More students across several tertiary institutions in Nigeria are optimistic of benefiting from the next batch of disbursements of the Nigerian Education Loan Fund (NELFUND), Weekend Trust gathered.

The NELFUND, established by the Students Loan Act 2023 is managed and administered by the Central Bank of Nigeria (CBN) through the money deposit banks. It aims to facilitate the mobilisation of funds to provide interest-free loans to students of tertiary institutions.

Beneficiaries are expected to begin a repayment process of 10% of their salary to be deducted at source two years after the completion of the National Youth Service Corps (NYSC), while self-employed beneficiaries are required to remit the same of their monthly profit.

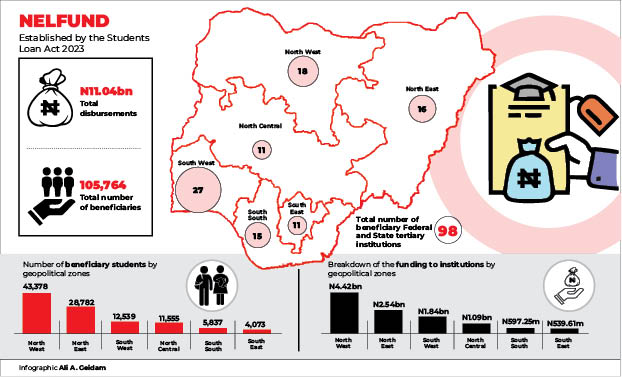

Established by the President Bola Ahmed Tinubu administration as a means of providing financial support to students for tertiary education, the management of NELFUND said it has so far disbursed N11,047,793,949.80 billion to 105,764 beneficiaries across 98 federal and state tertiary institutions.

- Alhaji (Dr) Abdulrahman Ado Ibrahim CON: The prince born to be king

- Addressing the environmental impact of green banking in Nigeria

The disbursement of funds is made directly to the institutions bank accounts while successful applicants are entitled to a monthly stipend of N20,000 for upkeep if they so wish.

Weekend Trust reports that in August, the NELFUND had released data that showed significant regional disparities in the registration, application and disbursement of funds with the South-east recording the lowest figure.

Netizens on X had accused NELFUND of neglecting universities in the South-east but the Fund refuted the claim, saying the management of tertiary institutions in the South-east had failed to respond to verification requests forwarded to them.

North-west leads in disbursement, South-west in institutions

The latest data released by NELFUND on November 7, shows that the South-west has the highest number of beneficiary institutions with 27 currently getting disbursements. This is followed by the North-west which has 18 institutions while the North-east has 16 and the South-south has 15 institutions. The North-central and South-east have 11 institutions each.

On the number of students by zone, the North-west has the highest number of students with 43,378 followed by North-east with 28, 782 and the South-west with 12,539. The North-central has 11,555 beneficiaries while the South-south has 5,837 and South-east has 4,073.

The breakdown of the funding by zones, also shows that the highest of N4,424,024,250 billion was paid to the 18 institutions in the North-west, followed by the16 institutions in the North-east which got N2,544,223,937 billion, then the 27 institutions in the South-west received N1,842,876,713billion. The 11 institutions in the North-central got N1,099,808,700 billion, while the15 in the South-south got N597,250,030 million and the 11 institutions in the South-east received 539,610,320 million.

Why South-east has fewer applicants

Weekend Trust reports that poor registration from some parts of the country had led to a massive sensitisation tour by NELFUND at tertiary institutions across the country. The sensitisation trail which began from the South-east according to the NELFUND’s X handle was designed to reach every zone.

NELFUND’s Managing Director/Chief Executive Officer, Akintunde Sawyerr said last month that the Fund had been proactive in reaching out to segments of the nation that feel left behind, particularly the South-east.

However, some students in the South-east said they were oblivious of the loan initiative while others said they were not interested.

Miss Chidinma Obiolu, a student of Chukwuemeka Odumegwu Ojukwu University, Igbiariam, said she was not aware of any federal government’s loan initiative.

Also, Chukwunoso Nnoruka of Nnamdi Azikiwe University Awka, said he was not aware of the loan, saying that he would be interested in it. Nnoruka, who is a student of continuing education programme (CEP) said nobody told them about the loan.

Mr Chinemerem Nwafor, a final year student of Nnamdi Azikiwe University Awka, said he knew about the student loan but had no interest in applying for it. “Most of us are aware of the student loan but it appears that we are not interested in the loan,” he said.

