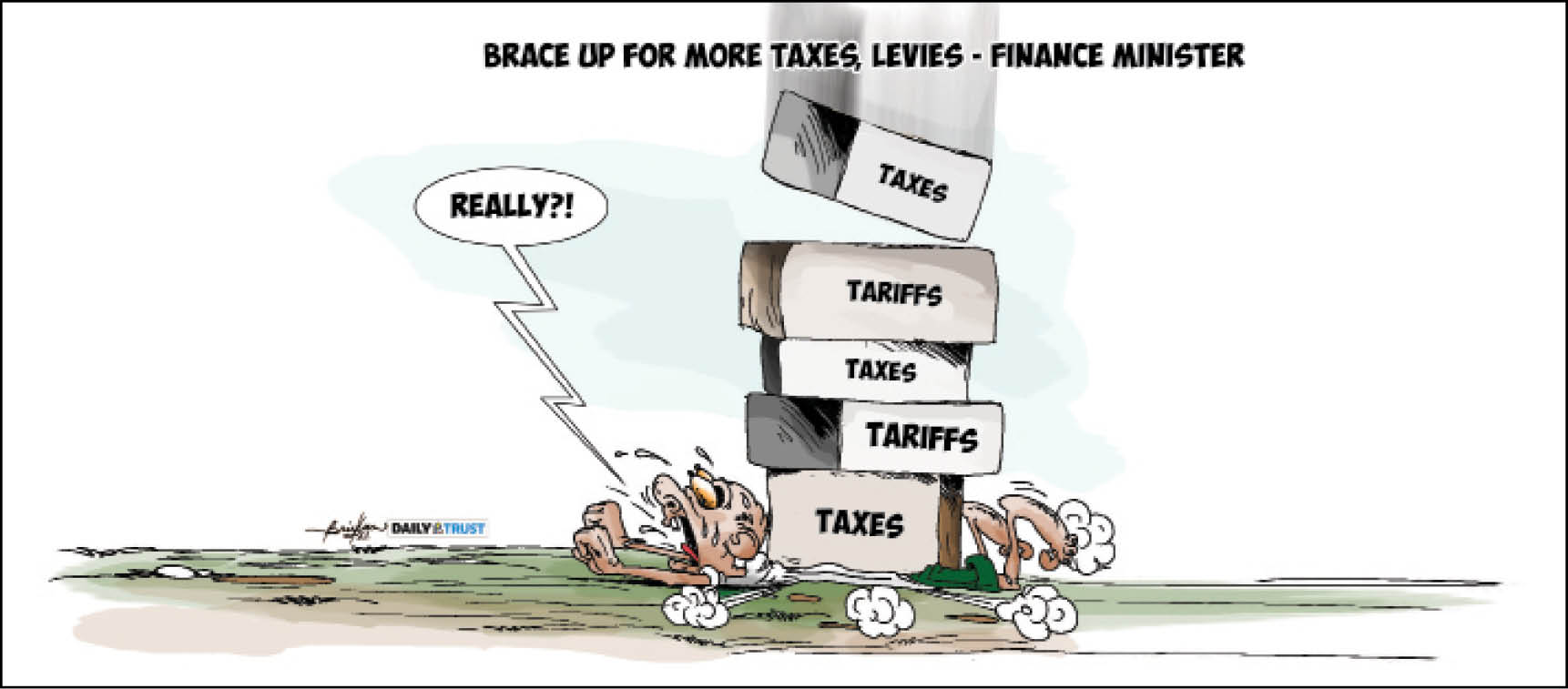

Minister of Finance, Budget and National Planning, Zainab Ahmed, says the best measures to reduce the nation’s high debt burden are collection of more taxes, and effective blocking of revenue leakages.

Ahmed stated this on Tuesday in Abuja at a workshop on tax expenditure organised by the ECOWAS Commission under the Context of the Implementation of the Support Programme for Tax Transition in West Africa (PATF).

Zamfara apologises for shutting down broadcast stations

I didn’t ask operatives to detain El-Rufai during Anambra guber in 2013 – Obi

The workshop was aimed at examining directives on harmonisation of tax expenditure management practices and the monitoring and evaluation of tax transition in ECOWAS member states.

Represented at the event by Fatima Hayatu, Director, Technical Services in the finance ministry, Ahmed said the issue of tax expenditure was of great concern to the government.

Recall that the government had in July revealed that the country’s debt service cost in the first quarter (Q1) 2022 was N1.94 trillion, N310 billion higher than the actual revenue received during the period indicating that Nigeria’s debt service cost presently outweighs its revenue.

However, the minister said the debt burden is not beyond what the government can handle.

“If we have more taxes and redirect the taxes to the right fiscal sectors of our economy, we will reduce our debt burden. It is not as if the debt is beyond what the goverment can handle. If you look at the ratio of the debt to the Gross Domestic Product (GDP), I think the goverment is doing well.

“The debt is not something that cannot be surmounted. The programme today is to block leakages where the taxes are being diverted. So if we block leakages, and if it is transparent, Nigeria will borrow less and we will have more money to finance other sectors,” she said.

Noting that reforms in tax expenditure management were gaining traction in Nigeria, the minister observed that the development had resulted in the continuous development of in-house capabilities and internal restructuring in agencies for greater efficiency.

Head of Corporations, European Union for Nigeria and ECOWAS, Cecile Tassin-Pelzer, while lamenting the ratio of tax to GDP in the West African region, described it as low.

While stressing the need for ECOWAS member states to effectively mobilise more taxes to offset the potential decline in revenues, she said domestic revenue is an important source of government expenditure funding, but revenue mobilization remains a critical challenge.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.