What’s your money worth? A series from the front line of the cost of living crisis, where people who have been hit hard share their monthly expenses.

Name: Mavis Namba

Age: 53

Occupation: Hairdresser’s assistant

Lives with: Her son Ntsikelo (19), daughter Bongiwe (24), mother Sylvia (75), brother Vuyo (47), and nieces, Hazel (30), Lethe (17), Ahkani (14), and Kwanele (10). They are nine in total and single mother Mavis is the only breadwinner in the home.

Lives in: A low-rent government-owned house in Gugulethu, a township on the outskirts of Cape Town, South Africa. Mavis shares the 40-square-metre, two-bedroom brick house with her extended family. There is only one outside toilet and no water heater, which means they do not have hot water and must boil water on the stove to bathe.

Monthly household income: Since February 2023, Mavis works full-time and earns 1,900 South African rand ($104) per week. This amounts to $416 a month. Mavis’s ailing mother gets a state pension of 1,650 rand ($90) a month. Mavis does not have any savings.

Nike’s Arts open Abuja gallery

Odugbemi nominated as AMVCA chief judge

Total expenses for the month: 6,560 rand ($360)

Mavis Namba loves wearing bright red or pink lipstick. Once every few months, the 53-year-old single mother of two buys a new one as a “treat”.

“I buy the lipstick and some makeup for about 150 rand ($8) and it cheers me up,” she says. “I like bright lips – it makes me feel good about myself.”

It’s a rare indulgence in her otherwise disciplined and challenging everyday life, where she is the sole breadwinner for her household of nine, which includes her ailing mother and a son who struggles with drug addiction.

“My son is either on tik (the local name for crystal methamphetamine) or smokes dagga (the local name for cannabis); he also has mental health issues,” Mavis says. “I have been trying to get him admitted to a mental institution but have not had much luck. He worries me and I hope and pray he can get a place to get the help he needs.”

She has never had support from her children’s father and says her son’s drug problems give her sleepless nights. “I don’t sleep, I never sleep when he’s out at night; I will sleep better if he’s at a rehab.”

In March, he was almost burned alive by drug dealers who accused him of stealing from the drug bosses; Mavis has tears in her eyes as she narrates the story. “My son’s situation makes me sad and depressed, the guys threw petrol over him and beat him up and wanted to burn him – just in time I called the police who rescued him.”

She says he was lucky to be alive and was admitted to hospital. But upon release, he simply went back to the drug house.

When her son is “high”, he eats the bread in the house before anyone else can have it, she says. For a household of nine surviving on a single income during a cost of living crisis, that presents bigger challenges.

But Mavis says she has to try and support her son with the basics – food to eat and a roof over his head – before he slips further into a life which may lead to crime.

‘Who’s going to help them?’

When she was young, Mavis wanted to become a nurse. But she failed her final year of high school, so had to give up that dream. “I was just sitting at home, I could see my parents struggle and had to find a job,” she says. So she opted for hairdressing, her second choice.

“I always loved doing people’s hair, styling it so that they feel good about themselves. Even though I was not trained, I was good at it.”

She started working as a hairdressing assistant in 1994 and eventually qualified as a stylist in 2006.

“I was trained and even wrote the exams but some hair [salon] owners underpay you and I struggled to find a job as a stylist and then applied as an assistant,” she says.

Mavis has worked at different salons in and around Cape Town. But the COVID pandemic and subsequent lockdowns forced some to close, leaving her without an income for long periods.

