the Central Bank, obtain $10 million and swap it to get huge premium.

- CBN must avoid the dilemma between sector deregulations (downstream petroleum for example), and unilateral devaluation of the naira (often arbitrary and baseless but being pushed by several powerful individuals and interests, locally and internationally). The devaluation of 2016/17 undid the deregulation of the petroleum sector by the Buhari administration and left us with spiking inflation and an eroded standard of living… while the deregulation still remains a problem. In other words, the CBN should try not to devalue the currency for now.

- Public officials, especially those whose opinions can sway the markets heavily should be made to understand that the markets are watching what they say. They are better off keeping their opinions to themselves. The public should also be educated that their country’s currency is their representation, and we should stop working to destroy the currency. Thatcher reechoed Stalin when she said that ‘To destroy a country, first debauch its currency’. Why are Nigerians today debauching their own currency?

- Further misconceptions that we must get rid of include the idea that a currency’s value is SOLELY determined by its productivity. No. If that was true, then the British Pounds should trade at around 30 to 50 to the US Dollar, after all the US economy is much bigger, the population is larger and the goods and services produced in the US are more sophisticated and science-based. Even the UK is losing bright people to the US in every field – even to China these days. So why is the Pound trading at $1.19=GBP1?

- The CBN may wish to have a rethink about the ubiquity of personal DOMICILIARY accounts in Nigeria. At the end of the day, it is a policy and a privilege for Nigerians to hold DOM accounts of any type. The CBN reserves the right to cool out the policy from time to time if it believes it has become an avenue for the siphoning of its reserves. This is a touchy policy, so the CBN can offer Nigerians a premium of up to N100 to sell dollars officially into its position. If the black market is no longer available on the streets, people will take that option and avoid the trouble of arrest or fraud.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.