Business success is about doing several things right. We talked about creating value first, which must be desired by your target customers that will be willing to pay you for it at a profitable price. Beyond creating value at a selling price that is profitable, sustainable business success is about asset growth built from profits that is cash-backed. Today, we will take up cash flow management.

One of the principles of modern accounting is the concept of ‘accrual’. This accrual principle requires that financial transactions are recorded in the time period in which they occur, regardless of when cash for the transaction is received in or paid out. The objective is to match revenues against expenses when transactions take place rather than when the payment for the transaction actually occurs. Whilst the accrual principle does help us in understanding the financial status of a business at any point in time, it does not show us what the actual cash position of the business is. This means that a business could show profits in its books but can go bankrupt for lack of cash! Consequently, it is crucial to understand what cash flow, its management and their importance are.

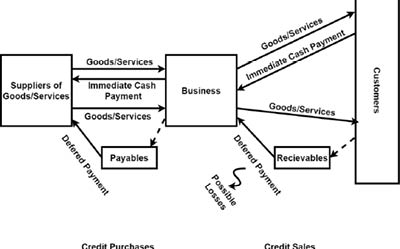

Cash flow cycle: Cash flows through a business in reasonably predictable ways. We either get supplies and services on credit or we pay for them in cash (which includes payments through your bank accounts). Similarly, we also sell our products (goods and services) either on credit or cash (which also include payments made through your bank accounts). How we manage the receipts for our sales and make payments for the goods and services we purchase determines our cash conversion cycles and our net cash position at any point in time.

The common example given to explain your cash flow and cash position is to imagine a bathtub into which you can let water in and out of which you can drain water, with the net water level representing your net ‘cash position’ at any point in time. The more water (i.e. cash) you want in the tub the more you have to let in water from the tap (i.e. more cash collections from sales, investors, creditors, etc.) but at the same time you have to slow the drain (i.e. by delaying payments to suppliers of goods and service). A note of caution at this point, however, is that no matter what you do to slow down cash outflow, you must always meet agreed payment terms with your suppliers. If, for unexpected legitimate reasons, you are unlikely to meet the terms, which should be an exception, you must negotiate and agree to new terms. Your credit reputation with suppliers is very important for your success. More of this will be discussed later in this series.

Understanding the cash flow cycle means you must understand the cash conversion process comprising working capital and even capital investment management. Assuming your capital investment decisions have been wise, prudent and optimum, you must be excellent at managing your working capital by understanding the impact of your inventory, receivables and payables on your cash position on a dynamic basis.

Key terms: You need to understand what basic working capital terms are:

· Liquidity refers to the ease with which an asset can be converted into cash without affecting its market value negatively. To be ‘liquid’ means to have cash and near cash assets that you can always draw on to settle obligations as they fall due and also seize opportunities.

· Cash and Bank balances refer to the cash holding you have in the office till, vault as well as in your bank accounts at any point in time. Generally speaking, this is the most liquid of all your assets.

· Account receivables are the debts owed to your business by your customers who have been supplied goods and services but have not yet made payment to you. (Note that this is regardless of whether the goods and services have been used by customers or not, unless there are terms to the contrary.)

· Inventory comprises various groups of materials and other consumables that are used to produce goods and services. This includes raw materials, work-in-progress, finished goods and some other consumables (so-called ‘maintenance, repair and operating supplies’). Typically, your inventory ends up as final merchandise available for sales to your customers.

·‘Other current assets’: Essentially, your cash/bank, receivables and inventory make up most of your ‘current assets’. But apart from these three major categories, there may be other ‘current assets’ that your business could hold such as marketable securities, prepayments, etc. The sum of all such assets form what is called your current assets are.

· Account payables are the short-term obligations due to your suppliers and other such creditors. If your raw material supplier provides you with goods for which payment will be made at a later date, you have a trade payable that will be due at the agreed future date.

· Current liabilities are your short-term financial obligations that will be maturing within a year or normal operating circle. Aside from your account payables, other current liabilities include accrued expenses, taxes payable, short-term debt, etc.

Your net working capital refers to the sum of all your current assets less the sum of all your current liabilities. Whilst different current assets and different current liabilities impact your liquidity position differently, it is necessary that you understand what each means and how each impacts on your operations. Actually, beyond understanding current assets and liabilities for cash management purposes, you also have to be fully conversant with financial statements consisting of income statements and statements of financial position.

Next week, we will take up the importance, principles and practices of cash flow management.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.