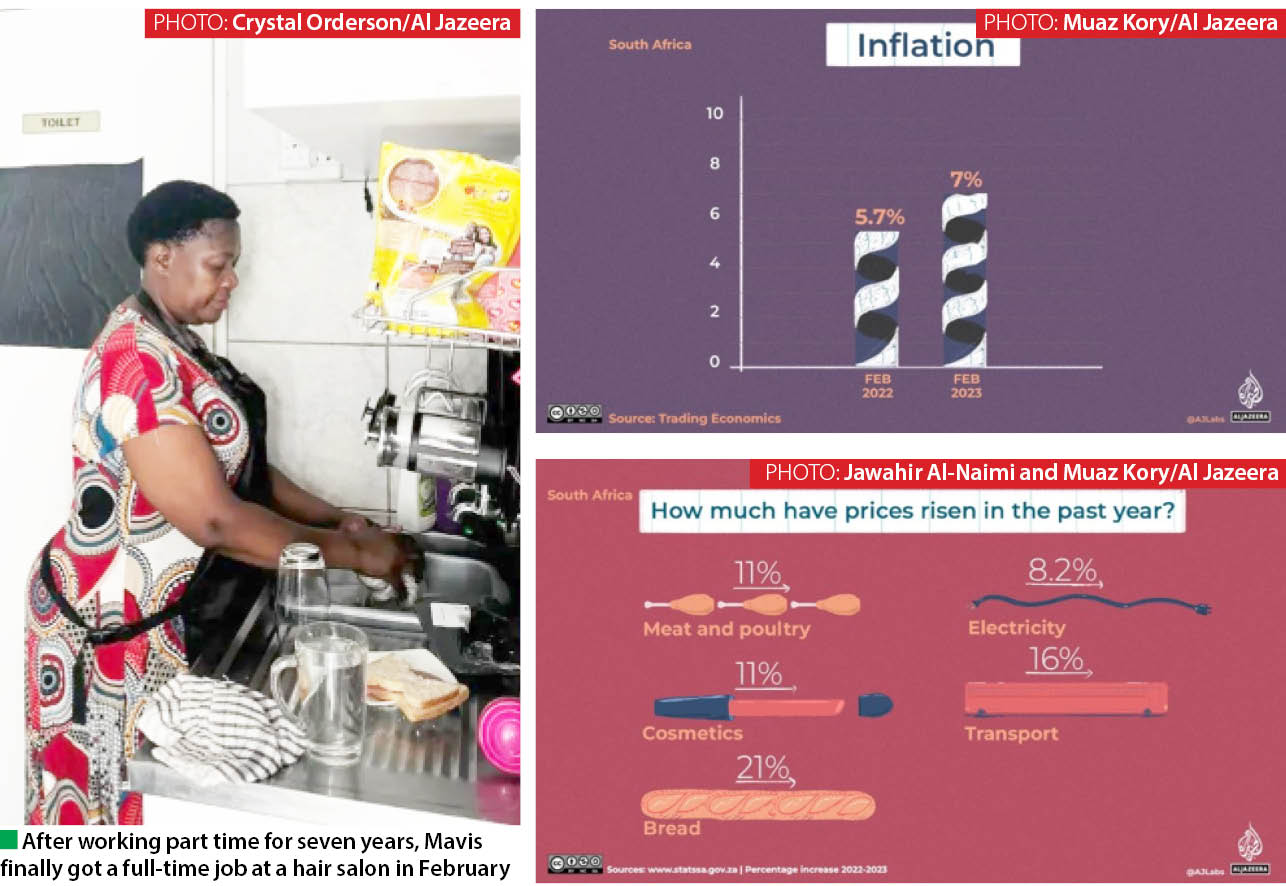

She has worked part-time at a small salon, called Crown of Beauty hair, for the past seven years. In February, she was made a full-time employee and now works five days a week. “I felt lucky ‘cause with the high food prices I need all the extra money.”

The salary – which she asked to be paid weekly instead of monthly “because I just don’t have money and need to buy food every day” – is helping to ensure she is able to support her family.

“If I don’t, who’s going to help them?” she asks. “They will starve. I have to support my family, and food is expensive but what can we do?”

Mavis tries to help everyone and although the burden of feeding eight other people is a lot, she does it because it makes her feel good.

“When I help at home, I feel good. When I use my money to buy food I am often left with nothing, but out of the blue something always comes my way. I am always blessed and someone always blesses me… all the blessings,” she says.

Over the course of a month, from February 15, 2023 to March 15, 2023, as part of a collaborative project, Mavis Namba tracked her expenses with reporter Crystal Orderson.

Here are the expenses that tested her finances the most.

Expenses over a month

Bread

As the sole breadwinner for her household of nine, Mavis is literally the only person who buys bread – something “everyone at home eats,” she says.

“I feel the pressure to support so many people. The cost of bread is so much.”

It is no surprise that Mavis feels this way. In February, South Africa’s Reserve Bank raised its food price inflation to 7.3 percent from 6.2 percent, the highest rate in more than a decade.

A local bank, Discovery Bank, and Visa, released their SpendTrend 23 report which showed that consumers in the lower income bracket like Mavis were spending 47 per cent more on basic groceries than in 2019.

“Last year bread cost between 10-12 rand ($0.54-$0.65)—now it’s almost double,” she laments.

The family goes through two loaves a day and she says she tries to buy what she calls the “bread specials” – going to a lower-cost store to save money. But she then ends up having to pay extra in taxi fares to get there.

“Boxer [a low-cost shop] sells three bread for 38 rand ($2) and the shop near to work it’s 20 rand ($1.09) per bread—so if I buy at Boxer I have to take a taxi which costs me between 10-13 rand ($0.54-$0.71), but the bread is cheaper; or then I buy the bread near to work cause it easier but more expensive,” she explains.

Last year: 672 rand ($37) at 12 rand per loaf*

This year: 1,120 rand ($61) at 20 rand per loaf

Transport

The legacy of apartheid in South Africa can be seen in its still-segregated cities, where spatial planning that once kept all Black people far from the city centre still keeps most poor Black people on the margins.

