Nigeria’s public debt has surged dramatically, increasing from N12.8 trillion in 2015 to N87.91 trillion in 2023, representing an astonishing 585 per cent rise, as per the National Bureau of Statistics (NBS). This debt increase, along with fluctuating forex rates and inflation, has worsened the economic challenges faced by Nigerians.

According to a report by Statista.com on September 22, 2023, Nigeria ranked as the second largest debtor in Sub-Saharan Africa, trailing only South Africa.

Soludo (2003) suggested that countries typically borrowed for two main reasons: to finance higher investment or higher consumption and to avoid budget constraints. Ideally, borrowing should promote economic growth and reduce poverty. However, Soludo argued that excessive debt could become burdensome, crowding out investment and growth as debt servicing costs soared.

The continuous quest for loans in the name of “development” without adequate checks and transparency creates opportunities for corruption. The Fiscal Responsibility Commission (FRC), which advises the government on borrowing within set limits and aligning with the country’s medium-term expenditure framework, lacks the prosecuting power to enforce financial accountability in Ministries, Departments and Agencies (MDAs).

Example, in the 2024 budget, over N8trn is allocated for debt servicing out of a total budget of N28.7trn. This necessitates stringent financial management to ensure resources are used wisely and deliver value for money in all government activities.

A recent report by the GIFT cluster project on the Revenue Remittances Compliance Index (https://shorturl.at/dm8jS) revealed widespread non-compliance with the Fiscal Responsibility Act (FRA) 2007 by federal MDAs, who failed to remit funds to the CRF or audit their accounts. This issue persists due to the FRC’s lack of prosecuting authority.

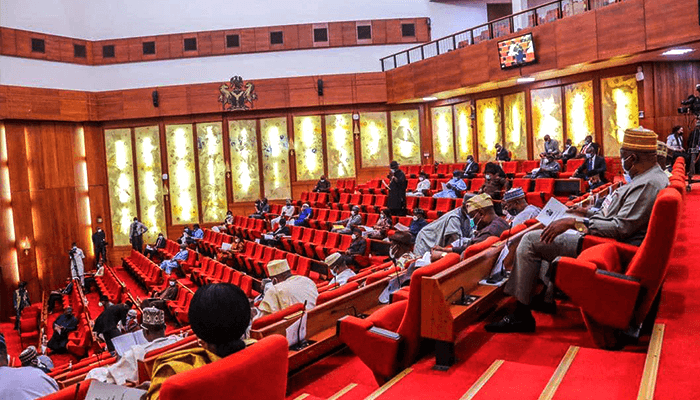

Given Nigeria’s dire financial situation, passing the FRA 2007 Amendment Bill into law is critical. The bill, which recently passed its first reading in the National Assembly, seeks to address systemic issues in public finance management and enhance accountability.

Despite Nigeria’s high debt, the country has the potential to borrow more. However, doing so without addressing fundamental public finance management problems will be counterproductive.

The FRA Amendment Bill, if enacted, aims to eliminate revenue leakages, improve remittance procedures and enforce stricter accountability measures. This will foster a sustainable financial system that supports long-term economic growth.

Key provisions of the FRA Amendment Bill are introducing stricter oversight and accountability for government spending, reducing corruption and ensuring efficient use of public funds. The bill also aims to tighten borrowing regulations, ensuring loans are used productively, and improve overall fiscal management.

Passing the amendment will empower the FRC to prosecute non-compliant MDAs, compel them to audit their accounts and ensure they remit funds appropriately. This will prevent reckless spending of public funds and promote value-for-money practices.

Furthermore, it aims to enhance public finance management and ensure the effective use of public funds in crucial sectors like healthcare, education and infrastructure, thereby improving the quality of life for Nigerians and supporting national development goals.

Passing the FRA 2007 Amendment Bill 2024 is essential for addressing Nigeria’s fiscal challenges. With soaring debt levels and widespread economic hardship, reforming public finance management is imperative.

I urge the National Assembly to expedite the bill’s passage and ensure it is swiftly sent to the president for approval. This action will demonstrate the APC-led government’s commitment to improving the lives and wellbeing of Nigerians, fulfilling its Renewed Hope promise.

Tochi Onyeubi and Bassey Bassey of HipCity Innovation Centre, Abuja.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.