The Federation Accounts Allocation Committee (FAAC), Wednesday shared to the three tiers of government, a total sum of N547.309 billion as April revenue shared in May, 2020.

The FAAC meeting was held Wednesday via Virtual Conferencing, chaired by the Permanent Secretary, Federal Ministry of Finance, Budget and National Planning, Dr. Mahmoud Isa-Dutse,

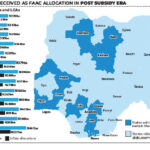

From this amount, inclusive of VAT, Exchange Gain and Excess Bank Charges recovered, the Federal Government received N219.799 billion, the States received N152.436 billion, Local Government councils got N114.095 billion, while the oil producing states received N37.021 billion as derivation (13% of Mineral Revenue).

It noted that cost of collection/FIRS Refund/ Allocation to North East Development Commission was N23.958 billion.

The communiqué issued by the FAAC at the end of the meeting, indicated that the Gross Revenue available from the Value Added Tax (VAT) for May 2020 was N103.873 billion as against the N94.498 billion distributed in the preceding month of April, 2020, resulting in an increase of N9.377 billion.

The distribution is as follows; Federal Government got N14.490 billion, the States received N48.301 billion, Local Government Councils got N33.811billon, while derivation got N0.000 and Cost of Collection/ FIRS Refund/ Alloc. to NEDC got N7.271 billion.

The distributed Statutory Revenue of N413.953billion received for the month was higher than the N370.411 billion received for the previous month by N43.542 billion, which the Federal government received N191.580 billon, States got N97.172 billion, LGCs got N74.915 billion, Derivation got N33.599 billion and Cost of Collection got N16.687 billion.

The communiqué also revealed that Petroleum Profit Tax (PPT), Import Duty and Value Added Tax (VAT) recorded increases, while Companies Income Tax (CIT), Oil Royalty and Excise Duty recorded decreases.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.