A post by Uba Easy Loan Foundation Services early this year on Facebook, claiming to be the United Bank for Africa (UBA) loan foundation service in Nigeria has made a fresh post some days ago.

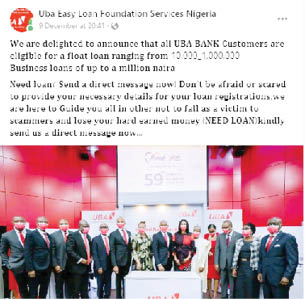

The post shows an image of the chairperson of UBA, Tony Elumelu, alongside some members of staff of the bank in front of several roll-up banners carrying the bank’s logo.

The caption of the post reads, “We are delighted to announce that all UBA bank customers are eligible for a float loan, ranging from N10,000-N100,0000. Business loans of up to a million naira.

“Need a loan? Send a direct message now! Don’t be afraid or scared to provide the necessary details for your loan registration.”

The author of the post added that they would guide interested applicants in order not to fall victim to scammers and lose their hard-earned money.

The post got over 60 comments; and many seem interested in applying for the loan.

There were many grammatical errors in the caption, which is a clear red flag.

Verification

Fact-checkers at Daily Trust sought to ascertain the claim, taking into consideration that banks in Nigeria always warn customers not to give out personal information to anyone outside the banking hall.

When a manual search on the page, Uba Easy Loan Foundation Service Nigeria was carried out, the results found were misleading as there was no connection to UBA.

The official UBA page (UBA GROUP) has over 3.8 million followers and was created in 2009.

All pages associated with the official account carry a Facebook verification badge.

A direct message was also sent to the page but there was no response after many hours.

Further investigation led us to speak to a staff of the bank who wished to remain anonymous and he confirmed that the Facebook page was out to scam customers.

She explained that the bank introduced what it calls click credit some years back and only eligible customers with salary accounts can apply using a code, *919*28# or sending a “Loan” to Leo on WhatsApp, Facebook or Instagram to chat to get more information. But that service is no longer available to customers because many applicants were refusing to pay back the loans while others were victims of fraudsters who would use their phones to apply for loans without their knowledge.

The click credit offered up to N5million to customers and the required repayment period was 12 months. The bank terminated the service over a year ago, she said.

She added, “Members of staff are always advised to inform customers not to share personal information with anyone online or outside the banking hall. It is very unfortunate that some customers still get scammed right in the banking hall from interacting with the wrong people, especially during this time of the year. That is why it is important to always engage someone with a staff tag inside the bank or even the security rather than a random person. We believe that in this way it is easier to trace any form of fraud.”

Conclusion

Based on available information, fact-checkers at Daily Trust can confirm that the Facebook page, “Uba Easy Loan Foundation Services” associating itself with the United Bank for Africa (UBA) and offering loans to customers is out to scam people and gain access to sensitive information; hence, the information coming from the page is misleading and fraudulent.

This fact-check was produced in partnership with the Centre for Democracy and Development (CDD).

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.