By Marion Jeng

Africa is a vast continent, beset with a myriad of challenges only matched by the scope of its potential. Healthcare here is one particular challenge that has been a priority for public, private and multilateral institutions for decades, with so-far mixed results. Now, innovative health-tech start-ups are taking on the challenge – as 2021 saw an 81% increase in investment in this ecosystem1.

Challenges facing health-tech

After years of political instability across the continent, and constant competition between national governments, multilateral lenders, private donors, and Non-Government Organisations (NGOs) which are increasingly involved, healthcare is disorderly and complex.

One of the main obstacles to progress is fragmented supply chains. Africa imports 94% of its pharmaceuticals, with local manufacturers producing only 25%–30% of pharmaceuticals and less than 10% of medical supplies2. When these extended supply chains meet national health agencies with poor infrastructure, which struggle to forecast, procure, and distribute what’s needed and when it’s needed, the ability to provide treatment or medicine is severely impacted. Competition and lack of cooperation between NGOs and national actors exacerbates this fragmentation.

A major complicating issue is that there are simply too few trained medical professionals, particularly in rural areas. As a result, Africa must tackle 25% of the global disease burden with only 1.3% of the world’s healthcare workers3. This is a monumental challenge, partially caused by ‘brain drain’ emigration of experts and made worse by underfunded and poorly managed state sectors that must co-exist with the chaotic web of NGO and charity-provided healthcare.

The third issue facing African health-tech providers is lack of quality control for medicine. Qualified laboratories are a rarity, and there are few national/ regional guidelines or labs to promote standardisation among labs. This, as well as the previous two structural issues mentioned above, makes Africa a hotbed for fake and counterfeit medicines. The World Health Organisation estimates that fake medications make up 42% of the world’s trade4 – a $200bn market. In Nigeria alone, fake malaria medication results in 12,300 avoidable deaths annually and nearly $1 billion of wasted spend.

Technological innovation is providing solutions

There is no simple or easy cure, since many problems need top-down, systemic action that no single charity or enterprise can provide. However, innovative start-ups and new technologies have already proven they can help both doctors and patients achieve better, more reliable outcomes.

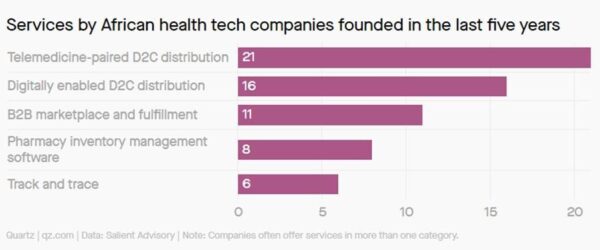

Innovation in delivery provides myriad benefits to the end-user – either through consumer or provider-facing solutions. Effectively, this means delivering medicine directly to consumers or to hospitals and pharmacies – bypassing inefficient or insufficient state-led supply chains or hyper-localised NGO efforts.

New technologies are also being used to ensure medicines are of sufficient quality by providing increased oversight of supply chains and manufacturing processes – such the Internet of Things (IoT) and the blockchain. IoT can provide irrefutable and real-time information about the journey of medicines and equipment – from production to delivery. Likewise, blockchain can do the same by providing irrefutable, algorithmic proof of production, packaging, and transport.

RxAll and True-Spec Africa, for example, have both developed AI-powered scanners for determining the legitimacy of drugs. Medsaf, a Nigerian innovator, allows pharmacies to directly link manufacturers to hospitals and pharmacies to ensure legitimacy and value for money.

Innovations in distribution

Getting the drug to the person who needs it remains the central challenge. The last 12 months have seen provider-facing solutions scale rapidly – growing more than consumer-facing offerings. Of note, Mpharma has acquired Mutti’s network of local pharmacies, and provider ShelLife has now scaled to 1600 outlets throughout the continent. Investment in this ecosystem has seen substantial growth, with investment reaching $392m in 2021, which is an 81% year-on-year gain.