For many working-class Black people in Cape Town, the distance from home to work is usually more than 20km (12.4 miles). This means thousands of workers spend a substantial amount of their salaries on public transport.

Cape Town had a working, reliable and affordable public train network, thus ensuring people could travel cheaply from home to work. But corruption and neglect have left the train line damaged and it is no longer in use.

So for more than four years now, workers have had to use expensive taxis or buses due to there being no other viable and affordable public transport system.

Minibus taxis are the country’s most popular transport choice. It’s estimated that there are close to 250,000 on the country’s roads. For people like Mavis, despite the taxis’ reputation for bad driving and the constant increase in fares, they get her to work on time.

“They are fast but whew, they increase their price all the time,” she says. Because the industry is unregulated, and does not receive any state subsidy, the increase in fuel prices affects taxi fares.

Mavis pays a large percentage of her salary, 70 rand (about $4) a day, on transport to get to and from work.

Last year: 880 rand ($48) at 44 rand per day*

This year: 1,400 rand ($77) at 70 rand per day

Electricity

Crippling power cuts, called “load shedding”, have continued to affect millions of residents and businesses. In 2022, there were more than 200 days of power cuts nationally, and so far this year Mavis says she has not had one day without a power cut.

“I get so upset, I just go to bed when there are power cuts … I get home after a long day, then there is no food and it is dark.” Mavis says this is when the family eats bread and cheaper cuts of processed meat known locally as polony, because they cannot cook.

They also use the stove to boil water to bathe, because the house does not have a water heater and only an outside toilet. But when the power cuts out, “I just wash with cold water and then go to bed ‘cause it’s too upsetting,” Mavis says.

She buys 30 rand ($1.64) worth of pre-paid electricity every day but says that barely keeps the lights on when there is power. A year ago, the same amount would get her 9-10 units of power, but now she only gets 6-7 units.

Mavis says if she has the money she wants to buy a small gas stove to at least boil water when there are power cuts. But she is also scared. “There are younger kids in the home and what if they get the matches and then burn down the house?”

Last year: 840 rand ($46) (Mavis used to get 9-10 units of electricity for R30 per day)*

This year: 840 rand ($46) (Mavis now gets 6-7 units at R30 per day)

Food

According to a Household Affordability Index conducted in the major South African cities and released in February 2023, the cost of a Cape Town household food basket increased from 4,023 rand ($221) in February 2022 to 4,942 rand ($271) in February 2023.

Mavis buys a combination pack of vegetables from a local supermarket which includes butternut squash, carrots, onions and potatoes. To this, she adds either pasta, rice or mealie meal to “stretch” the meal and ensure that everyone eats.

This combination usually costs about 180-200 rand ($9.87-$11) and she buys it every second week.

Mavis says she used to love buying pork products – they were a treat for the family – but nowadays it is simply unaffordable. “It used to be cheap but now it’s out of reach.”

She has now shifted to buying frozen chicken—a 5kg bag a week – as a protein source. But the price has also skyrocketed – from 130 rand ($7) in 2022 to almost 200 rand ($11) per bag today. Mavis says she also tries to “stretch” a bag to last for a few meals.

South Africa’s power crisis has seen a massive spike in the price of poultry, while the South African Poultry Association says the war in Ukraine has caused a steep increase in feed and input costs that it has had to pass on to consumers. Non-profit organisations have called on the government to remove the 15 per cent value-added tax from chicken portions.

Once in a while, usually after work on a Saturday, Mavis likes to spoil herself by buying a special KFC meal. “I work hard and this is my special treat. I would like to buy McDonald’s but it’s too expensive. But KFC makes me happy after a long day’s work.”

Last year: 260 rand ($14) for two 5kg bags of chicken*

This year: 400 rand ($22) for two 5kg bags of chicken

Five quick questions for Mavis:

- What is the hardest financial decision you have had to make this month? I’m always worried about having enough money for the everyday electricity recharge and the stress of whether I will have enough money to pay the 600 rand ($33) instalment for my funeral policy.

- Which is the most worthwhile expense from this month? The food specials I got at wholesale retailers this month; it was mealie meal for 30 rand ($1.64). It usually costs about 40 rand ($2.19), then I got two Specco rice for 50 rand ($2.74). It’s usually 37 rand ($2) a bag, so this was worthwhile.

- When finances get tough, what advice do you have? Never, ever go to a money lender—it’s just bad; they charge a lot of interest and it’s just stress. Rather if you don’t have money for transport or food, speak to your employer, maybe they can help you out.

- What is your biggest money worry? My biggest worry is to ensure there’s enough money for food for the house for the month.

- What is the saving hack you are proudest of? To go to wholesalers with a shopping list; and never go food shopping on a hungry stomach.

*Last year’s costs were sourced from Mavis.

Source: www.aljazeera.com

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.