After all, the Naira is already quite digital, isn’t it? Nigeria does have one of the most sophisticated financial systems in the world – especially in terms of payment systems. This is probably necessitated by the fact that because of our low per capita income and the informal structure of the economy, so many Nigerians altogether have to make millions of small transfers daily, especially to dependents. In developed countries, this is not the case. A typical worker abroad has all the debits – for rent or mortgage, insurance, taxes, tenement, loans and so on, set up such that they hit their account by month-end and they get by on what is left. Our economy – perhaps like many other African economies – is structurally different from what obtains in those places. Therefore, we saw quite a bit of innovations in our financial sector that may not be deemed particularly necessary elsewhere.

Some of us economists criticise this fact that the financial sector in Nigeria is running ahead of everyone else. We call it `financialisation’, as different from what we actually need; industrialisation. We also see that quirk manifest in the yearly declaration of superlative profits by our banks, even in a year like 2020 when half the time businesses where shut, and in the face of expanding poverty in the land.

So, who needs an e-Naira? Why is it necessary? Is it going to solve the problem of inflation, and corruption, and unemployment, and everything that ails the economy? Will it lead to a revaluation of the Naira which seems to be in a death spiral? Is the idea just a further ‘financialisation’ of the economy? Or is this not just another gimmick to embezzle funds at the CBN? All these and more are the questions that Nigerians are asking.

I think the eNaira is very useful, timely, and perhaps one of the smartest things that our central bank has been able to pull off in a while, even though it will certainly not solve every problem that ails our economy. I will therefore attempt to break down some of its likely uses below, even though I must admit that the whole idea of such hyper-digital currency is still nouvelle to everyone in the world. In other words, a number of central banks around the world are taking the initiative, and 90 per cent of them are thinking in this direction, but certainly mistakes will be made, lessons will be learnt, before the concept stabilises. The future of currency is digital. And the future is here. Let’s look at the critical questions:

What is the e-Naira?

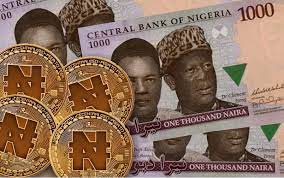

The e-Naira is a Central Bank Digital Currency (CBDC). Though the Naira was fairly digital before (as you can transfer value from your phone or laptop once you are connected to the internet, and via USSD without internet), this is a digital currency on fire! However, unlike other digital currencies (cryptocurrencies), the CBDC is backed by the sovereign – Nigeria – and is tied to the Naira (fiat currency). If we need to compare it to a cryptocurrency, we can compare to say USDT (a stable currency tied to the US Dollar, called Tether).

What is this idea of being backed by the Naira?

Well, this means that the eNaira and the fiat Naira will not diverge in value. The two types of currency will be same value at all times. Also, that the currency is backed by the government through the CBN is comfort, because people know that the CBN cannot default on its obligations. Investments with the central bank of a country are deemed to be the safest kind that anyone could undertake. Ordinarily, cryptocurrencies have some issues. People die, and if no one knows the key (their pin), their money is lost forever. People save their keys on devices. Devices get stolen or corrupted and their money is gone if they have no backups anywhere.

Meanwhile, people are scared backing up their keys anywhere because if anyone gets access to them, they can be wiped out. All sorts of issues occur because the idea is still developing. We have even heard of situations where crypto exchanges have collapsed (like Quadriga in Canada), and those who left money on the table for the exchange to help manage, were wiped out. And with cryptocurrencies, there is no arbiter; no one to run to; no one to guarantee the transactions; no deposit insurance. Nothing. It’s usually a case of ‘who send you’?

Where did the idea come from?

Whereas the central banks will hardly mention this, it is my strong belief that this is a reaction by central banks to the idea of cryptocurrencies. What started circa 2006/7 as a crazy idea by some crazy folks who were rather miffed by how central banks especially in developed countries bailed out investment and commercial bankers who had used people’s deposits to gamble on arcane derivative products like Credit Default Swaps, Collateralized Debt Obligations and such like, had become a major issue, with market valuation of more than $1 trillion. There are suddenly more than 8,000 cryptocurrencies around the world. It has become a swarm and no one knew which crazy bee among the lot could sting the system in the eye at any point in time.

The proponents of cryptocurrencies actually started out with the radical idea of taking down what we know as the financial system today, for past infractions – including for arbitrarily printing currencies or hiking interest rates thereby devaluing the money in people’s pockets and accounts, in the name of monetary policy management. They call their plan ‘decentralized’ banking or finance (Defi), which means ‘down with Central Banks!’ The only thing they didn’t reckon with was that they will need the central banks, investment and commercial banks to achieve this laudable feat. But will the traditional banks and central banks allow them? The central banks then got wise, and decided to piggyback on their idea, to save themselves, the banking sector, and the government. Why? The day you take down central banks, you will have taken down every bank because there’ll be nobody to manage currencies or maintain sanity or fidelity in the system. Then how do governments get their taxes? In what currency? Anarchy is the end point. This move by the central banks around the world is to prevent themselves from becoming so weakened and made vulnerable by the crypto warriors.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.