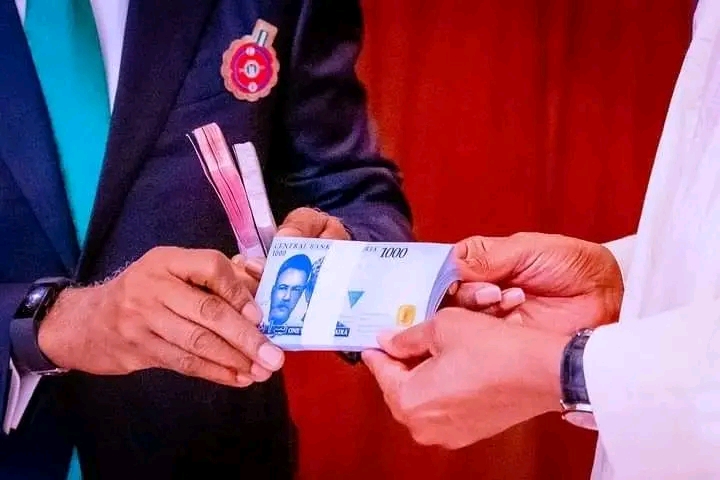

Nigeria’s premier non-interest lender and financial services operator, Jaiz Bank Plc and the newest entrant to the financial space, Taj Bank, have raised the bar by dispensing new naira notes to customers and non-customers alike when their peers were barely stocking their respective automated teller machines (ATMs).

The Central Bank of Nigeria (CBN) is on the verge of stopping the use of the old N200, N500 and N1,000 notes for payment in the country, and thus cease to be legal tender by February 17, 2023.

With the deadline for phasing out the old notes approaching, there has been an apparent scarcity of the new notes at ATMs across the cities. With the CBN’s decision to go ahead with the deadline set, Nigerians have continued to complain that there is a scarcity of the new notes in circulation, making it difficult for them to exchange their currencies – even in some banks.

However, the CBN said it had distributed sufficient amounts to banks operating in the country. Based on channel checks, large banks appear to be finding it difficult to meet customers’ needs despite a reduction in daily withdrawal limits for individuals and corporates.

Integrated farmers meet in Abuja, endorse Obi

200 female entrepreneurs compete in MTN contest

An investigation by our reporter indicates that over the weekend, most banks blocked access to their machines, largely due to the scarcity of the new notes.

Hardship caused by scarcity

Investigation across the country revealed hardship experienced by Nigerians, as, for instance, in many banks across the North, the ATMs are not dispensing cash. Even across the counter in banking halls, the amount of cash available is limited.

People queue for long hours at banks but return to their homes frustrated. Where money is available, it was learned that one can’t withdraw more than N2,000.

A customer, Clement, said he joined the queue at the Zenith Bank in the area at 6am but until 2pm, there was no cash in the machine.

He said: “I was given a tag that read 431. We were told the money would be available, but there’s no trace of it. Worse, only four of their branches are open in the city. I am frustrated. I need money to buy foodstuff.

“The mobile apps of banks such as Zenith and Access are not in top functionality.”

Another resident, Simeon Ezra said: “Now you can only withdraw N2,000 from most ATMs after queuing for nearly six hours… This is utterly disgusting.”

Many banks in various states have shut down their operations as citizens violently protest their inability to access their funds.

One of the managers of the Zenith Bank branch that opened for operations told our reporter, “There is really no sense in opening a branch where we don’t have physical cash to service customers’ demands.

“We have seen this posture lead to customers causing destruction in our banking halls, so we decided to close those branches until we could get cash.”

Nigerians praise Jaiz, Taj banks

Shaba Baba Muhammad said; “Other banks are selling the new naira notes to POS agents, except the Muslim banks like Jaiz and Lotus Bank that are dispensing the new naira notes for free to everyone. They are not selling it because it is haram.

Joseph Onuorah in Lagos said: “I hear only two banks are seriously issuing new bank notes collected from the CBN to customers: Jaiz and Sterling banks. The rest have several of their branches hoarding new notes to sell to POS operators, party sprayers, and corrupt politicians,” he said.

Some Nigerians, however, have argued that the Jaiz and Taj banks are effective because they are relatively small banks.

Hamza Bala, a customer of a new generation bank, said: “For how long are they dispensing? It’s not about religion; this is about doing the right thing. The same older bank you talk about will load a few new naira notes such that only a handful of the people in the queue will be able to withdraw; they prefer to give millions of new notes to aspiring politicians.

“But these Jaiz, Taj, and Standard Chartered banks don’t sell or give their new notes to politicians or big men. They load them into their ATMs. So there is a big difference, and we commend them for doing that.

“The truth is that if CBN gives First Bank and Jaiz bank N50,000,000 each, which bank do you think it will last the more in its machines considering the number of branches each of these banks will share the available money to?

“The more branches, the more ineffective the so-called allocation becomes. I hope you understand this now.”

TAJBank Limited is a bank in Nigeria operating under Islamic banking principles; non-interest banking. It is the second non-interest bank established in Nigeria and is headquartered in Abuja, the capital city of the country.

It was founded in 2019 as TAJBank Limited. On July 3, 2019, it received a licence from the Central Bank of Nigeria, to operate as a regional bank.

The bank announces a N150 billion Sukuk Bond, having been appointed by the federal government as a receiving agent, making it the first time the bank will be acting in that capacity.

Jaiz Bank Plc, the pioneer non-interest bank in Nigeria, has been providing ethical services to individuals, corporate and government entities since 2012 with the mission of making life better through ethical finance.

Since its debut, exactly a decade ago, the nation’s premier non-interest bank has maintained its leadership role by deepening this alternative model of financing, thus providing the foundation for its expansion, and providing the needed ethical funding for infrastructural development in the country.

Within this period, the bank has won notable international and local accolades, among which are the Most Improved Islamic Banking awards in 2020 and 2021, respectively, from the Global Islamic Finance Awards (GIFA).

It maintains the record of being the first Islamic bank in the world to break even within the first three years of operation, even when there were no Islamic banking and finance instruments to invest in the country.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.