One year after assuming office, some major economic policies taken by the government of President Bola Ahmed Tinubu have put many Nigerians on the edge with fears that the effect will lead more people into the poverty bracket.

Although the government has repeatedly said the pain of the policies would be temporary, there seems to be no end in sight one year after.

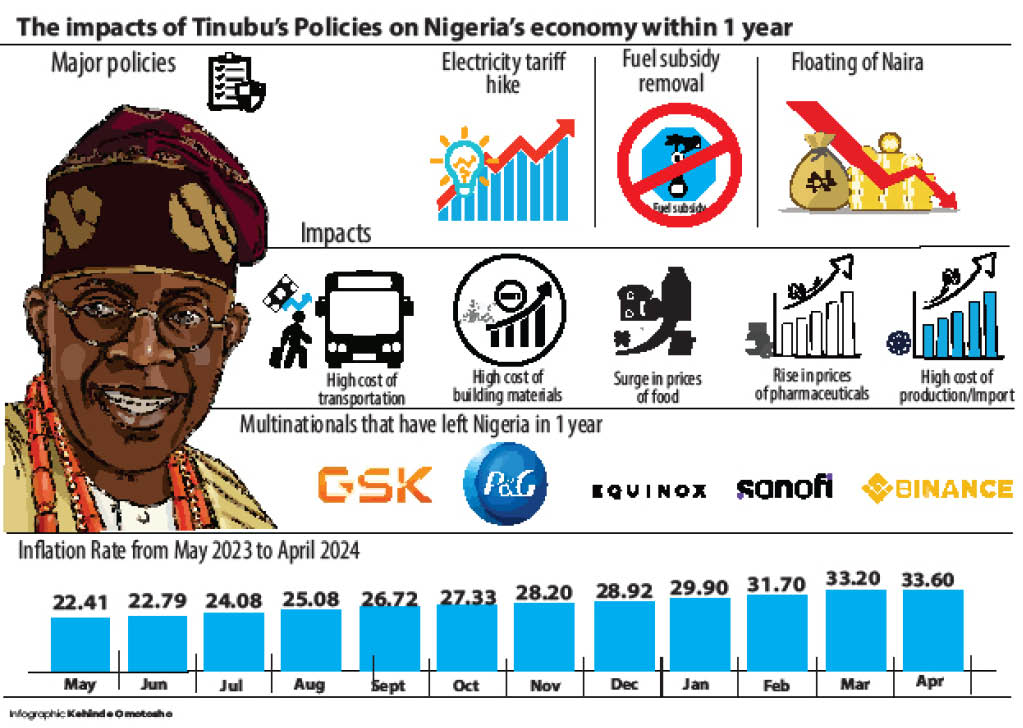

These policies range from electricity tariff hike, fuel subsidy removal as well as floating of the naira which have been adjudged by stakeholders as the major economic determinants due to their pass-on effect.

Electricity tariff hike

Daily Trust reports that on April 3, 2024, the Nigerian Electricity Regulatory Commission (NERC), announced new rates for electricity tariff which saw a jump from N66/N77 per kilowatt-hour to a significant N225.

- 1st anniversary: It’s time to publish your assets, SERAP tells Tinubu

- Jigawa releases N5.5bn to build nursing college

While the recent electricity tariff increase only directly impacts Band-A customers, most economic actors on the said band are transferring the cost to the end users.

Already, the National Bureau of Statistics has reported over 5.8 million unmetered customers in Q4/2023. Without meters to track actual usage, these consumers may end up paying even more due to estimated billing based on the new, higher tariff.

Fuel subsidy removal

Following the pronouncement of “Fuel subsidy is gone” by President Tinubu on May 29, 2023, during his inauguration, the entire country was thrown into confusion as a few minutes after, Nigerians began panic buying with many petrol stations immediately adjusting their pump prizes upwards.

Few hours after the president’s announcement, petrol pump prices increased from N187 per litre to N500 per litre, and are currently selling at N700 per litre in most retail outlets.

With the removal of fuel subsidies, transportation companies, including buses, taxis and motorcycles, have increased their fares to offset the higher fuel costs.

Transporting goods from the farms to markets and from wholesalers to retailers has become more expensive. These increased transportation costs has been passed on to consumers, leading to higher food prices, a major driver of food inflation in the country.

Floating the naira

On June 1 2023, Daily Trust exclusively reported that the Central Bank of Nigeria had devalued the naira.

Subsequently, on Wednesday June 14, the Central Bank of Nigeria (CBN) officially directed Deposit Money Banks (DMBs) to eliminate the rate cap on the naira at the Investors’ and Exporters’ (I&E) Window of the foreign exchange market.

Under a floating exchange rate regime, the government or central bank does not fix or peg the currency to a specific value against another currency or a basket of currencies.

That singular action has seen the naira devalued to around N1500 to a dollar from N400 at the time Tinubu was sworn in.

Experts have lined up on opposite sides of the aisle. Some argue that it would allow the currency to adjust to changing economic conditions, which can help promote competitiveness, adjust trade imbalances, attract foreign investment, and respond to shifts in global markets.

How Tinubu’s policies are ‘suffocating’ Nigerians

Daily Trust reports that these policies in the last one year have had a huge impact on both business and Nigerians. The impact can be seen in inflationary figures, manufacturing costs and the, exit of multinationals among others.