Funding however has concentrated on a few key companies – as mPharma, Goodlife Pharmacy, Rocket Health, and DrugStoc account for 72% of the money with the remainder shared among 23 much earlier-stage players – which hints at a varied and competitive market with it all still to play for at this very early stage.

The model in health care mirrors the broader B2B e-commerce space, where such companies as TradeDepot and Wasoko have managed to raise significant rounds and have become essential to their industries, though emerging health-tech companies are simply at an earlier stage.

Here lies the ‘existence proof’ for latent potential in this market. Fast-moving consumer goods distributors have already scaled, albeit with relatively low margins, which provides a template for the much-higher margin health-tech sector to emulate and provide clear proof points for what’s possible with a broader and broader range of potential investors.

Telemedicine

Telemedicine is another avenue that holds great promise for health-tech in the continent. Health services and advice can be readily distributed over the phone or the internet. This allows long-distance contact, care, advice, reminders, education, intervention, monitoring, and even remote admissions. This method of care, most common in Nigeria, Kenya, and Ghana has seen massive adoption in the last five years, thanks in part due to the pandemic. Today it represents a proven, viable alternative for health care delivery and can directly address the insufficient supply of medical professionals and services, particularly in rural areas.

The expansion of telemedicine has gone hand-in-hand with the growth of the consumer-facing health-tech industry and are both linked to pharmacies and dispensaries. They provide a natural mutual symbiosis as the people who need access to affordable medicine will also require access to long-distance care.

Driven by retention, provider-facing solutions have also expanded into telemedicine. A practitioner can issue a prescription which the patient can then fulfil at pharmaceutical providers owned by the same company.

How start-ups can stay ahead

With growing competition and the entry of several e-commerce giants into the pharmaceutical distribution market, it is becoming more essential that health-tech delivery companies, whether consumer or provider-facing expand their offerings – potentially through telemedicine or financing.

In the short-term, the entrance of these new e-commerce players will mainly disrupt the over-the-counter-medicine sector but could also eventually impact prescription providers. This may happen through acquisitions and partnerships; a not-uncommon trend, with Amazon buying Pillpack and Flipkart partnering with 1MG in India, for example.

However, the threat of market entry from larger e-commerce players is spurring existing players to expand more rapidly particularly post-Covid 19. For example, mpharma, a major pharmaceutical player, has set up 100 virtual clinics in seven new markets – allowing telemedicine to compliment its physical pharmaceutical provision.

However, this is not the easiest option for provider-facing distribution companies looking to concentrate their market presence. As mpharma found, it is easier for pharmacies to expand into telemedicine than it is for provider facing distribution companies – partially due to regulation, and secondly due to the fact that pharmacies have a physical presence in that area. Partnerships, and in time also acquisitions, may be the key here. In Kenya, the D2C distributor MYDAWA now offers telemedicine services powered by SASAdoctor and uses Zuri Health to deliver goods.

The bottom line

We believe the health-tech sector is set for even more rapid expansion in the coming 5-10 years. The cost of health-care delivery has come down dramatically via telemedicine. Confidence in the reliability of medication is rising as more supply chains are controlled or monitored end-to-end. Companies like mpharma are designing complete health-care networks that guarantee better outcomes for the mass population. Larger e-commerce players seeking higher margin products are already large enough to look seriously at entering the medication marketplace, as e-commerce giants elsewhere in the world have already done. While the challenges of incoherent regulation and lack of social and economic infrastructure remain as major hurdles, there is no question that the next decade will see the rise of better-funded, more broad-based health-tech players across the continent offering international investors much higher margins than nearly any other category of ecommerce.

By Marion Jeng, associate, DAI Magister

Reference:

- https://briter-bridges.typeform.com/africa-2021?typeform-source=briterbridges.com

- https://gh.bmj.com/content/6/6/e006108

- https://pubmed.ncbi.nlm.nih.gov/19484878/

- https://www.pharmaceutical-technology.com/analysis/counterfeit-drugs-africa/

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.