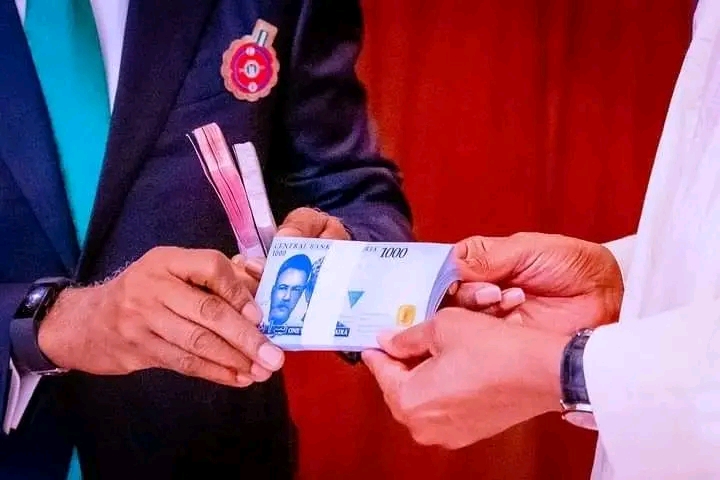

Somehow the naira redesign move now has multiple implications and is not only about operational counterfeiting issues but also a window to establish a better trajectory for the naira in terms of its value. The Central Bank must seize this opportunity and I also advise President Buhari to do the same.

In economics we always talk about unintended consequences. The first phase was the slump in the value of the naira as people moved money from their soak-aways to buy foreign currency, especially those who are too criminal to put same in a bank. A second phase could be marked by the strengthening of the naira in that same black market. A third phase may be precipitated by the CBN if it acts quickly and decisively to take the narrative away from speculators and currency saboteurs. Already, those who never wish well for Nigeria are gloating that the currency will fall to N1,000 now that the N650=$1 cannot be held firm.

Below is what I think the CBN should do now. Some of these steps will require political backing. Only Buhari can get the ‘Mallams’ off the streets. And anyone trading dollar on the streets must be arrested. With a little incentivization these guys can get off the streets and that will be a new vista for this country and its financial markets. The BDC subsector must also be urgently reorganized:

- CBN must maintain course with the redesigning of our currency

- I advise that the new currencies be polymers which are incredibly hard to forge and cannot be printed with existing printers with which currency forgers have mastered the art in Nigeria

- CBN should withdraw all the 6,000 BDC licenses for reissuance.

- CBN should work with the BDC supervising body to consolidate them into not more than 100. There are only 130 BDC brands in UAE, and 145 in the UK which are heavy tourism-oriented countries. BDCs are designed to aid tourism. So, what are we doing with 6,000 official BDCs and perhaps another 20,000 or more traders whom the association of BDCs’ president refers to as ‘ungoverned territory’.

- New modus operandi should be administered for the BDCs. The business is very profitable based on fee-based income but they need to be reorganised to meet global standards. Also, BDCs could involve in local and foreign transfer business, including remittances subject to limits. ALL transactions to be documented by CBN, under close supervision. This means that the CBN has to employ more boots on ground for this active daily work. BDCs are a great source of corporate employment all over the world. It is not a place for semi-literates.

- CBN must ensure political support around properly criminalising street trading of foreign exchange. It is the ease of access to the so-called ‘black market’ that has resulted in so much indiscipline and the constant volatility around naira rates.

- CBN to ensure education of newspaper houses, TV stations and other media including new media around why it is an anomaly to report ‘black market’ rates as the ‘real rates’. Also, CBN should engage and write intellectuals including those who may be consultants to it or advisers to the government about the implications of talking down the naira or valorising the black market. There is indeed a black market for everything, including currencies in every country, only that it is properly treated as illegal, and anyone approaches them with great fear and trepidation and a foreboding sense that anything could happen. These black markets are on the same plane as the dark web and are run by drug lords and men of the underworld. People who go there are such that do not want their transactions traced.

- CBN should take note of the recent IMF intervention on this matter, especially the concern about financial and real dollarization and their distortions in the economy. The IMF had advised that “Financial dollarisation-related financial instability would need to be addressed via policy responses such as a central bank forex reserve buildup and associated regulation’’. What this means is that the CBN will have to be firm in the area of regulation as this is the surest way of ensuring forex reserve buildup. Nigeria is a perfect case study for what the IMF described as hysteresis and bi-monetarism. But we must not allow hysteria run our economy. From what the IMF explained, financial dollarization is when transactions are done in local currency but savings in foreign currency (dollar). However, the escape by savers into dollars further reinforces inflation by amplifying external shocks, thus defeating the purpose and leading to a race to the bottom (vicious cycle and hyperinflation). This happens as people hoard dollars, making dollar/naira rates higher and imports (which is almost everything here), more expensive. The people thus amplify imported inflation. Talk about a snake swallowing itself.

- CBN must be careful of information asymmetry and compromises from within. It is a fact that every Nigerian that is financially buoyant accesses the easy black market today and the disappearance of that market will mean that we all technically lose money. However, we will be losing money for our country and its long-term survival. The first bitter pill will have to be swallowed by central bankers for this is the right thing to do. Also, the CBN should educate every Nigeria that having a single rate that clears the market is a myth. Nowhere in the world do we have a single rate. Not even from one BDC to another, or even in the same BDC. The margins should however be thin – not more than 10 per cent of quoted rates (the Investors and Exporters window being our benchmark now with as much transparency as we can manage)

- Since this is a two-sided affair, the CBN should show strength by applying carrot and stick. To this extent, I suggest that the CBN raises PTA limit to $10,000 BUT only $2,000 be paid as cash. The rest should be loaded in dollar debit cards. Indeed, I believe we should detach a bit from the fixation with dollar, and also issue GB Pounds and Euros to those going to where those currencies are spent. Also, it could peg family at a maximum of $30,000 no matter how large and once a year. Whereas some families can afford to spend more on a simple holiday, now is the time to appeal to everyone’s patriotism.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.