Students laud “seamless process”

Weekend Trust reports that though easily accessible, NELFUND has set out conditions for applicants. It states that applicants proven to have defaulted in past loans granted by any licensed financial institution in the country would be disqualified. Also, anyone found guilty of submitting fake/fraudulent documents and having been dismissed for exam malpractices by any school authority as well as anyone convicted of fraud and forgery, drug offences, cultism, felony, or any offences involving dishonesty will not be eligible for the fund.

For beneficiaries who decide to leave the country for better opportunities after NYSC, the NELFUND portal is clear that a beneficiary would have to contact NELFUND and sign an agreement with modalities to repay.

Anas Abdulrahman Dalibi and Muhammed Ibrahim Wakili, are part of the 2,536 students of Usmanu Danfodiyo University in Sokoto that are beneficiaries of the funds. In its latest data, NELFUND stated that it disbursed N226,931,440 to the school. Both final year students, Dalibi and Wakili, say they understand the conditions of the NELFUND and applaud the process for being seamless. The two were recently verified and their names appeared on the school’s disbursement list.

“We didn’t need to know anyone or have connections to get it, we just applied when the programme started, and our names came out,” they said. Both students independently mentioned that they promptly received their upkeep funds of N20,000.

Unfortunately, Ukashatu Ibrahim, from the same institution, hasn’t had the same success. Despite applying on the first day and assisting his peers who successfully received their funds, his name is yet to appear on the school’s disbursement list. Like others, he, however, said the process felt accessible to all students irrespective of status.

“Maybe I’ll be included in the second batch, as I’ve already been verified,” he said, sounding optimistic. “I’m ready to repay it after getting a job, and won’t treat it like free money,” he assured.

Graduates, dropouts receive upkeep in FUD

At Federal University Dutse in Jigawa State, where the NELFUND stated that it approved N207,106,000 million to 1,920 students, many said they were disappointed with the number but remain optimistic that many eligible students now waiting for loan approvals will get them soon.

Weekend Trust gathered that the distribution has left many active students frustrated and uncertain. A source from the university’s Students Account Department shared that several eligible students were still waiting on loan approvals, causing them to miss critical tuition and course registration deadlines ahead of final exams.

He alleged a likely manipulation of the system, adding that a few students who graduated from the school or dropped out have reportedly received upkeep funds.

“It’s supposed to be an automated system that shows students’ status after putting his/her registration number –whether active or graduated– but it seems there’s some sort of manipulation somewhere,” he said while explaining that students who had graduated or dropped out reportedly received funds, while current students face delays and struggle to access support.

The source added that, while around 70% of applicants have received their upkeep allowance of N20,000, the overall process was slow, leaving many students without the assistance they desperately need.

He said common issues include “mismatches between National Identification Numbers (NIN) and Bank Verification Numbers (BVN), discrepancies in JAMB details, and IT glitches from the NELFUND server.”

He said some graduates who unexpectedly received funds, despite not applying, came to the school to inquire about the refund process.

More sensitisation needed to encourage students – NANS President

Explaining the low enrolment figure from some parts of the country, especially the South-east, the President of the National Association of Nigerian Students (NANS), Lucky Emonefe said many students were initially sceptical about the initiative but their perspective shifted as disbursements began.

Emonefe said the union had observed lower application rates from the South-west and South-east regions of the country, prompting a state-to-state zonal sensitisation campaign in institutions across the country to raise awareness.

Weekend Trust reports that the X handle of NELFUND is actively engaging students with the right steps to apply for the funding as well as answering questions on the application and disbursement processes.

“The reason people didn’t apply earlier was the doubt surrounding the programme’s feasibility, but once disbursements started, students saw that it was real,” said the NANS president who praised NELFUND’s application process, noting its simplicity and the absence of favouritism.

He, however, acknowledged some challenges, including delayed responses and limited communication between NELFUND and institutions, which he said have left many students in limbo.

The NANS president also said network glitches have also affected the process, though improvements have been made.

Emonefe described the initiative as a transformative step for educational access across Nigeria. “This is a way forward for educational opportunities in the country, ensuring that no one has a reason not to pursue higher education, also the requirements for application have now been adjusted, making it easier for students to apply,” Emonefe added.

Reacting, the Director Strategic Communications at NELFUND, Oseyemi Oluwatuyi said they not aware of dropouts receiving funds for upkeep.

She said: “We would like to know which schools have drop outs who receive upkeep. Such has never been brought to our notice. We do not have any technical issues.”

For students who applied and are waiting, she said: “Applications go through a process, this process entails verification by schools, therefore they will be verified when all processes have gone through.”

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.