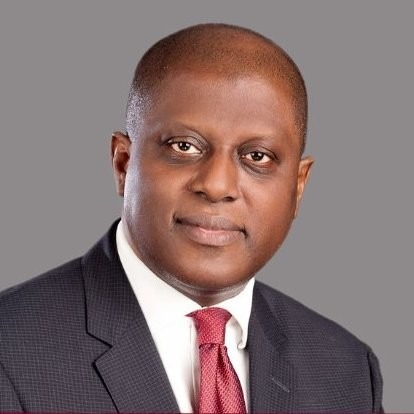

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has said the bank verification number (BVN) platform will be launched by December for Nigerians in the diaspora.

Cardoso spoke on Wednesday during a parley with members of the Nigerian community on the sidelines of the World Bank and International Monetary Fund (IMF) meeting in Washington D.C, United States.

He said the BVN platform will be launched by the Nigerian Inter-Bank Settlement System (NIBSS), a subsidiary of the CBN.

The BVN is an 11-digit number that is unique to each individual required to own and operate a bank account in Nigeria.

- APC to Amaechi: If truly those in power steal money, why can’t you afford diesel?

- Gombe to begin N70,000 minimum wage payment October

On February 14, 2014, BVN was introduced by the CBN to strengthen the banking system, safeguard bank customers, and mitigate fraud.

As of April 2, 2024, over 61.47 million have enrolled for BVN, according to NIBSS.

According to Cardoso, the platform would enable Nigerians in the diaspora to operate their local bank accounts, run their businesses and sort out know-your-customer (KYC) issues with financial institutions from anywhere in the world.

The CBN governor added that the initiative is part of efforts to ensure that Nigerians irrespective of their location anywhere in the world can participate in the Nigerian economy.

“As far as we are concerned it is totally unacceptable that you should be out here and be having hassles in operating your accounts or doing your business in your original country,” he said.

Cardoso added, “I want to tell you that starting in December 2024 Nigerians in the diaspora will no longer face the hurdle of travelling long distances for physical biometric verifications to access financial services.

“The launch of the non-resident BVN platform by NIBBS will enable enhanced KYC processes remotely making it more convenient and cost-effective for the diaspora to engage with the Nigerian banking system.

“This initiative in collaboration with our banks marks a significant step toward greater financial inclusion and accessibility as we continue to roll out innovative solutions.”

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.