As the federal government’s efforts to implement broad-based digital identity policies for transparent governance and functional economy gain strength, the Founder and Chief Innovation Officer of UrbanID Global, a digital identity and technology solutions company, Mr. Olatunji Durodola, has said Nigeria may find it difficult to issue physical ID to its citizens because the country currently faces problems of inadequate infrastructure to sustainably support physical card issuance.

Durodola, who stated this in a chat with Daily Trust, explained that issuing physical cards is a capital-intensive project that Nigeria can ill afford to go into given the paucity of funds, more so as digitalisation ensures seamless service delivery in the public sector.

According to him, while there is a need for physical identity tokens, “the support infrastructure is fragile and very capital intensive.”

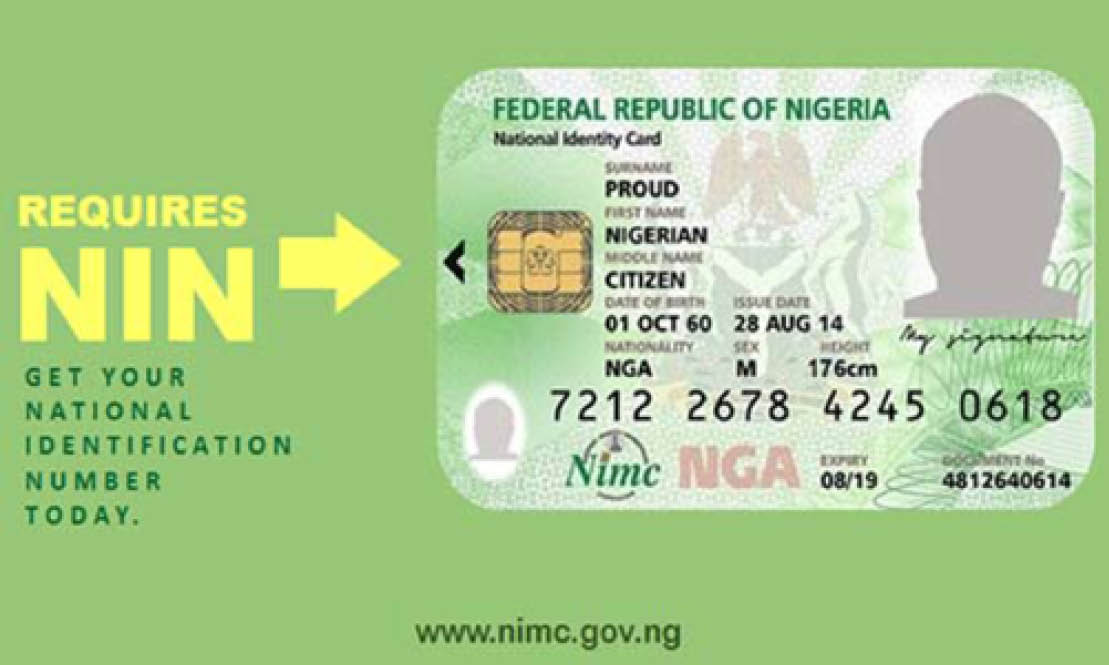

Only recently, the National Identity Management Commission (NIMC) announced that Nigerians who have registered for the National Identification Number (NIN) would soon be able to request an e-ID card with payment functionality for all types of social and financial services.

Durodola, whose company designed the NIMC Mobile ID app, noted that e-ID Cards and Payment Cards popularly known as ATM Cards may look alike, but their implementation, issuance, and lifecycle are very different.

Challenges of card issuance

The UrbanID CEO noted that in November 2013, the government had issued one of the most sophisticated e-ID Cards in the world but the lack of infrastructure led to its failure as NIMC was unable to maintain the issuance bureau or purchase much-needed high-performance card printing machines.

“The issuance of cards for free was also a challenge for companies who had installed capacity to personalize those cards. The sticky point was how they would be paid. So it eventually died.

“Between 2020 and 2024, Nigeria led Africa with the issuance of MobileIDs, taking advantage of the very enviable spread of Smartphones in the Country, and creating an enabling environment for their use. Alas, public awareness was lacking.

“That 23m MobileIDs were even issued is a testament to the power of word of mouth.

“All these developments were by 100% local talent – and it worked! Accolades around the world again. Yet, it would seem the trend is now to go back to physical cards,” he explained.

Durodola added that the World Bank had also advised against the issuance of physical cards, which were to a large extent, also very reliant on foreign expertise.

According to him, Nigeria does not produce components nor the operating systems they rely on.

“Those foreign vendors with specialist skills will provide invoices to the Government in their native currency (USD or Euro). They want our money, but not our currency,” he added.

Preventing data breach

Speaking on the recent alleged breach of the NIN database, Durodola emphasized the importance of maintaining strict identity verification protocols to prevent unauthorised access and misuse of personal data.

He noted that while businesses are set up to make a profit, loosening restrictions to achieve this can be disastrous.

According to him, every verification and transaction involving a person’s identity should be closely monitored, and the ID holder should be aware of how their identity is being used.

He questioned the practice of “store and forward” data handling, where companies keep unauthorised copies of identity information, making it vulnerable to breaches.

When asked about the broader implications of data breaches on a nation’s security and global standing in data privacy, Durodola pointed out that many systems still grant access rights to personal information without the ID holder’s consent.

He urged the implementation of stringent data privacy measures to ensure that each instance of personal data access requires explicit consent from the ID holder.

Durodola noted that UrbanID Global is focused on helping Nigeria become a benchmark for data privacy in developing economies.

What you should know

Earlier in April this year, NIMC announced that it was launching a National ID card with payment functionality for all types of social and financial services.

The ID card, which is billed to be launched in partnership with the Central Bank of Nigeria (CBN) and the Nigeria Inter-bank Settlement System (NIBSS), is to be powered by NIBSS’ AfriGO, a National domestic card scheme.

According to a statement signed by NIMC’s Head of Corporate Communications, Kayode Adegoke, the National ID card, layered with verifiable National Identity features, is backed by the NIMC Act No. 23 of 2007, which mandates NIMC to enrol and issue a General Multipurpose card (GMPC) to Nigerians and legal residents.

However, the date of launch and availability of the card still remains unclear over five months after the announcement.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.