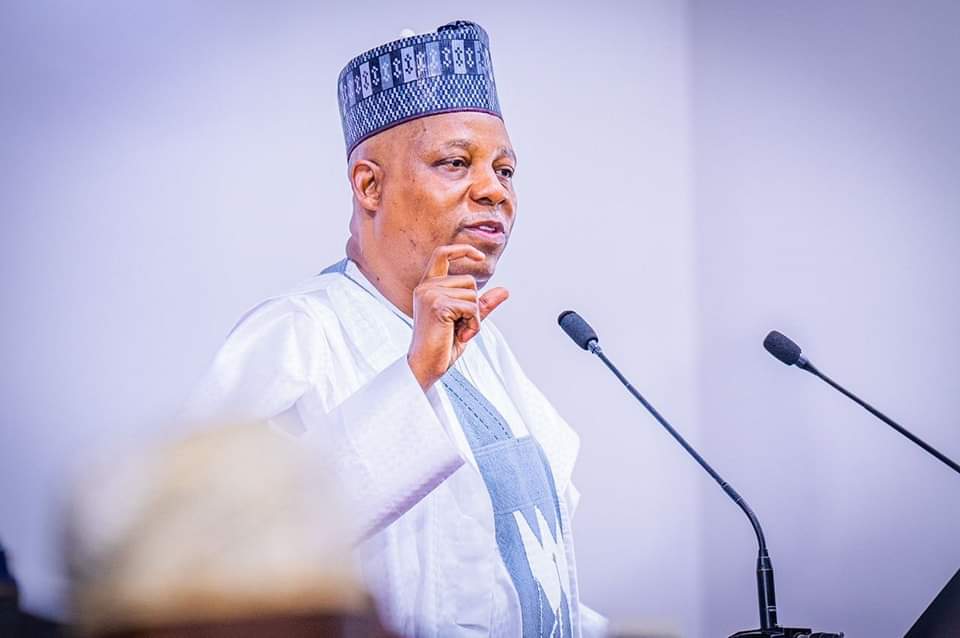

Nigeria’s vice president Kashim Shettima has said that the administration of President Bola Ahmed Tinubu is currently doing everything possible to deliver dividends of democracy, adding that the country’s economy is already on the path of sustained growth.

Shettima made the disclosure at a Ramadan iftar organised by President Tinubu for members of the Federal Executive Council (FEC) and Service Chiefs.

Verdict: Largely false

- Ramadan: Ice block business booms in Jigawa as patronage drops in Kano

- Peru reclaims over 4,000 cultural treasures from US, Europe

Full Text

The vice president while speaking said the president means well for the nation, noting that leadership requires commitment.

He reminded the ministers and the other senior state officials at the event that President Tinubu does not subscribe to bucks passing, for which reason he said posterity would be kind to him.

“Ramadan is a season of forgiveness; it’s a season of generosity, which incidentally coincides with the lent season, which goes to buttress the fact that what binds us together exceeds whatever divides us. This is time for all of us to rally around our leader because leadership requires sacrifice, leadership requires tenacity of purpose, leadership requires commitment.

“Honourable ministers, Service Chiefs, distinguished ladies and gentlemen, we have crossed the rubicon, and the nation is on the path to sustained growth. Some nations have gone through some worse phases in the annals of their history than us.

“The president means well for the nation; he has a good heart for the nation, and we have the moral imperative to support him in whatever way we can to salvage the ship of the state,” he said.

Verification

Checks by Daily Trust on Sunday show that contrary to the vice president’s claim, key economic indicators show that Nigeria’s economy is not yet on a path of sustained growth.

The World Bank has stipulated key indicators to measure if an economy is performing or not. These indicators include inflation, Gross Domestic Product, food and social security, employment rate, debt stock, conducive environment for businesses to thrive, strong currency among others.

Inflation

Since taking over as president in May 2023, Nigeria’s inflation has maintained steady rise, hitting an all time high of 31.7 per cent in February according to latest statistics from the National Bureau of Statistics (NBS).

Timeline of inflation surge under President Tinubu shows that headline inflation rate increased to 22.79 per cent in June 2023, higher 22.41 per cent recorded in May. It later rose to rose to 24.08 per cent in July, the highest in 18 years which represents 1.29 percentage points from 22.79 per cent in June.

Subsequently, the NBS announced that Nigeria’s headline inflation rate rose by 1.72 percentage points to 25.8 percent in August from 24.08 percent recorded in July.

By September, headline inflation rate had increased to 26.72 per cent and later 27.33 in October.

In the same vein, Nigeria’s headline inflation rate increased to 28.2 per cent in November showing a 0.87 per cent points increase over the 27.33 per cent recorded in October. In December, inflation had reached 28.92 percent, representing a 0.72 per cent points increase compared to the 28.20 per cent recorded in November 2023.

In January 2024, inflation had reached 29.9 percent, with the latest figure for February standing at 31.7 per cent, an all time high.

