The National Bureau of Statistics (NBS) last month presented the third quarter of 2022 Gross Domestic Product (GDP) report which showed real GDP growth slowing to 2.25 per cent against the 3.54 per cent recorded in the second quarter of 2022.

In simple terms, GDP is referred to as the measure of value added through the production of goods and services of a country at a particular time. This implies that GDP measures income earned from the production of goods and services excluding importation.

Checks by Daily Trust showed that although the economy expanded by 2.2 per cent in real terms year-on-year in Q3, local and international factors contributed to the slow pace of growth compared to 3.54 per cent recorded in the second quarter.

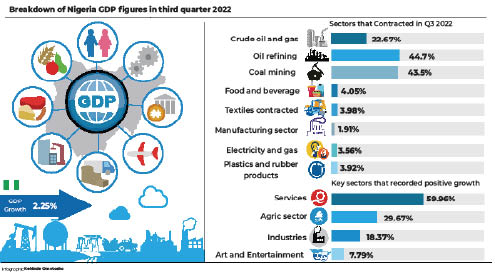

A further breakdown of the report shows that out of 19 sectors captured, 15 recorded a year-on-year positive growth, while four others recorded negative growth.

- Gunmen abduct 2, injure others in Jigawa community

- US awards $4m grant to fight child labour in Nigeria, others

The sectors which recorded negative growth in the period were manufacturing (1.91%), other services (2.67%), electricity (3.56%), mining and quarrying (21.31%).

Others include crude oil and gas which contracted by 22.67%, oil refining contracted by 44.7%, coal mining at 43.5%, the manufacturing sector at 1.91%, the food and beverage sector (one of the most shocking) contracted at 4.05%, textiles contracted by 3.98%, electricity and gas – 3.56%, and plastics and rubber products – 3.92%.

Crude oil and gas sector

A breakdown of the figures by Daily Trust shows that the oil sector recorded -22.67% (year-on-year) as of Q3 2022, indicating a decrease of 11.94% points relative to the rate recorded in the corresponding quarter of 2021.

Also, the growth rate decreased by 10.91% points compared to the 11.77% contraction recorded in the previous period.

The oil sector contributed 5.66% to the total real GDP in Q3 2022, down from the figures recorded in the corresponding period of 2021 and the preceding quarter, where it contributed 7.49% and 6.33%, respectively.

Daily Trust checks show that the drop may not be unconnected to Nigeria’s low oil production.

Reports show that Nigeria recorded an average daily oil production of 1.20 million barrels per day (mbpd), lower than the daily average production of 1.57mbpd recorded in the same quarter of 2021 by 0.37mbpd. It is also lower than the 1.43 mbpd recorded in the previous quarter.

Manufacturing

Also, Real GDP growth in the manufacturing sector in the third quarter of 2022 stood at 1.91 per cent (year-on-year), lower than the same quarter of 2021 and slower than the preceding quarter by 6.20 percentage points and 4.91 percentage points respectively.

The real contribution to GDP in the 2022 third quarter was 8.59 per cent, lower than the 8.96 per cent recorded in the third quarter of 2021 and lower than the 8.65 per cent recorded in the second quarter of 2022.

The manufacturing sector also recorded negative growth in the third quarter of 2022, for the first time since Q4 2020.

Daily Trust observed rising operating costs of imported items, foreign exchange and high-interest rates as some of the reasons behind the contraction.

Electricity sector

The electricity, gas, steam and air conditioning supply sector recorded a 3.56% contraction in its GDP, following an 11.48% contraction in Q2 2022 and an 11.2% decline in Q1 2022.

The sector has maintained negative growth in the last three quarters, despite recording impressive growth rates in the previous year.

Mining and quarrying

The mining and quarrying sector recorded a 21.31% contraction in the review quarter, on the back of an 11.09% contraction recorded in the previous quarter.

The sector has been on a negative trajectory since Q2 2020 largely due to the performance of the crude petroleum and natural gas sector.

The Nigerian oil-producing sector has been bedevilled by the volatility in the global crude oil market, and the inability to produce at full capacity as a result of oil theft, vandalism, insecurity, and investment flight amongst others.

Food and beverage sector

The food and beverage sector contraction was the first since 2020 when the economy slipped into recession.

The sector is the flagship of the Nigerian manufacturing sector, recalling that for several decades, it was the toast of investors in the stock market. However, the sector contributed N2.2 trillion to GDP in the third quarter of 2022.

Other sectors that recorded negative growth included textiles which contracted by 3.98 per cent as well as plastics and rubber 3.92 per cent

However, in real terms, some sectors recorded tremendous growth, like the agriculture sector which accounted for 29.67% of Nigeria’s aggregate GDP, growing from 23.24% in Q2.

The industrial sector accounted for 18.37% and services accounted for 51.96%.

Others include art, entertainment and recreation – 7.79%; accommodation and food services – 6.77%; construction – 5.52%; trade – 5.08%; human health and social services – 4.58%.

Experts react

Commenting on the development, the Chief Executive Officer of the Centre for Promotion of Private Business Enterprise (CPPE), Dr Muda Yusuf, lamented the contraction in the manufacturing sector which, according to him, serves as one of the life wires of the economy.

“The plunge in the manufacturing sector performance has profound implications for food inflation, food security and employment. The food processing sector has the biggest impact on jobs because of the strong backward integration content and high multiplier effect in the agriculture value chain.

“The growth is likely to decline further in Q4 because the slowing economic growth is significant due to inactivity and slump in oil production and other critical productive sectors of the economy,” he said.

Also commenting, a development expert at the Centre for Democracy and Development, Victor Agi, said the GDP figures meant Nigeria still has a long way to go in improving the economy.

“With inflation rising at over 20 per cent and the cost of goods and services increasing, the impact will bring untold hardship on the people, coupled with elections next year. The present government might not achieve much in terms of GDP figures before its tenure expires.

“The only way we can add to GDP figures is when we produce and manufacture goods for exports; at the moment, this is not happening, as such, the incoming administration should focus on the area of production to improve growth.”

He added that fixing the challenges of “high inflation and currency volatility, structural impediments to production and other economic activities; reforming the foreign exchange market to inspire investors’ confidence and addressing challenges of insecurity will go a long way in improving growth.”

Similarly, Agi noted that accelerating the implementation of the Petroleum Industry Act; reforming the monetary policies to facilitate financial deepening in the economy and creative support for small businesses to promote economic inclusion will be crucial in GDP contributions in the fourth quarter of 2022.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.