For the third time, international media reports on the acquisition of offshore assets have listed Nigeria’s most prominent public officials, a development that has triggered fresh outcry from citizens.

Reports of Panama Papers, Paradise Papers and Pandora Papers have followed a similar pattern by including Nigeria’s wealthy and influential persons in political, business and religious circles using offshore secrecy vehicles, not only to siphon funds but to avoid tax.

- PODCAST: Why Anambra politicians have gone into hiding

- BREAKING: Fury knocks out Wilder to retain WBC crown in heavyweight classic

The investigations were done by journalists across different parts of the world, who spent months surfing through documents and matching the names of company owners found in the papers with land registry records.

The first of the reports was the Panama Papers of 2016, where a network of journalists under the International Consortium of Investigative Journalists (ICIJ), the German newspaper, Süddeutsche Zeitung and 100 other news organisations, including Nigeria’s Premium Times, in a massive cross-border investigation, made revelations that led to protests and fall of governments and business empires.

Some prominent Nigerians cited to have acquired secret offshore assets in the tax havens include former presidents of the Senate, Bukola Saraki and his wife, Toyin; and David Mark.

Others are the late governor of Bayelsa State, Diepreye Alamieyeseigha; that of Delta State, James Ibori; Africa’s richest man, Aliko Dangote, and his brother, Sayyu Dantata; as well as the offshore companies of Wale Tinubu, the chief executive of Nigeria’s biggest indigenous oil company, Oando Plc, among others.

Also exposed were those of the late televangelists, Temitope Joshua, popularly called T.B Joshua; a former minister of defence and billionaire businessman, Theophilus Danjuma; Etisalat boss, Hakeem Bello Osaigie; the chief executive officer of Globacom, Mike Adenuga; Governor Abubakar Sadiq Sani Bello of Niger State; the late Ooni of Ife, Okunade Sijuwade; the chairman of Arik Air, Joseph Arumemi-Johnson and his wife, Mary; as well as two other serving senators – Andy Uba (Anambra) and Ibrahim Gobir (Sokoto).

Like the Panama Papers, the Paradise Papers leaked 13.4 million records, which exposed secret dealings and assets of world leaders. It was again anchored by a German newspaper, Suddeutsche Zeitung and shared with the ICIJ and a network of more than 380 journalists. Some of the details were made public on November 5, 2017.

Some of the revelations included the business ties between Russia and former president of the United States of America (US). Donald Trump’s billionaire commerce secretary, the secret dealings of the chief fundraiser for Canadian Prime Minister Justice Trudeau and the offshore interests of the Queen of England and more than 120 politicians around the world.

Nigeria’s former Senate President Bukola Saraki and Africa’s richest man, Aliko Dangote, were also mentioned in the leaks.

The latest report of the Pandora Papers in 2021, which was also led by the ICIJ, reveals how 137 influential Nigerians obtained about 233 properties through 166 offshore companies worth a total of £350million.

