The Niger Delta Power Holding Company (NDPHC) was formed in 2005 as the legal vehicle to implement the National Integrated Power Projects (NIPP) using private sector best business models.

NDPHC was funded from the Excess Crude Account (ECA) of the Federation of Nigeria with equity distribution at 18 percent, states at 35 percent and local governments at 47 percent.

In this analysis, Daily Trust dissects the over N3 trillion investments in the NIPPs and their impacts in bridging the power sector infrastructure gap.

This is just as NDPHC plans the NIPP Phase 2 to consolidate on its 14 year of infrastructure delivery in the sector.

NIPPs add 4,500MW power to grid in 14 years

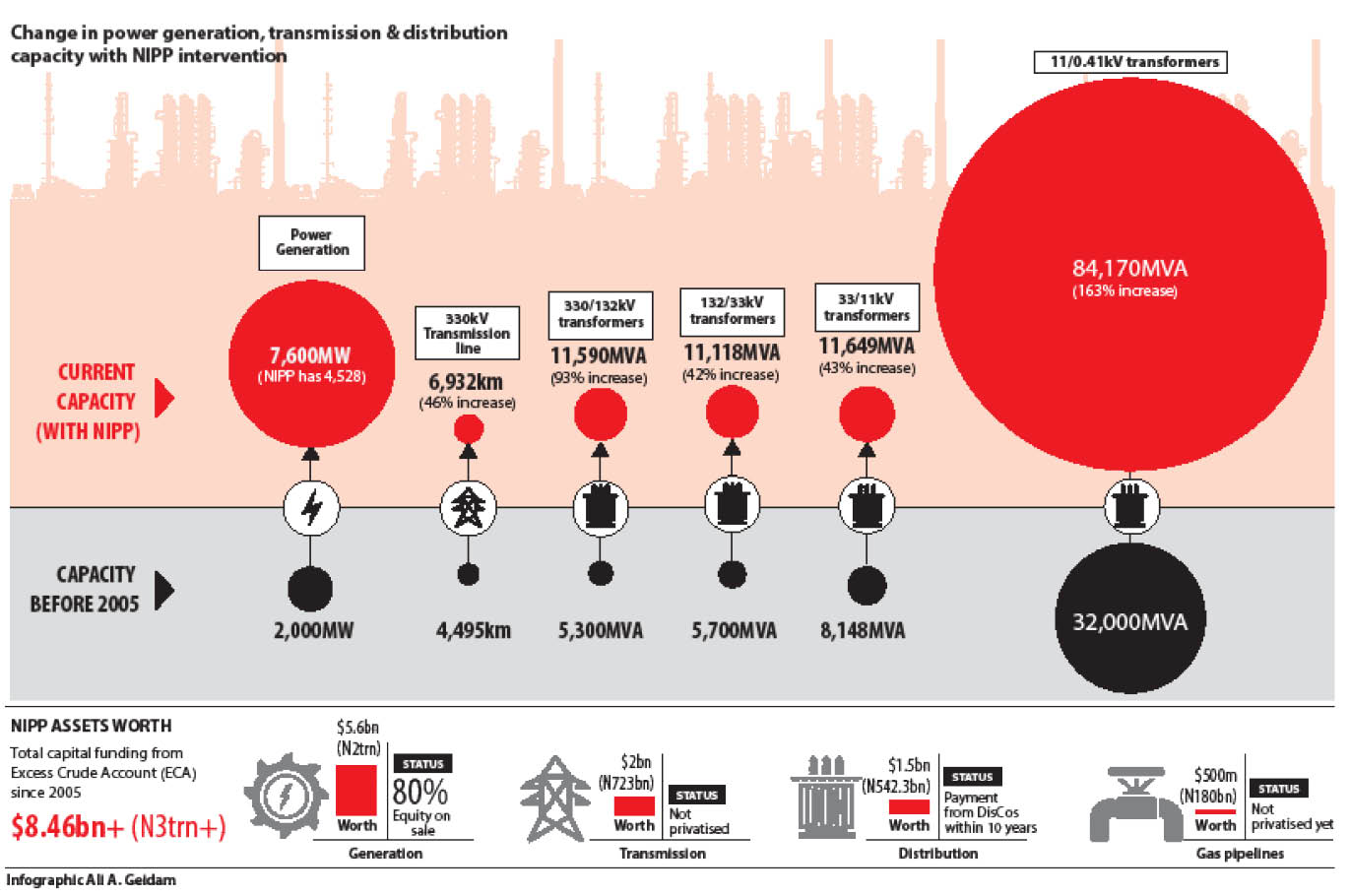

Prior to the conception of the NIPP/NDPHC in 2005, Nigeria could barely generate 2,000 megawatts (MW) of electricity, but 14 years into its operation, the country now boasts of over 10,00MW installed capacity, with 4,528MW added by the NIPP plants.

Domiciled in the Presidency, NDPHC was funded by ECA with capital funding of about $8.46 billion (about N3.058 trillion) during this period.

The company through the NIPP mandate built 10 gas-fired power stations with a combined installed capacity of 4,528.5MW.

“Today, the NDPHC-built power plants contribute an average of 900MW to the national grid, with about 820MW idle for reasons of evacuation capacity,” the projects’ brief obtained yesterday stated.

During the Phase 1 of the NIPP, the company built several gas pipelines and its accessories to deliver natural gas to the 10 NIPP power plants.

Expanding transmission, distribution networks

As at 2005, Nigeria had 4,495 kilometre (km) transmission line capacity on 330 kilovolt (kV) lines. In terms of transformer capacity, the country had 5,300 mega volt ampere (MVA) capacity on the 330/132kV transmission band. It has another 5,700MVA capacity for 132/33kV transmission band.

