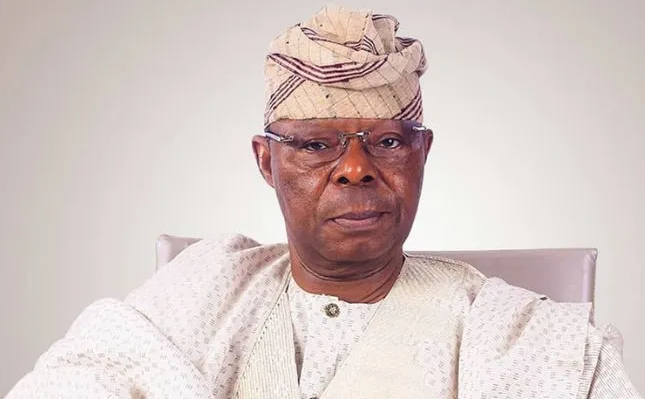

Major shareholders of FBN Holdings, the parent company of First Bank of Nigeria are said to be against the move by a former chairman of the bank, Oba Otudeko to gain proxy control over the bank through his daughter.

Barbican Capital, an affiliate of Honeywell Group, disclosed on Friday that they have purchased an aggregate of 4,770,269,843 shares in FBN Holdings Plc putting its stake at 13.3%.

Mr Otudeko, in the cross deal worth N87.8 billion, now takes over from Nigerian billionaires, Femi Otedola and Mike Adenuga, thereby making him the largest shareholder of Nigeria’s oldest financial institution.

Messrs Odukale and Adenuga are joint third, each with seven per cent shareholding. Saheed Arisekola is fourth with a five per cent shareholding.

- Insecurity: S/East govs meet, to send delegation to Tinubu

- How our first kidnap attempt failed — Suspects

Following the announcement, some of the majority shareholders of FBN Holdings Plc are said to be joining forces to fight Otudeko from reclaiming control of the bank holding company.

Daily Trust gathered that Barbican Capital Limited was only incorporated on the 9th of March 2023, with the Corporate Affairs Commission, RC 6900918, according to a search of public CAC records.

Persons with significant control include: Oyeleye Foluke and Otudeko Obafemi. Foluke is understood to be the daughter of Oba Otudeko.

“The shares were sold to Barbican Capital Ltd and kept with FBN Securities, UBA Capital and Royal Asset Management. It was also moved from the account of 26 sellers,”the source revealed.

Otudeko troubles

Recall that in April 2021, the Central Bank of Nigeria (CBN) removed Oba Otudeko as chairman and sacked the board of the bank.

The decision to fire the board, led by Otudeko was triggered because the current MD/CEO, Sola Adedutan was removed despite having steered the bank into profitability after years of mismanagement.

The CBN in a letter to the former chairman of the bank dated April 26th, 2021, said the bank had not complied with regulatory directives to divest its interest in HoneyWell Flour Mills despite several reminders.

The CBN governor, Emefiele said he spoke with Oba Otudeko, a major shareholder controlling about 10 per cent of First Bank, not to interfere with the running of the bank by engineering the removal of its CEO, Sola Adeduntan, which was rebuffed by Otudeko.

“We will not allow a shareholder who feels that he cannot subject himself to regulatory control and authority to remain as a director of the bank. We didn’t have any choice but to take this decision,” Emefiele said.

“The insiders of First Bank of Nigeria who took loans in the bank with controlling interest on the Board of Directors, failed to adhere to the terms of restructuring of their credit facilities, which contributed to the poor financial state of the bank”, Emefiele, had said in a press briefing in April following the sacking of the board of the bank.

Shareholders join forces:

The shareholders are reported to be concerned about the consequences of having Oba Otedeko back in control of the bank in any capacity, following the debacle he had with the CBN two years ago.

Sources who have insider knowledge of the development said a meeting was held yesterday by some of the shareholders to decide on how to take on Oba Otudeko, as they fear his return “might damage the progress” made by the bank over the last two years.

The shareholders also believe they have enough votes in the bag to stall any possible return of Otudeko despite his declaration of a 13.3% stake in the bank.

Some analysts, however, believe that Otudeko may be in a better position than he was two years ago as the Honeywell deal with Flour Mills has helped him repay most of the loans putting him in a financial position to fight back.

However, he still faces an uphill battle against Ecobank who has a case with him at the Supreme Court on disputes over an unpaid debt.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.