Surging inflation

Since his assumption to office on May 29, 2023, inflation under the current administration of President Tinubu has surged by about 55 per cent from 22.41 per cent in May 2023 to the current 33.36 per cent (April).

A breakdown of the figures by Daily Trust shows that in May 2023 when President Tinubu took over, inflation rate stood at 22.41 per cent. In June, it moved upward to 22.79 and by July it jumped up again to 24.08 per cent.

Subsequently, for the month of August, NBS reported that inflation had hit 25.80 and 26.72 per cent in September and by October of 2023, inflation rate had gone up to 27.33 per cent

In November, inflation surged to 28.20 per cent and moved up further to 28.92 per cent. By January 2024, inflation maintained a steady growth to 29.90 per cent at the beginning of the new year and by February, again inflation rose to 31.70 per cent.

In March, NBS reported that the March 2024 headline inflation rate showed an increase of 1.50% points to 33.20 per cent when compared to the 31.70 per cent February 2024 headline inflaton rate.

The latest inflation figures as reported by the National Bureau of Statistics (NBS) revealed that Nigeria’s headline inflation rate increased to 33.69 per cent in April 2024, up from 33.20 per cent in March 2024.

The latest inflation figure shows a 28 year high under the current administration of President Tinubu.

Exit of multinational companies

Further checks by Daily Trust have shown that no fewer than five multinationals have left the country leading to thousands of job losses.

Many others are showing signs of exiting in the near future. Among the multinationals that have exited the country are GSK, Procter and Gamble, Sanofi, Equinox, among others.

GlaxoSmithKline (GSK) exited Nigeria after it announced plans to discontinue direct operations in Nigeria in August 2023.

This ended its 51-year presence in the country, known for household brands like Panadol and Sensodyne.

The exit of GSK from Nigeria has severely affected the prices of pharmaceuticals in the country.

Similarly, in December 2023, Procter & Gamble (P&G), a US consumer goods company, also announced that it would discontinue manufacturing in Nigeria and pivot to import-only activity.

Sanofi, a French multinational pharmaceuticals company, also announced its exit from Nigeria in November 2023.

The company however stated that it had appointed a third-party distributor to handle its commercial portfolio of medicines from February 2024.

Rising prices of cement, construction materials rent

The rising price of cement which is driven by the high cost of transportation as a result of subsidy removal, has a devastating effect on the construction sector as well as rents in major cities across the country.

Checks by Daily Trust have shown that the price of cement has seen a significant rise from N3,500 in May to N5000 in December 2023 and is now selling at between N7,500 and N8,000 per bag depending on the region.

This upward trend in cement prices has subsequently impacted the prices of sand and blocks, with block makers raising prices from N450 to N650 for a six-inch block and from N550 to N700 for a nine-inch block.

Also, Daily Trust has recently reported how landlords have increased rent by almost 200 per cent

Manufacturers lament sustained increases in interest rate

The Manufacturers Association of Nigeria (MAN) has said the persistent macroeconomic instability in Nigeria, resulting from sustained monetary policy decisions over the past two years, has negatively impacted the manufacturing sector.

The instability, they noted, is compounded by various constraints affecting sectoral performance and continue to disrupt production plans, undermine investments and cast uncertainty over prospects.

The manufacturers’ union said recent decisions by the Monetary Policy Committee (MPC) exacerbated the challenges by further tightening credit interventions, increasing loan costs, raising production costs, limiting fund accessibility, and eroding investment and competitiveness within the manufacturing sector, showing that the MPC leans towards prioritizing the financial sector over the real sector, rather than striving for a balanced approach between the two.

Nigerians lament cost of living crisis

In another development, a former Chief Executive Officer of the National Health Insurance Scheme (NHIS), Professor Usman Yusuf, has accused the Tinubu administration of underperformance in its first one year in office.

Yusuf, a member of the Northern Elders Forum (NEF), said the Renewed Hope Agenda of the president has turned into hopelessness.

People have lost hope. It pains me to see our people lining up to collect cups of palliatives. Renewed Hope has turned into hopelessness. People have lost hope,” Yusuf said.

“The last one year has been a year of nothing but deception, destitution and hopelessness,” he said.

Dr Nathan Ugbechie, an economist and economic affairs analyst, said the biggest culprit of the high inflation in the country is the falling value of the naira.

He said while the removal of fuel subsidies was inevitable, the government should not have left the local currency to float against strong international currencies such as the dollar and pound. He added that if the government does not reconsider its policy of floating the naira we are headed for bigger problems.

“We import a large percentage of the food we consume in Nigeria. Every time the naira loses value, it means further inflation for us. That is why the traders in Nigerian markets confirm the day’s exchange rates before selling each imported item. And it happens virtually on an hourly basis,” he said.

Moses Jakpor, a development economist, on his part, said the government should have built capacity, including the production, storage and transportation of agricultural products before removing subsidies on fuel and floating the currency.

He argued that in times like this, the government should be humble enough to admit that there is a shortage of food in the land and open the borders for Nigerians to have access to cheaper food.

He said keeping the borders closed benefits only a tiny percentage of Nigerians but makes life difficult for most of the people.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.