GDP

Latest data from the National Bureau of Statistics (NBS) shows that Nigeria’s Gross Domestic Product (GDP) grew by 3.46 per cent (year-on-year) in real terms in the fourth quarter of 2023.

NBS however stated that the growth rate is lower than the 3.52 per cent recorded in the fourth quarter of 2022.

Also, experts have said in different fora that for Nigeria to experience sustainable growth, GDP should hit double figures as single figure growth rate cannot yield significant changes and growth in real sector of the economy.

Unemployment rate

Latest unemployment figures from the National Bureau of Statistics show that for the third quarter of 2023, unemployment rate surged to 5.0 per cent, marking a notable increase from the 4.2 per cent recorded in Q2 2023. Among men, the unemployment rate stood at 4.0 per cent, while among women, it was 6.0 per cent.

Geographically, urban areas reported a 6.0 per cent unemployment rate compared to 4.0 per cent in rural regions. Youth faced a particularly high unemployment rate of 8.6 per cent.

The NBS also noted that regarding educational attainment, the unemployment rates varied: 7.8 per cent among individuals with post-secondary education, 6.3 per cent for those with upper secondary education, 5.5 per cent for those with lower secondary education, 4.8 per cent for those with primary education, and 2.7 per cent for those with no formal education.

Most importantly, experts have queried how the unemployment rate dramatically fell from 33 per cent to 4 per cent as the indices for measurement did not add up, experts had said.

Food and Social security

One of the major drivers of headline inflation is food inflation. The inability of farmers to go to their farms especially in the northeast and north central part of country is currently posing a huge challenge for food security in the country. Recently, the country witnessed hunger protest in different states of the country like Niger, Oyo, Kano, among others.

Also, the soaring prices of food clearly indicates a crisis in the country’s agriculture and food sector which has forced the president to open the national grain reserves for onward distribution to citizens.

Similarly, the recent donation of 2.1 million bags of fertilizer to the Agriculture ministry by the Central Bank of Nigeria clearly indicates the failure of the fiscal arm of government to tackle food crisis in the country, forcing the CBN whose job is solely monetary inclined to wade in.

Conducive environment for businesses to thrive

Due to the removal of fuel subsidy and shortage of forex, many companies have folded up in Nigeria. Some foreign companies have also discontinued operations and have left the country.

The recent wave has swept some multinational companies in Nigeria out of the country due to the toxic environment for business. Analysts believe that the situation is a clear reflection of the challenges surrounding the ease of doing business in Nigeria.

For instance, Unilever Nigeria Plc – one of the leading consumer goods companies, announced plan to stop manufacturing some of its popular products, including Omo and Lux, in Nigeria. Also, GSK Plc GlaxoSmithKline (GSK), a British healthcare and multinational biotech firm, ceased operations in Nigeria after 51 years of operations. The company in a statement announced the stop to the commercialisation of its top medicines and vaccines in the country via GSK local operating companies and moved to a third-party direct distribution model.

The closure of GSK and other pharmaceutical companies have led to the skyrocketing of several pharmaceutical products in the country, posing great challenge to the health sector.

Businesses have cried out for intervention on several fora. Although the federal government has stated commitment, no significant respite has reached businesses.

Only recently, the Nigerian Economic Summit Group (NESG), a leading Think tank stated that Nigeria’s private sector productivity has remained weak amid high cost of production as well as inadequate liquidity in Nigeria’s forex market.

The NESG stated this in its new 2024 private sector outlook report with the theme “Nigeria’s Private Sector in Turbulent Times: Mitigating Risks and Positioning for Economic Transformation”.

Stable currency

The term “Foreign Exchange” or “Forex” refers to a global market where currencies from different countries can be exchanged. The forex markets are often the biggest and most liquid asset markets in the world because of the global nature of commerce, finance and trade.

In June 2023, the Central bank unified Nigeria’s forex market, a move that has led to the crisis the country is currently experiencing in the forex market although there has been some level of stability lately.

Since the unification of the forex, the local currency has been falling against the dollar and has weakened to an all time high and was trading at almost N2,000 to $1 at a time.

The recent intervention of the CBN when it resumed sales of forex to BDC and the clearing of $7 billion valid forex claims by the apex bank has brought some level of stability in the market even though experts say more needs to be done to stabilize the Naira.

Also, The Debt Management Office in December said Nigeria’s public debt profile has increased to N87.91 trillion at the end of the third quarter of 2023. Experts have warned that debt to GDP may exceed threshold if concerted efforts are not made to put borrowing in check.

Conclusion: Daily Trust on Sunday analysed key economic indicators that measure an economy that is on the path of growth and found that contrary to the vice president’s claim, the realities on ground do not portray that the economy is already on the path of growth. Although efforts are being put in place by the government, the economy is not out of the woods yet as shown by key indicators, as such the claim by the Vice President is largely false.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.