The Central Bank of Nigeria (CBN) may release the framework that will guide transactions on the Nigeria-China currency swap deal anytime soon.

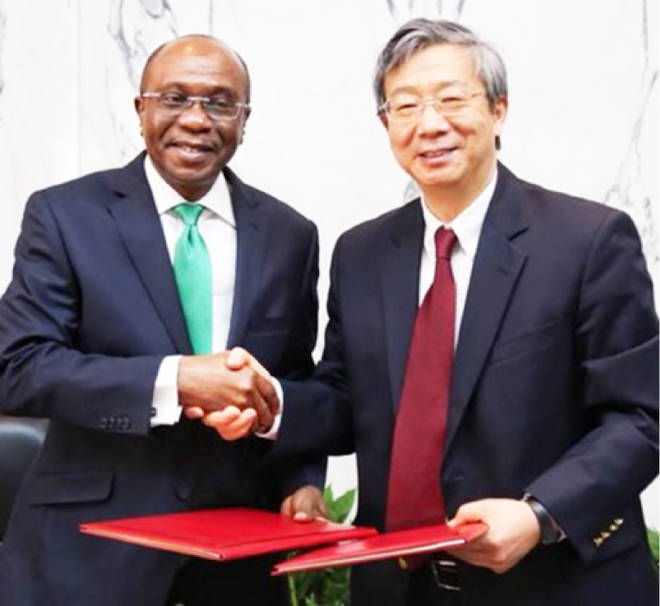

Recall the Central Bank of Nigeria (CBN) on behalf of Nigeria entered the bilateral currency swap agreement with the Peoples Bank of China (PBoC). The deal was signed on Friday, April 27 2018, in China.

The Governor of the CBN, Mr. Godwin Emefiele, led CBN officials while PBoC Governor, Dr. Yi Gang, led the Chinese team at the official signing ceremony in Beijing, China, ending an over two years of painstaking negotiations by both Central Banks.

“The transaction, which is valued at Renminbi (RMB) 16 billion, or the equivalent of about $2.5bn, is aimed at providing adequate local currency liquidity to Nigerian and Chinese” the CBN has said in a statement. In naira terms, the deal is worth about N720 billion.

Chiefly, the deal provides for Nigerian and Chinese industrialists and other businesses to transact in RMB or naira respectively as opposed to the dollar thereby reducing the difficulties encountered in the search for the dollar.

Speaking to journalists at the 261ST meeting of the Monetary Policy Committee (MPC) on Tuesday, May 22, 2018 in Abuja, the CBN Governor,

Mr. Godwin Emefiele had said the framework will be released to guide transactions in that space.

“When will it come into effect? We plan to release the framework by next week (two weeks ago) and the settlement banks have been chosen”

he had said. Though the framework wasn’t released as promised by the CBN governor, sources within the CBN said the framework should be out anytime soon.

On the settlement banks he explained that the settlement banks will be Standard Chartered Bank and Stanbic IBTC bank that is an affiliation of the bank of China, which will be the correspondent banks at the Chinese ends.

This policy has indeed come under critical review with some analysts saying it may not impact significantly the economy and the naira. In fact some analysts claim, it’s bad for Nigeria’s economy.

But the CBN and other market watchers say, it holds enormous good prospect for the Nigerian economy.

“I repeat, the negotiation that has been reached will be positive to Nigeria and whatever comes out from this can never ever be negative to Nigeria” Mr. Emefiele assured.

Speaking further he said “this was a negotiation that was painstakingly done and I am optimistic that Nigerians will reap the

positive impact from this and we do expect that by the time the framework is released, and Nigeria will end up being the Renminbi

trade hub in the West African sub region because there are currently only three countries in Africa that enjoy the currency swap deal between China and themselves : South Africa, Egypt and Nigeria’ he explained further.

According to him, “there are a lot of hope to growth rate, there are a lot of Nigerians to benefit from this arrangement and particularly, not just in Nigeria but also in the West African subregion” he noted.

“I have read some newspapers report on the currency swap, but I can tell you, it’s going to be positive and I repeat, strongly positive for Nigeria, for Nigerian imports and also for Nigerians, that is what we expect and we would ensure that we achieve that’ he further assured.

The CBN governor also noted that the huge trade that happen between Nigeria and china informed the need for the currency swap.

“China is Nigeria’s largest trading partner controlling close to 35

percent of total trade. What that means is that all things being equal by the time we conclude the framework, we should see to it that more invoices would be issued on the local currency against the traditional dollar” he said.

While announcing the currency swap deal, the CBN had said in a

statement that, among other benefits of the deal, is to “provide Naira liquidity to Chinese businesses and provide RMB liquidity to Nigerian businesses respectively, thereby improving the speed, convenience and volume of transactions between the two countries.”

“It will also assist both countries in their foreign exchange reserves management, enhance financial stability and promote broader economic cooperation between the two countries” it said.

It noted that “with the operationalisation of this agreement, it will

be easier for most Nigerian manufacturers, especially small and medium enterprises (SMEs) and cottage industries in manufacturing and export businesses to import raw materials, spare-parts and simple machinery to undertake their businesses by taking advantage of available RMB liquidity from Nigerian banks without being exposed to the difficulties of seeking other scarce foreign currencies.”

“The deal, which is purely an exchange of currencies, will also make it easier for Chinese manufacturers seeking to buy raw

materials from Nigeria to obtain enough Naira from banks in China to pay for their imports from Nigeria” it explained further.

“Indeed, the deal will protect Nigerian business people from the harsh effects of third currency fluctuations” the statement noted adding that “with this, Nigeria becomes the third African country to have such an agreement in place with the PBoC.”

The statement further noted that both countries expressed delight at the conclusion and signing of the agreement and expressed the hope that it would boost mutually beneficial business transactions between Nigeria and the Peoples Republic of China.

Speaking on the deal, CBN’s acting Director, Corporate Communications, Mr Isaac Okorafor recently told newsmen the currency swap deal doesn’t apply to the importation of the 41 items banned in 2015 as the regulation on those still apply.

He assured that the items that will be imported may not necessarily be finished goods, so the issue of Nigeria becoming a dumping ground for China is misplaced.

Commenting on the deal, Mr. Rislanudeen Mohammed, an economist and investment analyst based in Abuja said “in the context of minimizing concentration risk of having our foreign exchange denominated in United States dollar alone, this is a positive development.”

“Secondly, in view of our huge imports from China, this agreement will help in reducing time as well as transaction cost by eliminating third party currency deals” he said adding that “reduced transaction cost will make goods imported from China more cheaper to both importers and ultimate Nigerian consumer.”

He however noted that “this may negatively impact on our

diversification efforts by making Chinese imports cheaper. However there is no impact on the economy as far as the balance sheet of central bank is concerned” he said.

But one thing is certain; the market is excited by the currency swap deal and eagerly awaits the framework for transactions to begin to happen.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.