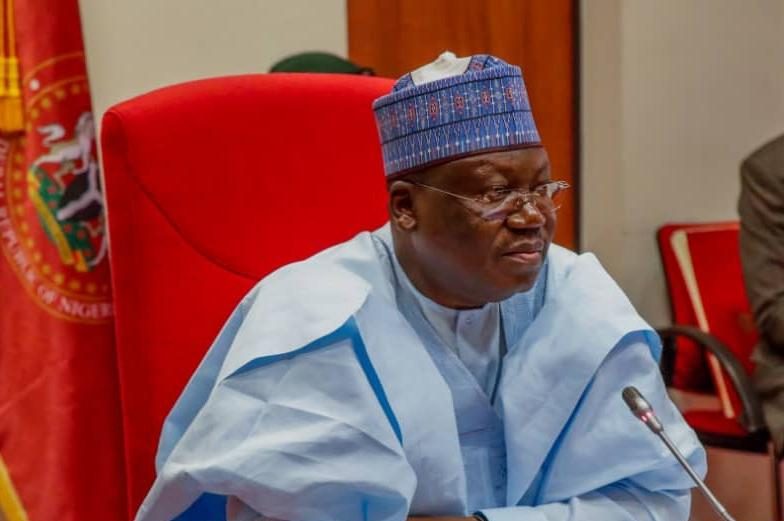

Senate President, Senator Ahmed Lawan Friday decried the nonpayment of taxes by some companies operating in Nigeria, saying this is robbing the nation of huge amounts of revenue accruable from taxes.

He spoke in Lagos during the business luncheon organised by the Chartered Institute of Taxation (CITN).

- JUST IN: ISWAP abducts another set of passengers on Borno highway

- Kannywood musicians can help fight kidnapping, banditry – Abubakar Sani

Represented by his Special Adviser on Economic Matters, Professor Nazifi Abdullahi, the Senate President stated that Nigeria’s low tax GDP ratio is a significant challenge.

“The aggregate collection in September this year is only 4% which means so many companies are not paying their tax. If that is a problem at the federal level, to effectively collect taxes with the advanced capacity of the FIRS; you can imagine the extreme losses that are happening at the national level.”

Commenting on the theme of the luncheon, “The nature and implication of Digital currency technology and e-Naira for taxation.”

Lawan pointed out that a large percentage of the Nigerian population is technologically savvy and economic activities are progressively migrating into cyber space.

This, he said, is an opportunity to expand the economy and improve income but it is also a challenge.

“How do you improve tax collection on economic activities that are progressively becoming technologically savvy? What is the level of tax that should be imposed which won’t be too appalling to the growth of that sector? What is the affordability component? What are the challenges associated with avoidance and hacking? What are some of the measures that CITN and other institutes will put in place?” he asked.

The President Council Chairman of CITN, Adesina Adedayo, stressed the need for the Federal Government to simplify the tax system as it relates to the recently introduced e-Naira.

Adesina Adedayo said, “Undoubtedly, taxes are the only sustainable source of generating revenue for the government to fulfill its obligations to the citizens and to promote physical development.

“To a large extent, policies on the monetary and physical levels have considerable impact on the tax system. It is on this basis that we have the thematic focus for this luncheon: Digital Currency Technology and e-Naira.”

“The outcome of our deliberation will be articulated as a position paper to the government and relevant stakeholders as input to policy formulation.”