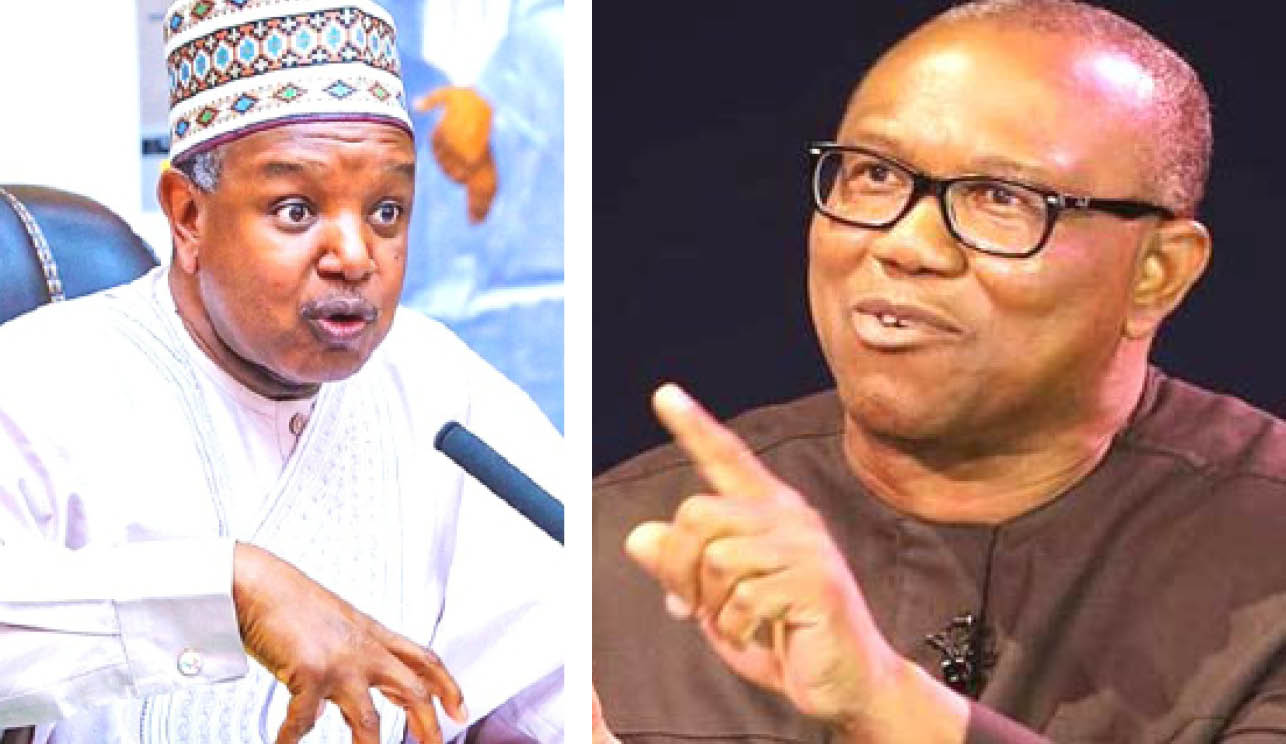

Some Nigerians mentioned in the current expose include Governor Abubakar Atiku Bagudu of Kebbi State; Stella Oduah, a serving senator and former minister of aviation between 2011 and 2014; Mohammed Bello-Koko, a finance director at the Nigerian Ports Authority (NPA); and a former governor of Anambra State, Peter Obi, who served between 2006 and 2014 and was the vice presidential candidate of the Peoples Democratic Party (PDP) in the 2019 general elections; and Governor Adegboyega Oyetola of Osun State.

The report alleged that eleven years ago, Abubakar Bagudu sought a new haven for his wealth in Singapore, using Asiaciti Trust, as part of billions of dollars he helped the Sani Abacha family steal from Nigeria in the 1990s.

The Monetary Authority of Singapore (MAS) imposed a fine of one million and a hundred thousand dollars on Asiaciti in July 2020 for “serious breaches” of Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) regulations between 2007 and 2018

On Stella Oduah, the leaked documents alleged she secretly bought a landed property in London, and the Deutsche Bank reported suspicious activity and suspicious payment of almost $72,000 to a London property broker in 2012.

A search of Land Registry records then showed that one month later another company, registered in Seychelles paid £5.3 million for a London townhouse, which had a name similar to the Oduah family.

Bello-Koko and his wife were alleged in the paper to have acquired properties in the UK as anonymous owners of the company BVI. Searches at the Land Registry showed that these companies bought five London properties between 2009 and 2017, for a combined total of almost £1.5 million. One of the properties has since been sold.

The report alleged that Obi had in 2010 set up an offshore discreet company in the name of his daughter, Gabriella Nwamaka Frances Obi, named Gabriella Investments Limited in the British Virgin Island.

The paper further claimed that Obi used representatives, Acces International officials to contract a local registered agent in the island, Aleman Cordero Galindo & Lee Trust (BVI) Limited (Alcogal), and set up subsidiary trust companies in Panama, BVI, and Belize.

The leaked documents alleged that Oyetola who was a directorship of Aranda Overseas Corporation, acquire his UK mansion by proxy in 2017 while he was Chief of Staff to former governor, Ogeni Rauf Aregbesola.

Obi and Oyetola have since denied any wrongdoing as suggested in the reports.

Obi said it was exhilarating that nowhere in the article was he accused of any form of corruption, whether in the form of diversion of public funds or in any other manner, during and after his stewardship as the governor of Anambra State.

“On the allegation that I violated the Nigerian Code of Conduct Bureau and Tribunal Act, as well as sections of the 5th Schedule to the constitution of the Federal Republic of Nigeria 1999 (as amended), by not declaring any alleged assets in companies registered outside the Nigerian federation, I think the authors displayed ignorance on matters of trust and international investment practices,” he said.

Oyetola said “since 2011 till date, he has had no association, dealings and business transactions with the said company, as he is neither a director nor shareholder of the said company.”

Although the reports did not produce evidence that the secret offshore assets were proceeds of corruption or other criminalities, it shows a growing culture of acquiring assets outside countries of origin among the elite.

In Nigeria, there is public outcry that the non-declaration of the overseas properties in the forms sent to the Code of Conduct Bureau (CCB) act constitutes an offence.

Speaking on the matter, a former general secretary of the Nigerian Bar Association (NBA), Afam Osigwe, a Senior Advocate of Nigeria (SAN), said persons who acquired properties outside the country to avoid tax payment and include them in asset forms breached the law.

“People ought to declare their interests in these entities, otherwise they can use joint ownership to say they cannot disclose,” he said.

In his view, Sebastine Hon (SAN) said that since the central definition of corruption is unlawful enrichment using one’s privileged position, the Pandora Papers would be examined on this basis.

“The facts affecting each of those persons mentioned in the Pandora Papers will be critically examined in terms of their legitimate incomes being weighed and measured to see if the current sums discovered are commensurate with those legitimate incomes, minus reasonable expenses.

“Consequently, if the value of those overseas assets outweighs such legitimate incomes, there is prima facie evidence of corruption. Be informed, too, that merely having money and assets more than your lawful earnings makes you an exposed person in that regard; and in jurisdictions like the United Kingdom (UK) and Nigeria, the burden is on you to explain the excess,” he said.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.