Planned shutdown of units for maintenance and upgrade at some of India’s refineries may hurt Nigeria’s share of crude oil exports to the South Asian country, Daily Trust reports.

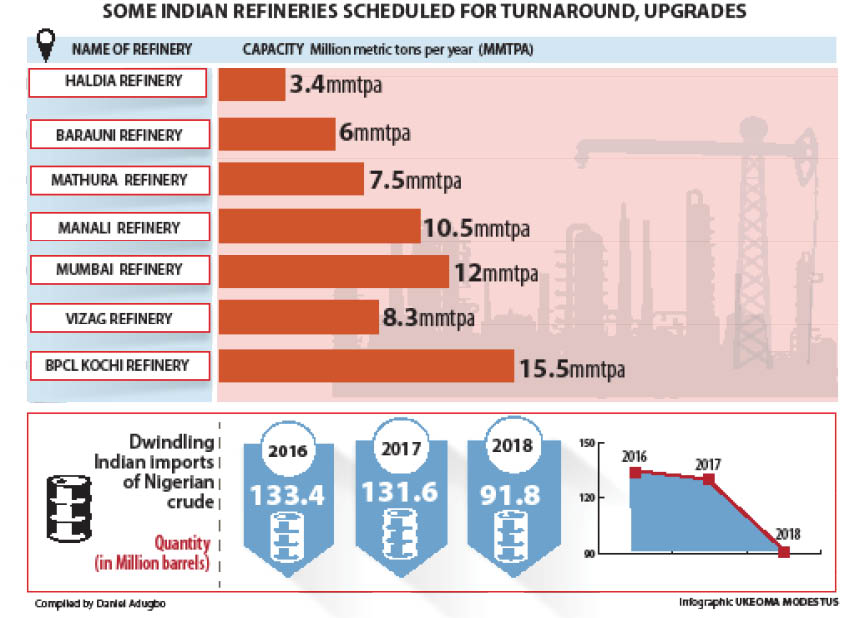

India, according to data from the Nigerian National Petroleum Corporation (NNPC), is Nigeria’s biggest oil buyer, importing over 131 million barrels of Nigeria’s crude in 2017, followed by the United States and Spain.

The National Bureau of Statistics (NBS) data shows that India, as at the last quarter of 2018, remained Nigeria’s major export market for crude.

Experts said the outage at some of these refineries, which utilise Nigerian crude, could put additional strain on Nigeria’s crude exports to India.

Speaking on some of the potential impact, professor of energy economics and former president of the International Association for Energy Economics (IAEE), Prof. Wumi Iledare, said the turnaround maintenance in India will lead to a decrease in demand for crude oil during the period.

Iledare who is also the Executive Vice President at the International Institute for Petroleum, Energy Law and Policy (IIPELP), Abuja, said “Certainly, demand for Nigerian crude will fall. Basic law of demand requires other things must be equal.

“Other things are no longer equal under these circumstances when there is shut down of refineries that use sweet crude so demand will fall in the short run,” he said.

Ongoing upgrade and planned turnarounds scheduled for between fourth quarter (Q4) 2019 and Q1 2020 at units of some India’s refineries could see the refineries go offline for months.

For instance, Indian state oil firm, Indian Oil Corporation (IOC), plans to take some units at its 3.4 million metric tons per year (mt/year) capacity Haldia refinery offline for a maintenance programme, state media reported.

The maintenance programme is expected to start in September and end around December.

Another of IOC’s operated 6 million mt/year Barauni refinery is scheduled for a full turnaround for 30 days. Separately, IOC also plans to expand the atmospheric and vacuum units at the refinery to boost its overall capacity to 9 million mt/year by 2021, the company said at its annual press conference May 17.

IOC has also scheduled a maintenance programme for units at its Mathura refinery which also processed low sulphur crude from Nigeria. The maintenance will take place between October and December.

Also India’s Chennai Petroleum Corporation Limited, a subsidiary of the country’s top refiner IOC, plans to shut down a crude distillation unit at its 210,000 barrel-per-day Manali refinery for 60 days from September to undertake a regular maintenance programme, company officials told energy news-provider Platts.

The project is in advance stage of completion and will be ready by 1st January 2020.

Another Indian oil giant, HPCL plans to shut some of its Vizag refinery’s secondary units and some of its Mumbai refinery’s secondary units in September-October as part of its plan to upgrade the overall process to produce Euro 6 fuels from April.

Also, leading Indian oil and gas firm, Bharat Petroleum Corp Ltd refinery at Kochi will undergo a shutdown for 15 days to replace a catalyst in its hydrotreater during the fourth quarter of 2019, local media reported.

However on his part, the Technical Adviser to the President of Dangote Group on Refinery and Petrochemicals, Mr Babajide Soyode, said because crude oil import and turnaround maintenance were not necessarily correlated, there was no way crude exports to India will be affected.

“Crude oil import is based on projected annual capacity (of refineries). What is going to be maintained are the processing equipment, not the storage tank. In other words they (Indian refiners) can still be importing,” he said.

He said turnaround maintenance is a temporary activity that generally did not last more than 30/35 days.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.