Time and again, Nigerians have fallen prey to the wits of dubious companies who promise them high return on investments.

The companies, who suddenly appear and disappear after duping their victims in hundreds of millions, make bogus claims of investment in certain goods and commodities which are phantom.

- 5 killed, 20 abducted in fresh attack on Plateau village

- Endless hardship hits widows in Nigeria’s conflict-ridden North West

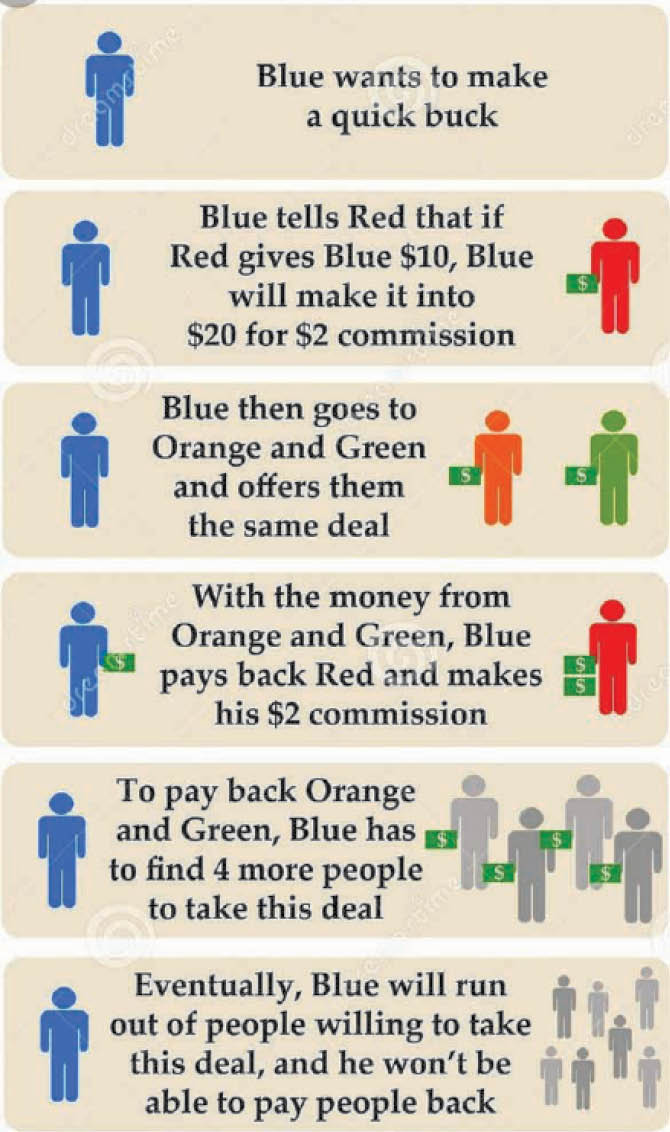

Known as Ponzi Scheme, this model of investment fraud lures investors and sustains its operations by using part of money gained from new investors to pay old investors until the going gets burst.

What differentiates it from the pyramid scheme is that victims are not paid on the number of referrals they attract into the scheme but the belief that legitimate investment is made with their hard-earned money.

According to a report by Guardian Newspaper, Nigerians are estimated to have lost over N300 billion from 2016 to 2021 to fraudulent investments owing to “rising inflation, perceived poor performance of the capital market, as well as low returns on government securities have exposed Nigerians to speculative and dubious schemes with victims suffering over.”

Alarmed by the new trend and proliferation of ponzhi scheme operators in the Nigerian financial sector, the Central Bank of Nigeria (CBN) issued an advisory for the public not to be a victim of their business guile.

Classifying them as Illegal Financial Operators (IFOs), the apex bank, through its Financial Services Regulation Coordinating Committee (FSRCC), contended that their activities portend grave risk to public confidence and the stability of the Nigerian financial system.

While promising to nip them in the bud, CBN disclosed that they are oftentimes unlicensed with the aim to lure and defraud the public with offerings of “extra-ordinary returns on investments as bait.”

How not to be victims

Before putting in your money into investment of companies that are not household names, the CBN further advised on the need to visit its websites, that of the Securities and Exchange Commission (SEC) and other relevant member agencies to verify the registration and license status of such companies and schemes before investing in them.

This is because registration would help investors with access to information about the company’s management, products, services, and finances.

Also, a report by the United States Securities and Exchange Commission stated that companies that operate ponzi schemes follow the same pattern, thus, investors should not be enamoured by their high returns with little or no risk as every investment carries some degree of risk. As such, acclaimed investments yielding higher returns should involve higher risks.

Getting consistent returns is also a red flag as all businesses are affected by external factors that make profit fluctuate, thus, when you are told that the companies have maintained a streak of paying same returns to investors since inception, you should be sceptical.

The current vogue of ponzi companies in Nigeria claim to invest in agriculture, they tend to be secretive with coming out with the yields of what they invested in by using complex strategies to get your emotions, rather than information, so, take your money somewhere else.

When the bubble wants to burst, difficulty receiving payments should be the last signal that you are about to be defrauded, so, don’t be naïve to put in more money when excuses are made for money to get trapped funds in the bank surfaces.

Most importantly, research the company.

Investor should endeavour to research a company they intend to invest in and the easiest way is to contact the SEC and ask if they are currently conducting open investigations (or investigating prior cases of fraud).

Also, before investing in any scheme, one should ask for the company’s financial records to verify whether they are legit.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.