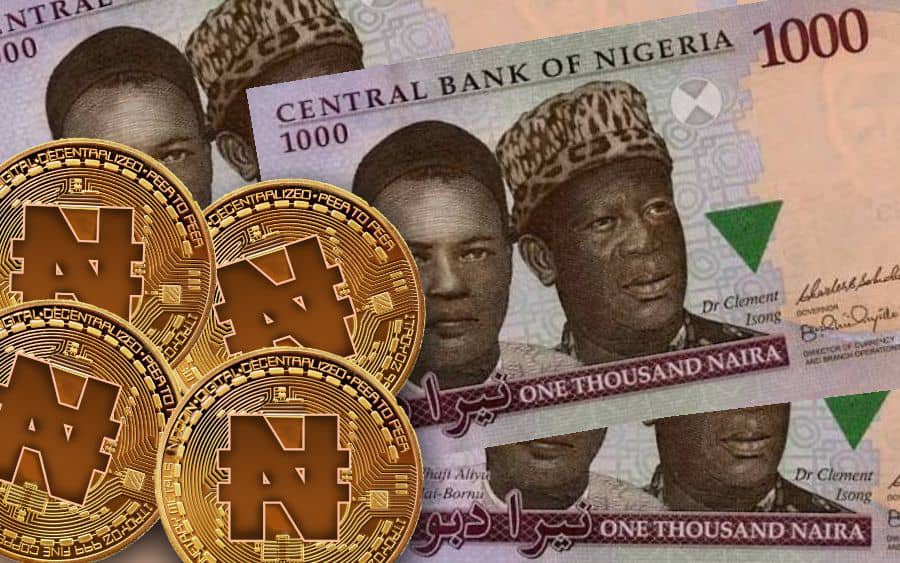

The Central Bank of Nigeria (CBN) has earmarked Friday, October 1, 2021, for the launch of the guidelines for its Central Bank Digital Currency (CBDC) also known as the e-Naira project. The guidelines are in respect of the regulation, designing and issuing of the CBDC, which shall be legal tender when launched throughout the country.

According to the CBN, the e-Naira is a digital currency to be issued by the Nigerian government with the same value as fiat naira (i.e. physical naira notes). It is to be purchased by the general public through FI and transferred into e-wallets maintained by customers. It is similar to the Chinese digital renminbi and the Swedish e-krona. Digital currencies are monies that exist not in physical form but only as electronic data, but perform the basic functions of money being unit of account, store of value and means of exchange.

- 4 kidnappers, robbers nabbed with human skulls

- PODCAST- ‘How And Why I Thought Of Knifing Myslef To Death’

Digital currencies, therefore, remain useful for inter-party transactions as long as such parties accept the validity of the currency in use, as they have the advantage of instant settlement, especially among online communities.

Although the most popular form of the digital currency remains the cryptocurrency, there are actually thousands of digital currencies in the contemporary world with each of them operating and enjoying security courtesy of the respective encryption codes mutually adopted by the parties in such transactions, especially as most governments in the world had played shy of conferring any form of endorsement and legitimacy on transactions conducted through any digital currency.

However, given the growing use of the digital currency dispensation, several governments across the world Nigeria inclusive, have started showing interest in the operations of digital currencies with the CBDC option emerging as the preferred starting point for them. In that context too, the CBN’s initiative to launch the e-Naira must qualify as the first attempt by the Nigerian government to embrace the digital currency dispensation. That is also why there seems to be significant public interest trailing the intended launch of the e-Naira guidelines.

Of primary interest to the Nigerian public is the prospect of effective implementation of the guidelines in a manner that will impact public interest most profitably without avoidable risks. Considering that transactions in this mode run without any physical exchange of funds but through computers that still remain mysterious to most Nigerians, the level of exposure to digitally non-compliant persons remains significant. Hence, while there is the advantage of digital currency aiding speedy transactions, the dark side of the exercise cannot be over-emphasised. In the first place, the issue of the country’s banking sector manifesting significant challenges related to effective administration persists, therefore, the introduction of the e-Naira should not be allowed to exacerbate the problems of the sector. There is the need to ensure that all operators of the programme demonstrate verifiable track record and measure of integrity, which the public can count on.

Closely related to the issue of effective implementation of the guidelines remains the matter of public sensitisation and enlightenment in respect of the seamless migration of more Nigerians to digital transactions. It is lamentable that less than one month to the implementation of such a novel enterprise, most Nigerians have not even heard of the dispensation not to talk of preparing to come on board. Such a situation poses a clear danger to the success of the programme as a wider cross section of the Nigerian public may have been left to their own designs as far as the CBDC is concerned. This is a grave disservice, as by now the public enlightenment exercise ought to have gone far. In light of this, we call for aggressive campaigns across the country to get the buy-in of citizens. They must also be educated on how to avoid pitfalls.

We also urge the CBN to do due diligence on the company that it is partnering in this venture to ensure that it is of good standing, just as we ask that it considers the option of partnering with other companies also, as limiting the enterprise to just one company could be dangerous in the long run. The CBN must ensure that all missing links related to the successful and hitch free implementation of the CBDC are resolved effectively before the launch date.