Prior to the delivery of the NIPP projects, Nigeria had 8,148MVA distribution transformer capacity across the 33/11kV substations. At a step down level of 33kV, 11/0.41kV substation, it had 32,000MVA power supply capacity.

Comparatively, 14 years into the NIPPs implementation, NDPHC has raised bulk electricity transmission capacity on 330kV lines to 6,932km, signifying 46 percent increase. The transformer capacity on this 330/132Kv transmission band rose to 11,590MVA, showing a 93 percent increase from the 5,300MVA before the period.

The transformer capacity on 132/33kV transmission band also rose to 11,118MVA, higher by 42 percent. At the power distribution level, the 33/11kV substations rose by 43% capacity to 11,649MVA; 33kV and 11/0.41kV substations were increased by 163% to 84,170MVA capacity.

Further breakdown shows NIPP added 5,590MVA of 330/132kV transformer capacity; 3,313MVA of 132/33kV capacity; 2,194km of 330kV lines; 809km of 132KV lines; 10 330kV substations; and seven 132kV substations.

NDPHC also expanded 36 existing 330kV and 132kV substations. It executed 296 distribution projects nationwide, which brought in 3,540MVA injection substation capacity. Among other power distribution projects are the construction of 2,600km of 11kV lines for High Voltage Distribution System (HVDS), 25,900 Completely Self Protected (CSP) transformers and 1,700km of 33kV lines.

With the delivery of critical projects in power transmission and gas-to-power generation, NDPHC said new challenges emerged. The Transmission Company of Nigeria (TCN) has a wheeling capacity of about 8,100 megawatts (MW) but the load absorption capacity of the 11 Distribution Companies (DisCos) is only about 68 percent (about 4,600MW) of the TCN wheeling capacity.

This inadequacy of the distribution network leaves between 2,500MW to 3,000MW stranded generation capacity and the results are: shaky transmission grid integrity, frequency and load control issues, load rejection by DisCos poor infrastructure among other problems.

“This is one critical misstep of the privatisation process which has greatly hindered the expected positive results of privatising those huge and invaluable national assets,” NDPHC reported in one of the records.

The management of NDPHC led by the Managing Director, Mr Chiedu Ugbo, said it takes these new challenges as immediate opportunities for growth by raising investments in the power sector.

Although the company played a pivotal role to raise the installed capacity of power generation by nearly 5,000MW, the management said in a milestone document that there are sets of on-going projects that will further improve generation capacity and transmission networks (partnering with TCN, a public utility firm).

With the pace of the Ugbo-led team, NDPHC said it will most definitely fulfil its mandate of tremendously increasing the power infrastructure of Nigeria especially through the planned NIPP Phase 2.

NIPP Phase 2 attracts foreign investors

The National Integrated Power Projects (NIPP), the power sector infrastructure driver of NDPHC will soon enter the second phase.

“The NDPHC has received proposals from interested foreign investors for partnership and financing of the NIPP Phase II projects. Aside foreign partnership, funding for the projects can also come from the three tiers of government via divestment of their equity holdings,” an official said.

Privatising assets to fund NIPP Phase 2

In spite of the achievements, the company said power supply has remained epileptic, and to wade into this, there was need to begin the Phase 2 of NIPP.

NDPHC in its fresh action plan said the Phase 2 was preconceived through a divestment and reinvestment plan by the NIPP initiators.

Instead of completely privatising the entire investments, the owners (three tiers of government) are divesting 80 percent equity in the NIPP generation assets (10 NIPP plants) to private investors.

The governments have sold the distribution assets to the DisCos operated by private hands. The worth of the assets at $1.5bn (about N542.3bn) will be recovered over a period of 10 years, the NDPHC records showed.

The owners are not privatising the NIPP transmission assets estimated at $2bn (about N723bn) as at December 2015, and the gas assets worth $500 million (N180.8bn). They may however divest the equities to the private sector in the future to earn revenue from the initial joint $8.46bn investment in NIPP Phase I.

To accelerate implementation of the NIPP Phase 2, NDPHC is urging the three tiers of government and other stakeholders to close ranks to combat the current challenges.

hese challenges include inadequate gas for full the commercial operations of the 10 power plants; court case on the bids for Alaoji, Gbarain and Omoku NIPP plants; and the plans by NNPC/Nigerian Gas Company (NGC) to divert gas on the western axis which may cut about 240mmscf gas supply volume to Omotosho and Geregu NIPP plants.

Other concerns NDPHC raised are that of poor capacity for transmission and distribution, and the increasing vandalism of NIPP facilities, other power infrastructure in the Niger Delta and other parts of Nigeria.

“This is where stakeholders in the power sector look up to the Ministry of Power for policy guidance and leadership in the sector. The National Assembly is also expected to play its crucial legislative roles to move the power sector forward,” the company urged.

NIPP 2 to tackle power supply hurdles

If the interventions come in handy and accelerated, NDPHC in its commitments statement said it can move in with the Phase 2 to significantly resolve the power sector woes.

It proffered some lasting solutions of these power hurdles. For instance, the transmission network woes of system collapse can only be solved by a ‘Super grid’.

Daily Trust reports that just last week, Nigeria recorded a total system collapse; 11 had occurred in 2019, and about 209 occurred since 2010.

“This is a modern transmission line that can take huge power, thereby reducing system collapses. This will be achieved under the NIPP Phase 2,” the NDPHC said.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.