Claim: A post has been making the rounds that the Central Bank of Nigeria introduced an Unstructured Supplementary Service Data (USSD) for bank users to block their accounts when their phone is stolen or notice any form of compromise in deductions.

Verdict: The claim is misleading. Available records show that the code was launched by Zenith bank for its customers to block their accounts and not CBN so users of other banks can’t make use of it.

- Uncertainty Trails FG’s N348trn National Development Plan

- 6 issues FG must address before 2023 polls – CDD report

Full Text

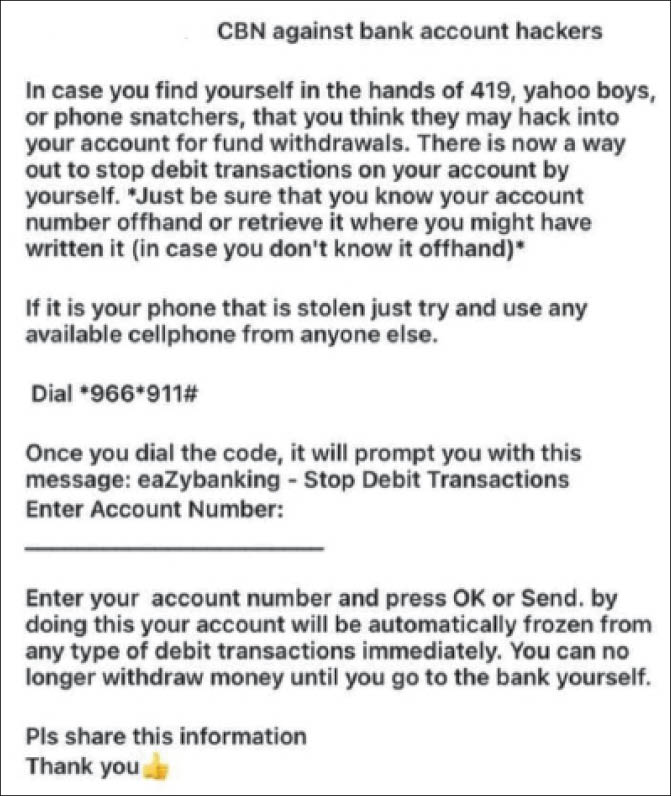

A post, advising bank users on ways to prevent monies kept in their bank account from being stolen when their account is compromised, has resurfaced online. It said the CBN has created a USSD code to freeze activities on the account to avoid it being emptied.

The post stated that “CBN against bank account hackers. In case you find yourself in the hands of 419, yahoo boys, or phone snatchers, and you think they may hack into your account for fund withdrawals, there is now a way out to stop debit transactions on your account by yourself.

“Just be sure that you know your account number offhand or retrieve it where you might have written it (in case you don’t know it offhand). If it is your phone that is stolen just try and use any available cell phone from anyone else. Dial *966*911#, once you dial the code, it will prompt you with this message: eaZybanking – Stop Debit Transactions Enter Account Number: Enter your account number and press OK or Send. By doing this, your account will be automatically frozen from any type of debit transactions immediately. You can no longer withdraw money until you go to the bank yourself. Pls share this information Thank you.”

Background

Hackers have, over the years, reigned supreme, pulling out different guises under their sleeves to defraud people of their money. With bank transactions now seamless, bank users now rely on their phones to conduct millions of transactions daily.

With every innovation embedded with its peculiar challenges, hackers and fraudsters devise ways to steal from bank users when their phones are compromised or relevant information extracted through guile that gives them unfettered access to the accounts.

Troubled by the menace, the CBN had in 2020 issued an advisory to Nigerians to be careful on who they share information of their bank details to.

The bank had noted that cyber-criminals took advantage of the COVID-19 pandemic to defraud citizens by stealing sensitive information or gain unauthorized access to computers or mobile devices using various techniques.

The advisory, which was issued by its Director, Corporate Communications, Isaac Okorafor, said its priority was to ensure that Nigerian banking customers were aware of the trend and to prevent them from falling victim to such cybercrimes.

He added that the cyber-criminals use tactics like Phishing campaigns which send out emails claiming to be from organisations and when clicked, steals login credentials or other confidential information from the victim’s computer or mobile device.

Okoroafor also said they make use of relief packages by sending messages on social media or emails asking people to click on links to register in order to get their COVID-19 relief packages from the Government or other organisations.

“They simply use this to get confidential information from unwary victims. Relief package scams also come in the form of phone calls asking people to provide their banking details to receive relief packages. They also use impersonation to place calls to individuals claiming to be staff of their banks and asking them to get mobile apps that would help them get through this pandemic period.”

He stated that to ensure bank customers do not fall victims, they should “Beware of and verify emails or phone calls claiming to be from NCDC, WHO or Government, especially when such emails request your banking information or to click on a link.”

“Visit official websites of relevant organizations for desired information, avoid clicking on links or attachments in emails that claim to have more information regarding the COVID-19 pandemic; iii. Avoid downloading mobile apps from untrusted sources; and iv. Obtain relief packages or other information from trusted news media.”

While the advisory was two years ago, it is still relevant as such cases are still made to banks who at most times do not act quickly to freeze the affected to save the customers from their accounts not being wiped away.

Verification

When this reporter pasted the claim on Google’s search engine, it brought similar Facebook posts and news stories from blogs and it indicated that the claim was first posted in 2021.

When the USSD was also searched on google, it brought out a blog post on Zenith Bank’s official website that announced the launch of the code.

The post stated that the bank became the first Nigerian Bank to successfully launch its USSD account control code, “*966*911#.”

It said “this unique code stops unauthorized transactions and protects the account holder’s funds in the event of mobile phone, ATM Card or hardware token loss as well as account details compromise.”

Conclusion

Though the USSD code that freezes bank accounts when it is compromised does exist, it was launched by Zenith Bank and not the CBN.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.